Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

The term "k form" is not specific enough to provide a definitive answer. It can refer to various things depending on the context. Without additional information, it is not possible to determine the exact meaning of "k form."

Who is required to file k form?

The reference to a "k form" could refer to several different IRS tax forms, such as Form 1099-K, Form 1065 (K-1), or Form 1120-S (Schedule K-1).

1. Form 1099-K: This form is required to be filed by payment settlement entities (such as merchant services providers or third-party payment processors) who process payments on behalf of third-party sellers or individuals engaged in a trade or business. It reports the gross amount of payment card transactions and third-party network transactions.

2. Form 1065 (K-1): This form is required to be filed by partnerships (including limited partnerships and limited liability partnerships) to report the income, deductions, and credits allocated to each partner (owner) of the partnership.

3. Form 1120-S (Schedule K-1): This form is required to be filed by S corporations to report the income, deductions, and credits allocated to each shareholder (owner) of the S corporation.

It is important to consult a certified tax professional or refer to the IRS guidelines to determine the specific filing requirements based on the specific form you are referring to and the circumstances of your situation.

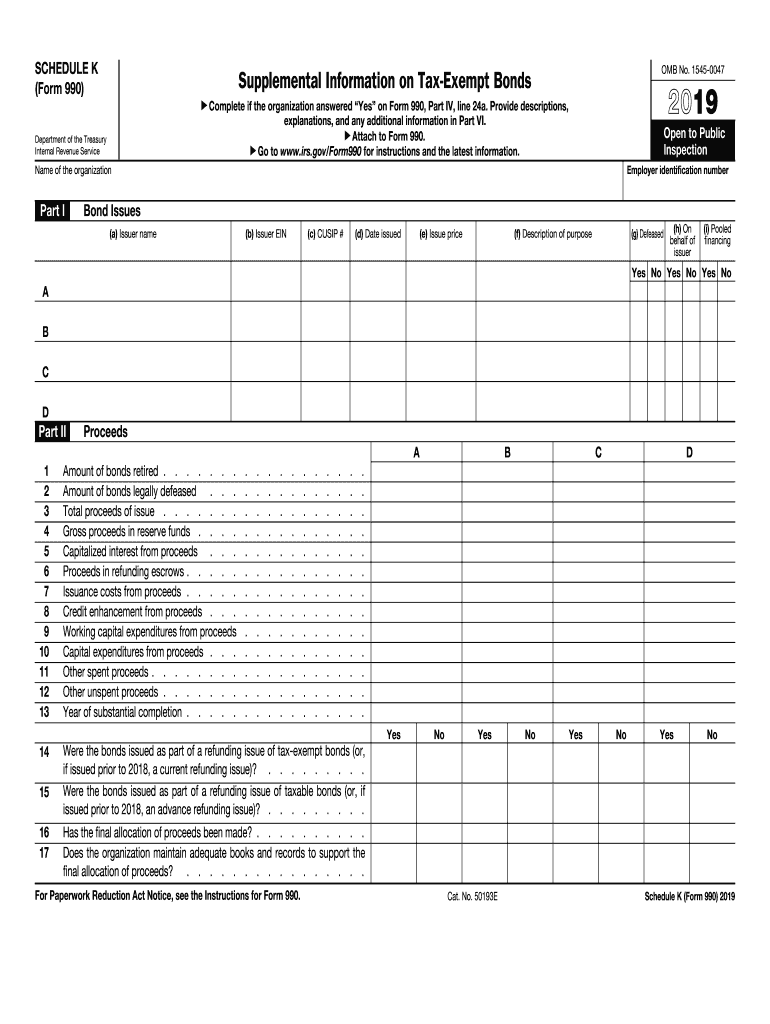

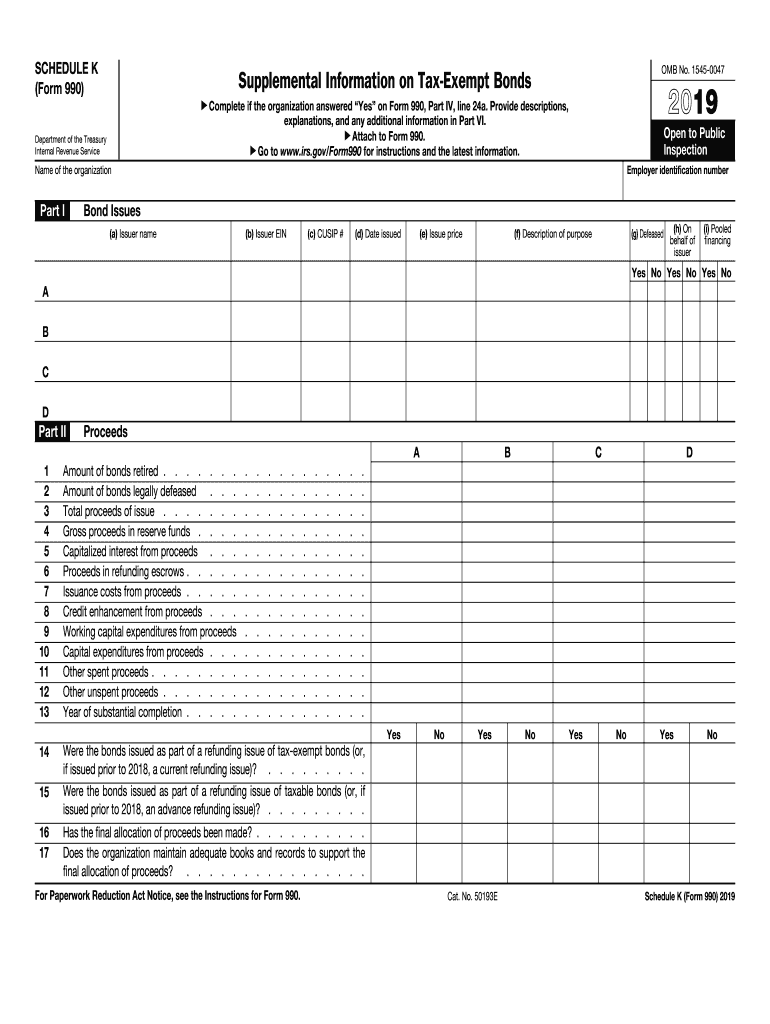

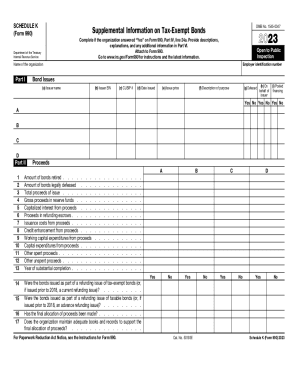

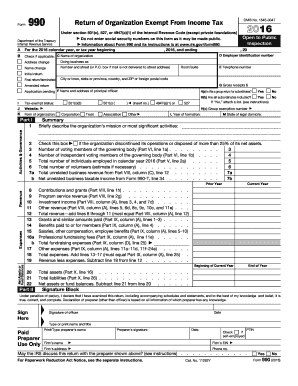

To fill out a K form, follow these steps:

1. Obtain a copy of the K form. This form should be provided by the organization or institution that requires it.

2. Read the instructions carefully. The instructions will guide you through the process of filling out the form correctly.

3. Gather the necessary information. The form will likely require personal or business information, such as your name, address, social security number, or tax identification number. Collect all the required information and have it readily available.

4. Start at the top of the form. The K form will typically have different sections to be completed. Begin with the first section and work your way down.

5. Fill in your personal or business information. Enter your name, address, contact details, and any other requested information accurately and legibly. Make sure to follow any specific formatting instructions provided.

6. Provide financial information. The K form may require you to report relevant financial details, such as income, expenses, or assets. Be prepared to provide accurate information in these areas.

7. Complete any additional sections. Depending on the purpose of the form, there may be additional sections to address specific requirements, certifications, or authorizations. Read and respond to these sections accordingly.

8. Check for completeness and accuracy. Before submitting the form, review each section to ensure all required fields have been filled out accurately. Double-check spellings, dates, and numbers for any errors or typos.

9. Sign and date the form. Most forms will require your signature and date. Sign the form in the appropriate section using your legal signature.

10. Submit the form. Determine the submission method specified by the organization or institution. It may be submitted electronically, by mail, or in person. Follow the necessary steps to submit the form as instructed.

It is recommended to consult professional assistance if you encounter any difficulties while filling out the form or have specific questions about the information required.

What is the purpose of k form?

In the field of science and mathematics, the "k form" refers to expressions written in the form of "kx^n", where "k" represents a constant, "x" denotes a variable, and "n" is a constant exponent. The purpose of expressing equations or terms in this form is to simplify and generalize calculations and analyses.

The k form allows for easier comparison and identification of similar terms, as the variables are isolated and the exponents are clearly defined. It also facilitates differentiation and integration of functions by applying various mathematical rules and techniques.

Additionally, the k form enables the recognition of specific patterns and relationships between different equations or terms. It provides a more standardized representation that aids in understanding and communicating mathematical concepts.

What information must be reported on k form?

The k form, also known as Form K-1, is used to report the distributive share of income, deductions, and credits for a partnership, limited liability company (LLC), or S corporation. The information that must be reported on a K-1 form includes:

1. Partner or Shareholder Information: This section includes details about the individual or entity receiving the K-1 form, such as their name, Social Security number or taxpayer identification number, and address.

2. Partnership, LLC, or S Corporation Information: This section provides information about the partnership, LLC, or S corporation issuing the K-1 form, including their name, EIN (Employer Identification Number), and address.

3. Income: The K-1 form reports the individual's share of the partnership, LLC, or S corporation's income, including ordinary income, rental income, interest income, dividends, capital gains, and other income.

4. Deductions: This section reports the individual's share of the partnership's deductions, such as business expenses, depreciation, depletion, taxes, and interest expenses.

5. Credits: Any credits allocated to the partner or shareholder, such as tax credits for investments in certain industries or renewable energy projects, will be reported in this section.

6. Alternative Minimum Tax (AMT) and Foreign Taxes: If applicable, the K-1 form may report information related to alternative minimum tax or foreign taxes paid or accrued by the partnership, LLC, or S corporation.

It's important to note that specific items to be reported on the K-1 form may vary depending on the type of entity and the nature of its business activities. Additionally, the K-1 form is generated by the partnership, LLC, or S corporation and distributed to each partner or shareholder, who will use the information to complete their individual income tax return.

When is the deadline to file k form in 2023?

The deadline to file a K form in 2023 depends on the specific type of form you are referring to. However, assuming you are referring to the Form 1099-K, the deadline for filing is usually January 31st, 2024. It is important to note that tax deadlines can change, and it is always recommended to consult official IRS guidelines or a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of k form?

The penalty for the late filing of a K-Form depends on the specific form and the type of late filing involved. Since K-Forms cover a range of tax forms, such as K-1, K-4, K-9, etc., the penalties can vary.

For individual taxpayers, if you fail to file a K-1 tax form by the deadline, the penalty is generally 5% of the unpaid tax amount for each month or part of a month that the form is late, up to a maximum of 25%. If the K-1 form is filed more than 60 days after the deadline, the minimum penalty would be either $215 or the amount of tax due, whichever is smaller.

For businesses and partnerships, the penalty for late filing of K-1 forms can be more significant. The penalty is generally $195 per partner or member for each month or part of a month that the form is late, up to a maximum of 12 months. However, if the partnership or LLC fails to file the K-1 forms at all or intentionally disregards the filing requirement, the IRS can impose a much higher penalty.

It's important to note that these penalties are subject to change, and there may be additional penalties or interest charges depending on the circumstances. It is advisable to consult with a tax professional or review the specific IRS guidelines for accurate and up-to-date information regarding the penalties associated with late filing of K-Forms.

How can I get 2020 k form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific 2020 irs schedule k form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in 2020 schedule k form?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your 990 schedule tax form to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I complete irs 990 schedule k form on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your 990 schedule k form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.