Get the free unum site pdffiller com site blog pdffiller com

Show details

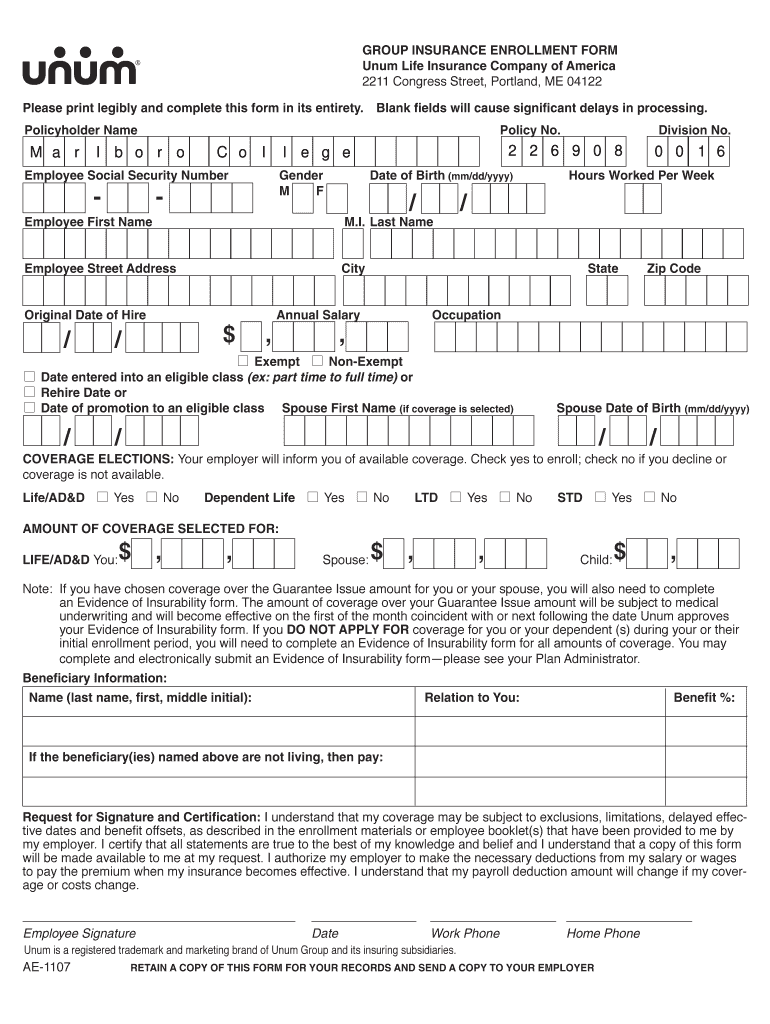

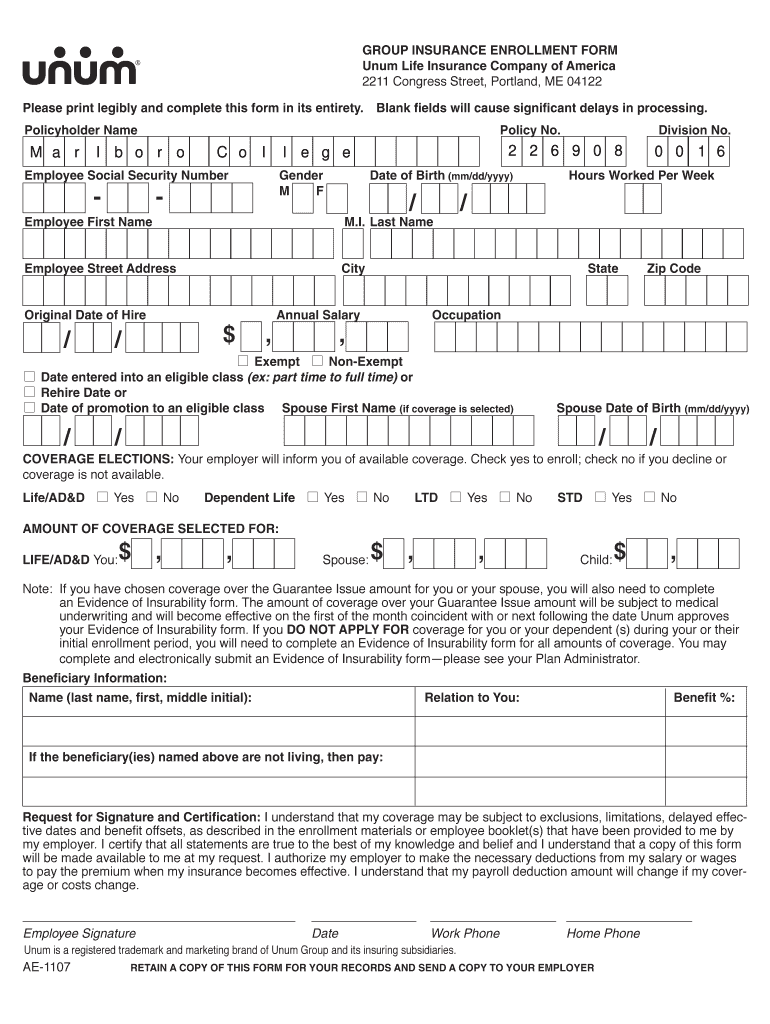

GROUP INSURANCE ENROLLMENT FORM

UNM Life Insurance Company of America

2211 Congress Street, Portland, ME 04122

Please print legibly and complete this form in its entirety. Blank fields will cause

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unum site pdffiller com

Edit your unum site pdffiller com form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unum site pdffiller com form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing unum site pdffiller com online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit unum site pdffiller com. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out unum site pdffiller com

How to fill out term life insurance enrollment:

01

Gather personal information: Collect details such as your full name, date of birth, address, and contact information. You may also need to provide your Social Security number or tax identification number.

02

Select the coverage amount: Determine the desired amount of coverage you need for your term life insurance policy. Consider factors such as your financial obligations, dependents, and future expenses.

03

Choose the term length: Decide on the duration of your term life insurance policy. Common options are 10, 15, 20, or 30 years. Consider your current age, expected retirement date, and financial goals while making this decision.

04

Complete the medical questionnaire: Answer questions regarding your health history, current medical conditions, medications, and lifestyle choices. Be truthful and provide accurate information, as this will impact the premium and eligibility.

05

Determine beneficiaries: Specify the individuals or organizations who will receive the death benefit in the event of your passing. Include their full names, relationship to you, and their contact information.

06

Review and sign the enrollment form: Carefully read through the enrollment form, ensuring all the information provided is accurate. If any changes or corrections are needed, make them before signing the document.

07

Attach supporting documentation: Depending on the insurance provider, you may need to submit additional documentation, such as proof of income or medical records. Follow the specific instructions provided by the company.

Who needs term life insurance enrollment:

01

Individuals with dependents: If you have children, a spouse, or other individuals who rely on your income, term life insurance can provide financial protection to support them in your absence.

02

Breadwinners: If you are the primary income earner in your household, term life insurance can help replace lost income and ensure your loved ones can maintain their lifestyle and financial security.

03

Business owners: Term life insurance can be beneficial for business owners who want to protect their business from financial hardship in case of their untimely death. It can be used to cover debts, business expenses, or even fund a succession plan.

04

Individuals with financial obligations: If you have outstanding debts, such as a mortgage, car loan, or student loans, term life insurance can help cover these obligations, preventing your loved ones from inheriting the burden.

05

Individuals seeking affordable coverage: Term life insurance typically offers more affordable premiums compared to permanent life insurance policies. If you are looking for cost-effective coverage for a specific period, term life insurance may be the right choice.

Fill

form

: Try Risk Free

People Also Ask about

What bank does Unum use?

EagleBank is a community bank headquartered in Bethesda, Maryland.

What are the benefits of Unum?

Employees and Families Benefits. Disability Insurance. Life Insurance. Accident Insurance. Critical Illness Insurance. Hospital Insurance. Dental Insurance. Vision Insurance. File a Claim.

Does Unum provide life insurance?

Unum offers group and individual life insurance coverage to suit your employees' life stages and evolving needs.

What does Unum stand for?

1986: Union Mutual changes its name to Unum.

How long does it take Unum to process a life insurance claim?

For most leave requests, once Unum has received all required information, a decision can be made within 2 business days.

Can I borrow money from Unum life insurance?

* You can borrow from that cash value, or you can buy a smaller, paid-up policy — with no more premiums due. What's included? A “Living” Benefit You can request an early payout of your policy's death benefit (up to $150,000 maximum) if you're expected to live 12 months or less.

How much money can I borrow from my life insurance?

Loan limits: The limit for borrowing money from life insurance is set by the insurer, and it's typically no more than 90% of the policy's cash value. If you need more than that amount, you may need to consider other loan types.

Can I pull money out of my work life insurance?

You can usually withdraw part of the cash value in a permanent life policy without canceling the coverage. Instead, your life insurance beneficiaries will receive a reduced payout when you die. Typically you won't owe income tax on withdrawals up to the amount of the premiums you've paid into the policy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my unum site pdffiller com in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your unum site pdffiller com and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit unum site pdffiller com straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing unum site pdffiller com.

How do I edit unum site pdffiller com on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign unum site pdffiller com on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is term life insurance enrollment?

Term life insurance enrollment refers to the process of signing up for a term life insurance policy, which provides coverage for a specified period of time, typically ranging from 10 to 30 years.

Who is required to file term life insurance enrollment?

Individuals who wish to obtain term life insurance coverage are required to file term life insurance enrollment.

How to fill out term life insurance enrollment?

To fill out term life insurance enrollment, you typically need to complete an application form provided by the insurance company, which includes personal information, details about your health, and the coverage amount desired.

What is the purpose of term life insurance enrollment?

The purpose of term life insurance enrollment is to formally apply for insurance coverage that pays a death benefit to beneficiaries if the insured person passes away during the term of the policy.

What information must be reported on term life insurance enrollment?

Information that must be reported on term life insurance enrollment includes personal details such as name, age, gender, address, occupation, health history, and lifestyle habits.

Fill out your unum site pdffiller com online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Unum Site Pdffiller Com is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.