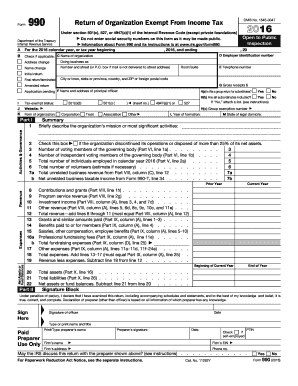

IRS 990 - Schedule K 2019 free printable template

Show details

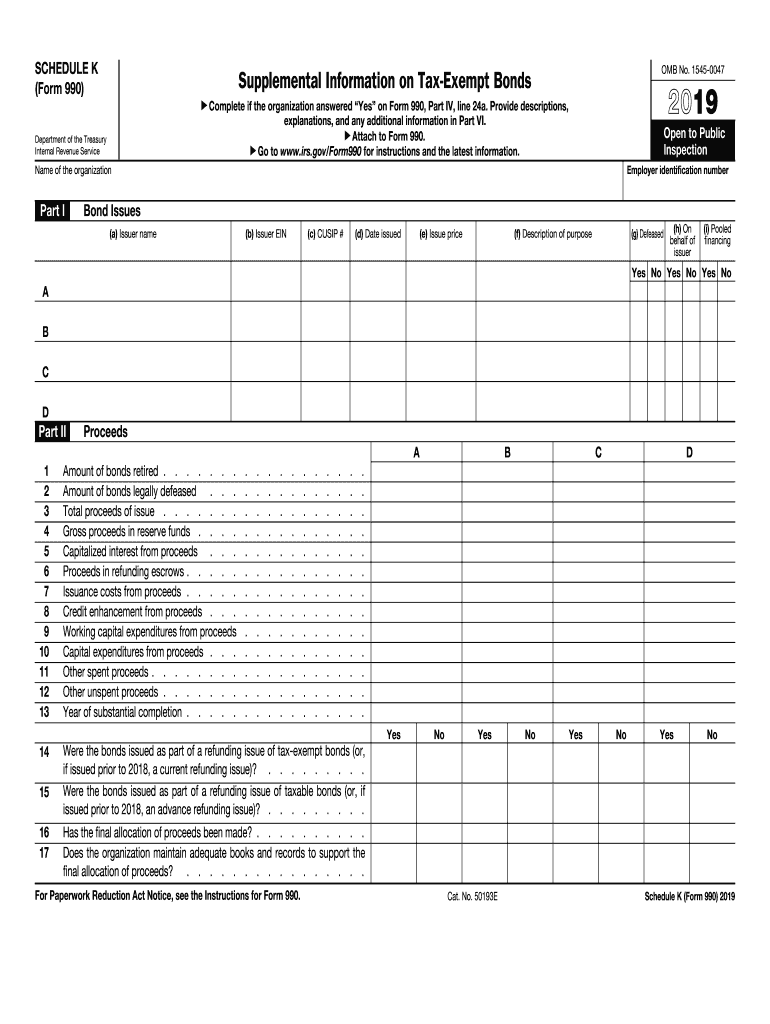

For Paperwork Reduction Act Notice see the Instructions for Form 990. Cat. No. 50193E Schedule K Form 990 2017 Page 2 3a Are there any management or service contracts that may result in private business use of bond-financed property. SCHEDULE K Form 990 OMB No. 1545-0047 Supplemental Information on Tax-Exempt Bonds Complete Department of the Treasury Internal Revenue Service if the organization answered Yes on Form 990 Part IV line 24a. Provide descriptions explanations and any additional...information in Part VI. Attach to Form 990. Go to www*irs*gov/Form990 for instructions and the latest information* Open to Public Inspection Employer identification number Name of the organization Part I Bond Issues a Issuer name b Issuer EIN c CUSIP d Date issued e Issue price f Description of purpose g Defeased h On behalf of issuer i Pooled financing Yes No Yes No Yes No A B C D Proceeds Amount of bonds retired. Total proceeds of issue. Gross proceeds in reserve funds. Capitalized interest...from proceeds. Proceeds in refunding escrows. Issuance costs from proceeds. Credit enhancement from proceeds. Working capital expenditures from proceeds Capital expenditures from proceeds. Other spent proceeds. Year of substantial completion. Were the bonds issued as part of a current refunding issue. Has the final allocation of proceeds been made. Does the organization maintain adequate books and records to support the final allocation of proceeds. Yes No Private Business Use Was the...organization a partner in a partnership or a member of an LLC which owned property financed by tax-exempt bonds. Are there any lease arrangements that may result in private business use of bond-financed property. b If Yes to line 3a does the organization routinely engage bond counsel or other outside counsel to review any management or service contracts relating to the financed property c outside counsel to review any research agreements relating to the financed property Enter the percentage of...financed property used in a private business use by entities other than a section 501 c 3 organization or a state or local government. 8a b If Yes to line 8a was any remedial action taken pursuant to Regulations sections 1. 141-12 and 1. 145-2. nonqualified bonds of the issue are remediated in accordance with the requirements under Regulations sections 1. 141-12 and 1. 145-2. Has there been a sale or disposition of any of the bond-financed property to a nongovernmental person other than a 501 c...3 organization since the bonds were issued disposed of. result of unrelated trade or business activity carried on by your organization another section 501 c 3 organization or a state or local government. Total of lines 4 and 5. Does the bond issue meet the private security or payment test. Arbitrage Has the issuer filed Form 8038-T Arbitrage Rebate Yield Reduction Penalty in Lieu of Arbitrage Rebate. If No to line 1 did the following apply a Rebate not due yet. b Exception to rebate. c No rebate...due. and. If Yes to line 2c provide in Part VI the date the rebate computation was performed. Is the bond issue a variable rate issue.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 990 - Schedule K

How to edit IRS 990 - Schedule K

How to fill out IRS 990 - Schedule K

Instructions and Help about IRS 990 - Schedule K

How to edit IRS 990 - Schedule K

Edit your IRS 990 - Schedule K form easily by using pdfFiller’s editing features. Upload your completed form to pdfFiller and use the editing tools to make necessary adjustments. Ensure all modifications are accurate before finalizing the document.

How to fill out IRS 990 - Schedule K

To fill out the IRS 990 - Schedule K form, gather all required financial information and follow these steps:

01

Download the form from the IRS website or use pdfFiller for direct access.

02

Enter your organization’s name, employer identification number (EIN), and address at the top of the form.

03

Provide detailed information about the payments made and purchases acquired during the reporting period.

04

Review each section and ensure accuracy in reporting amounts and descriptions.

05

Sign and date the completed form before submission.

About IRS 990 - Schedule K 2019 previous version

What is IRS 990 - Schedule K?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 990 - Schedule K 2019 previous version

What is IRS 990 - Schedule K?

IRS 990 - Schedule K is a financial reporting form used by organizations exempt from federal income tax. The form captures transactions related to payment card and third-party network transactions for the tax year.

What is the purpose of this form?

The purpose of IRS 990 - Schedule K is to disclose information regarding payment processing services that a tax-exempt organization engages in. This helps the IRS track the flow of funds and ensures accurate reporting of income received through these services.

Who needs the form?

Organizations that operate as non-profits and participate in payment card and third-party network transactions must complete and file IRS 990 - Schedule K. This typically applies to charities that receive contributions through credit cards or digital payment platforms.

When am I exempt from filling out this form?

You are exempt from filling out IRS 990 - Schedule K if your organization does not engage in any payment card or third-party network transactions during the tax year. Additionally, certain small organizations may qualify for exemptions based on gross receipts.

Components of the form

IRS 990 - Schedule K consists of several key components, including sections for reporting types of transactions, associated fees, and total amounts processed. Ensure that you address each component thoroughly to avoid omissions.

Due date

The due date for filing IRS 990 - Schedule K aligns with the due date for IRS Form 990, which is typically the 15th day of the 5th month after the end of your organization’s accounting period. For organizations with a fiscal year ending December 31, the deadline is May 15.

What are the penalties for not issuing the form?

Failing to file IRS 990 - Schedule K can result in significant penalties. Organizations may incur a fee of $20 for each day the form is late, with a maximum penalty for each missing or incomplete form. This can add up quickly, especially for organizations with multiple forms due.

What information do you need when you file the form?

When filing IRS 990 - Schedule K, collect the following information:

01

Your organization’s EIN and contact details.

02

Details of all payment card transactions, including total amounts and fees incurred.

03

Information about any third-party network transactions your organization received.

Is the form accompanied by other forms?

IRS 990 - Schedule K is usually submitted alongside Form 990, as part of the overall package of information requirements for tax-exempt organizations. Ensure that all relevant forms are filed together to avoid processing issues.

Where do I send the form?

Submit IRS 990 - Schedule K along with Form 990 to the address listed in the form instructions. Generally, this will be dependent on the organization’s location and whether you are filing electronically or via mail.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.