Get the free BS1209 - Introduction to Financial and Management Accounting

Show details

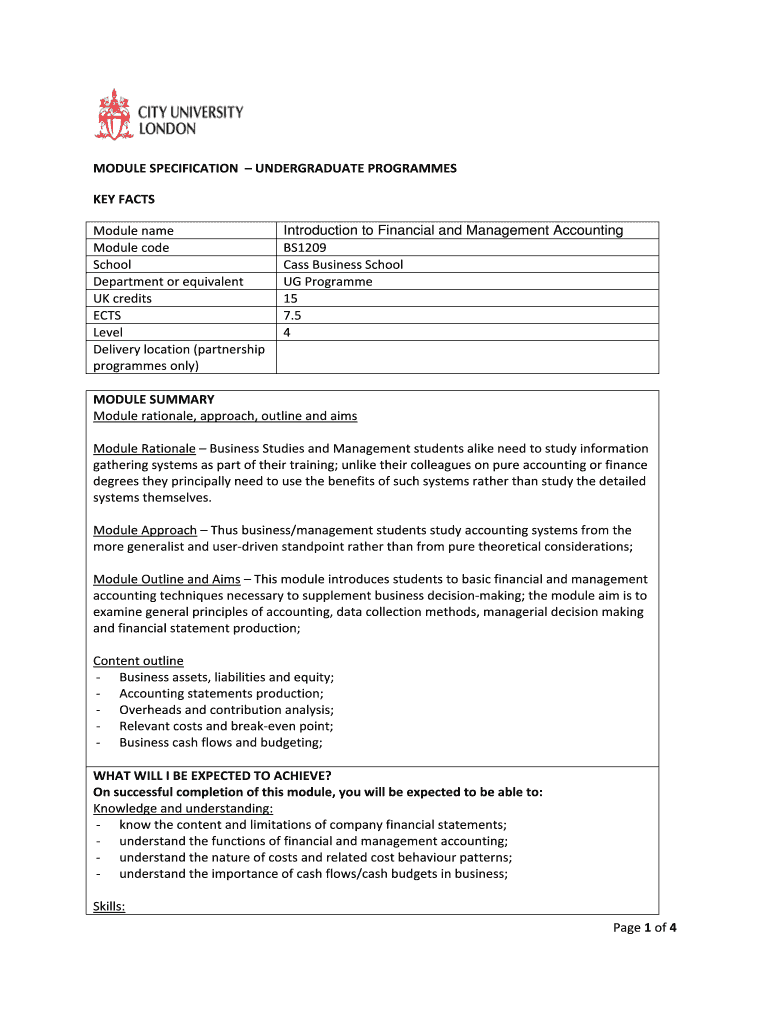

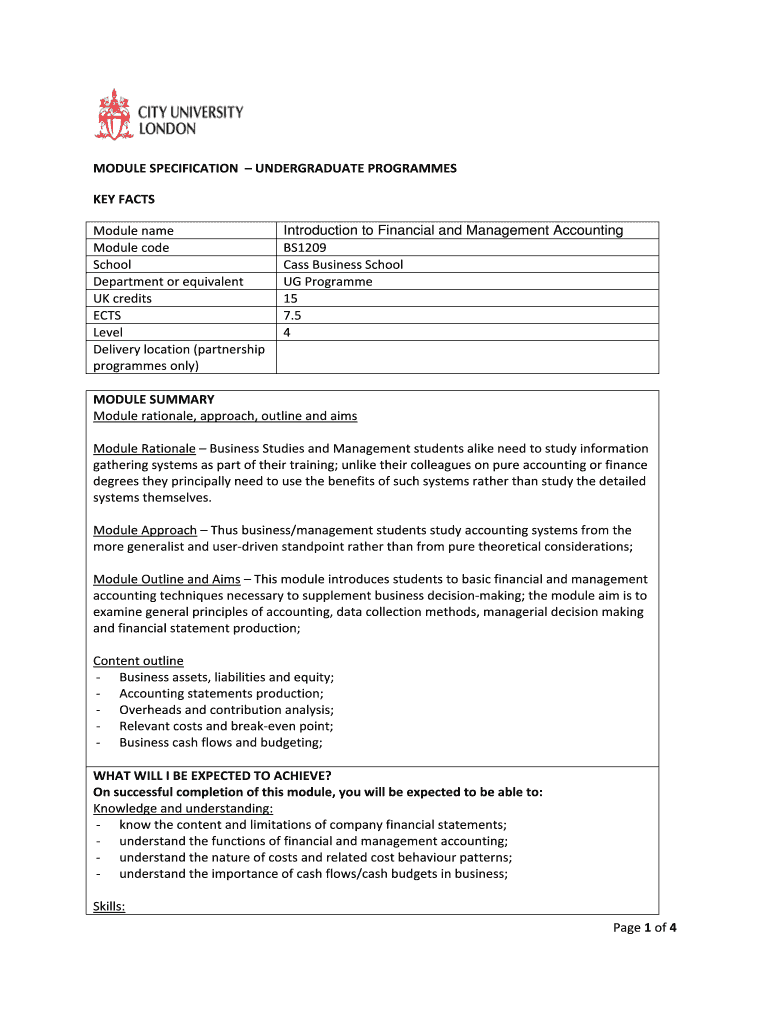

MODULESPECIFICATIONUNDERGRADUATEPROGRAMMES KEY FACTS Introduction to Financial and Management Accounting Module name Module code BS1209 School CassBusinessSchool Departmentorequivalent Programmed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bs1209 - introduction to

Edit your bs1209 - introduction to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bs1209 - introduction to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bs1209 - introduction to online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bs1209 - introduction to. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bs1209 - introduction to

How to fill out bs1209 - introduction to:

01

Start by carefully reading the instructions provided for each section of the form.

02

Provide accurate and complete information in the required fields. Double-check for any spelling errors or missing information before submitting.

03

If there are any optional sections, decide whether or not they are relevant to your situation and fill them out accordingly.

Who needs bs1209 - introduction to:

01

Individuals who are interested in gaining a basic understanding of the subject matter covered in bs1209.

02

Students or professionals who are required to take this course as a prerequisite for further studies or career advancement.

03

Anyone looking to broaden their knowledge in the specific field addressed by bs1209 - introduction to.

Fill

form

: Try Risk Free

People Also Ask about

What is financial & management accounting?

The difference between financial and managerial accounting is that financial accounting is the collection of accounting data to create financial statements, while managerial accounting is the internal processing used to account for business transactions.

What is introductory management accounting?

Management Accounting includes the methods and concepts necessary for effective planning, for choosing among alternative business actions, and for control through the evaluation and interpretation of performance.

What is a management accounting statement?

Management accounts are financial reports produced for the business owners and managers, generally monthly or quarterly, normally a Profit & Loss report and a Balance Sheet. In principle they are similar to Year End accounts but are less formal and are personalised to the user's requirements.

Is managerial accounting class hard?

Managerial accounting can be considered a challenging subject for several reasons: Conceptual Complexity: Managerial accounting involves the understanding and application of various complex concepts and techniques.

What is the difference between a financial accountant and a management accountant?

A financial accountant prepares detailed reports on a public company's income and outflow for the past quarter and year that are sent to shareholders and regulators. A managerial accountant prepares financial reports that help executives make decisions about the future direction of the company.

Is financial or managerial accounting harder?

Managerial or management accounting is considered to be easier, as it requires fewer journal entries and mostly involves budgeting and forecasting. It is used for internal purposes only and doesn't require financial statements that conform to specific accounting standards.

What is financial management and management accounting?

Financial accounting emphasizes on giving true and a fair view of the financial position of the company to various parties. On the contrary, management accounting aims at providing both qualitative and quantitative information to the managers, so as to assist them in decision making and thus maximizing the profit.

Is managerial accounting hard?

Yes, managerial accounting is hard. Responsibilities can include completing internal-facing tasks and creating the reports necessary to operate a business, such as monitoring and reporting on costs, sales, spending, budgets, and internal financial trends.

What are the major financial reports?

The balance sheet, income statement, and cash flow statement each offer unique details with information that is all interconnected. Together the three statements give a comprehensive portrayal of the company's operating activities.

What are the 5 basic financial reports?

5 Types of Financial Reports and Their Benefits for Business Balance Sheet. Income Statement. Cash Flow Statement. Statement of Changes in Capital. Notes to Financial Statements.

What is financial and management accounting description?

Financial accounting emphasizes on giving true and a fair view of the financial position of the company to various parties. On the contrary, management accounting aims at providing both qualitative and quantitative information to the managers, so as to assist them in decision making and thus maximizing the profit.

What are the 4 types of financial reports?

For-profit businesses use four primary types of financial statement: the balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings.

What is financial cost and management accounting introduction?

The function of cost and management accounting is to gather data like time taken, wastages, process idleness etc., analyse the data, prepare reports and take necessary actions. Cost and management accounting information which are generated or collected are used by different stakeholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send bs1209 - introduction to for eSignature?

When you're ready to share your bs1209 - introduction to, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in bs1209 - introduction to?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your bs1209 - introduction to and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for the bs1209 - introduction to in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your bs1209 - introduction to in seconds.

What is bs1209 - introduction to?

BS1209 is an introductory guideline concerning a specific regulatory or reporting framework, typically related to business compliance or industry standards.

Who is required to file bs1209 - introduction to?

Typically, businesses, organizations, or individuals that fall under the regulatory framework specified by BS1209 are required to file this document.

How to fill out bs1209 - introduction to?

To fill out BS1209, one must carefully follow the provided instructions, ensuring all required fields are completed accurately and any necessary supporting documentation is attached.

What is the purpose of bs1209 - introduction to?

The purpose of BS1209 is to facilitate compliance with specific regulatory requirements and to ensure accurate reporting of relevant information in the context of business operations.

What information must be reported on bs1209 - introduction to?

BS1209 typically requires the reporting of information such as business identification details, compliance data, financial figures, and other pertinent operational metrics.

Fill out your bs1209 - introduction to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

bs1209 - Introduction To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.