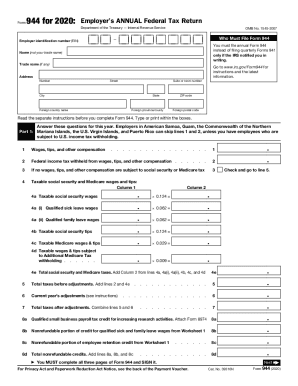

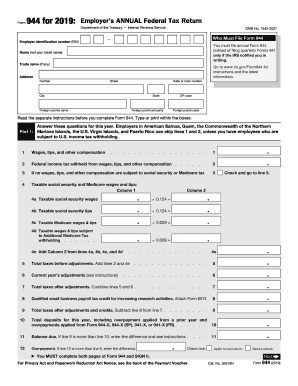

IRS 944 Instructions 2019 free printable template

Show details

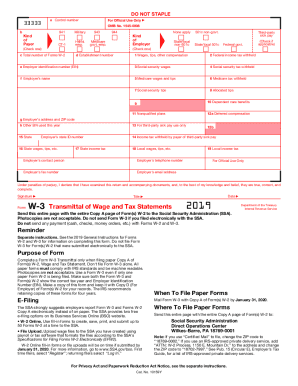

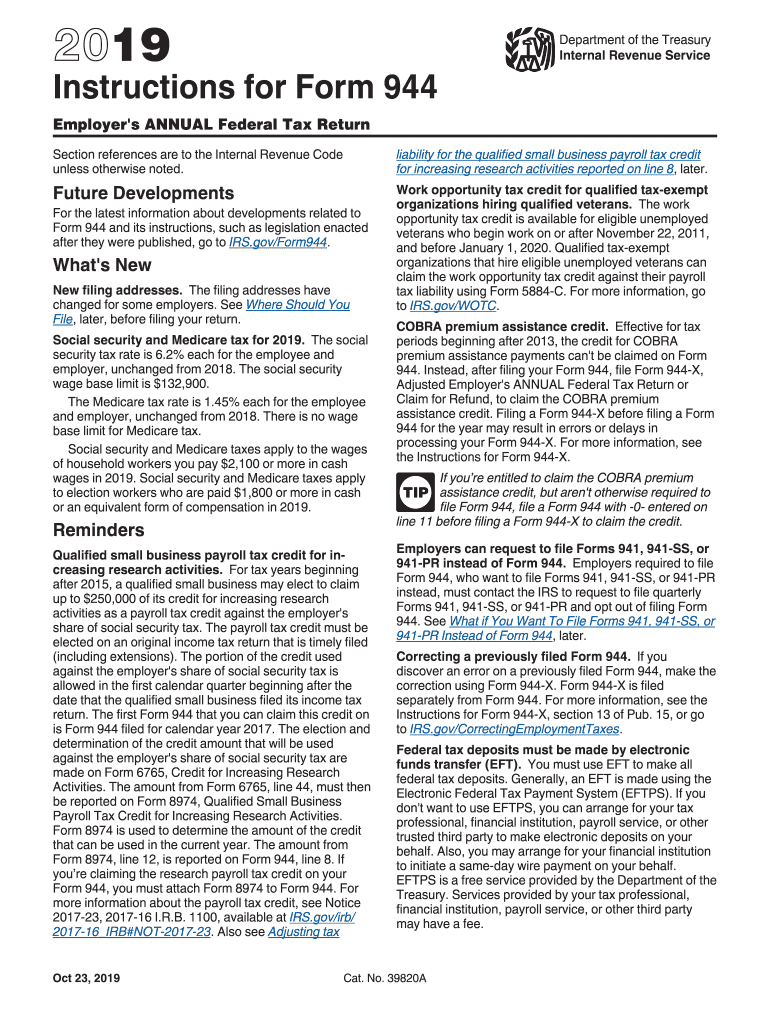

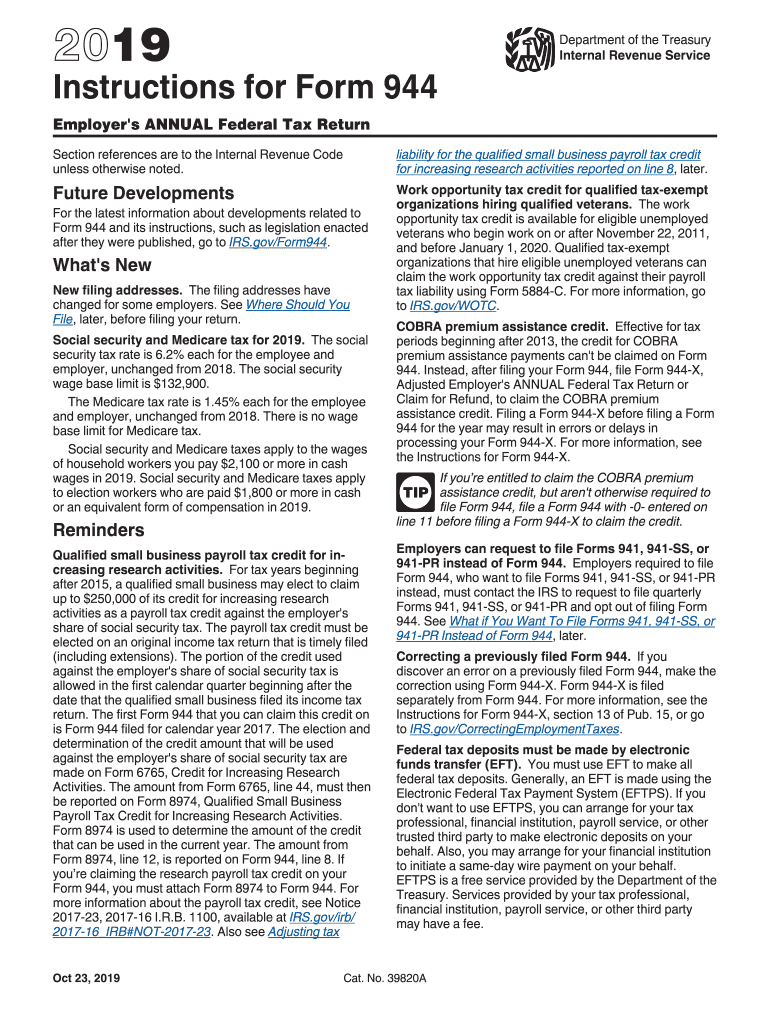

These instructions give you some background Form 944 how to complete it line by line and when and where to file it. See the Instructions for Schedule D Form 941 to determine whether you should file Schedule D Form 941 and when you should file it. Select one of the addresses above based on the state filing alignment for returns filed Without a payment under the IRS will send you a written notice that your filing notice you must file Form 944 for calendar year 2018. Department of the Treasury...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 944 Instructions

Edit your IRS 944 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 944 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 944 Instructions online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 944 Instructions. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 944 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 944 Instructions

How to fill out IRS 944 Instructions

01

Gather your financial records including income and tax information.

02

Obtain Form 944 and its Instructions from the IRS website.

03

Enter your business name, address, and Employer Identification Number (EIN) at the top of the form.

04

Report your total income and any taxable wages paid to employees throughout the year.

05

Calculate your payroll taxes including Social Security, Medicare, and federal income tax withholding.

06

Complete the payment sections based on your calculations and any payments already made.

07

Review the instructions for any specific state or local taxes that may apply.

08

Sign and date the form, ensuring all information is accurate before submission.

09

File the form with the IRS by the deadline specified in the instructions.

Who needs IRS 944 Instructions?

01

Employers who have an annual payroll tax liability of $1,000 or less.

02

Small business owners who are required to file employment tax returns for their employees.

03

Nonprofit organizations that pay wages and need to report payroll taxes.

04

Businesses that have been specifically instructed by the IRS to file Form 944 instead of quarterly returns.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between 944 and 941?

Form 941 is very similar to Form 944, except that it's meant for businesses with annual payroll tax liabilities greater than $1,000. Businesses should generally file Form 941 unless the IRS tells you to use Form 944 or if you successfully request to use 944 forms because of your lower liability.

Do I have to file a 944 form?

You must file Form 944 if the IRS has notified you to do so, unless you contact the IRS to request, and receive written notice, to file quarterly Form 941 instead. This is true even if your employment taxes for the year will be over $1,000.

Do sole proprietors with no employees file 941?

Sole proprietors need to file Form 941, Employer's Quarterly Federal Tax Return (or Form 944, Employer's Annual Federal Tax Return), for the calendar quarter in which they make final wage payments.

Who is required to file a 944?

Form 944 is designed so the smallest employers (those whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less) will file and pay these taxes only once a year instead of every quarter.

What is a Form 944 for?

More In Forms and Instructions Form 944 is designed so the smallest employers (those whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less) will file and pay these taxes only once a year instead of every quarter.

Do I need to file Form 944 if I have no employees?

What is Form 944? Form 944 lets small business owners who have a few (or no) full-time employees file and pay their employment taxes yearly, instead of every quarter. Even if you have no employees, you will need to file a return for your business.

Do I need to file a 941 if I have no employees?

Who must file Form 941. Generally, any person or business that pays wages to an employee must file a Form 941 each quarter, and must continue to do so even if there are no employees during some of the quarters.

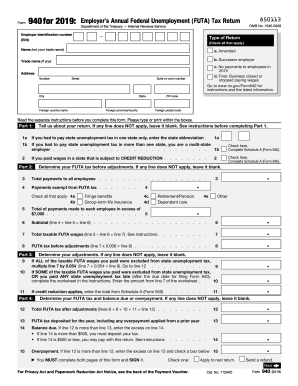

Do I need to file Form 940 if I have no employees?

Form 940 reports the amount of Federal Unemployment Tax (FUTA) an employer must pay. Employers who've paid $1,500 or more to any W-2 employee OR had at least 1 employee for 20 or more weeks of the year must file Form 940.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS 944 Instructions directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your IRS 944 Instructions along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I fill out IRS 944 Instructions on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your IRS 944 Instructions from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I fill out IRS 944 Instructions on an Android device?

Use the pdfFiller Android app to finish your IRS 944 Instructions and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is IRS 944 Instructions?

IRS 944 Instructions provide guidance for employers who file Form 944, which is used to report annual federal payroll taxes instead of filing quarterly.

Who is required to file IRS 944 Instructions?

Employers with an estimated annual payroll tax liability of $1,000 or less are required to file IRS 944 Instructions.

How to fill out IRS 944 Instructions?

To fill out IRS 944 Instructions, follow the guidelines on the form, providing accurate payroll information, calculating tax liabilities, and ensuring all required signatures are included.

What is the purpose of IRS 944 Instructions?

The purpose of IRS 944 Instructions is to simplify the filing process for small employers by allowing them to report their federal tax liabilities annually instead of quarterly.

What information must be reported on IRS 944 Instructions?

IRS 944 Instructions require reporting total wages paid, federal income tax withheld, Social Security and Medicare taxes, and any adjustments for prior periods.

Fill out your IRS 944 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 944 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.