Get the free Small Residential Income Property Appraisal ... - Fannie Mae

Show details

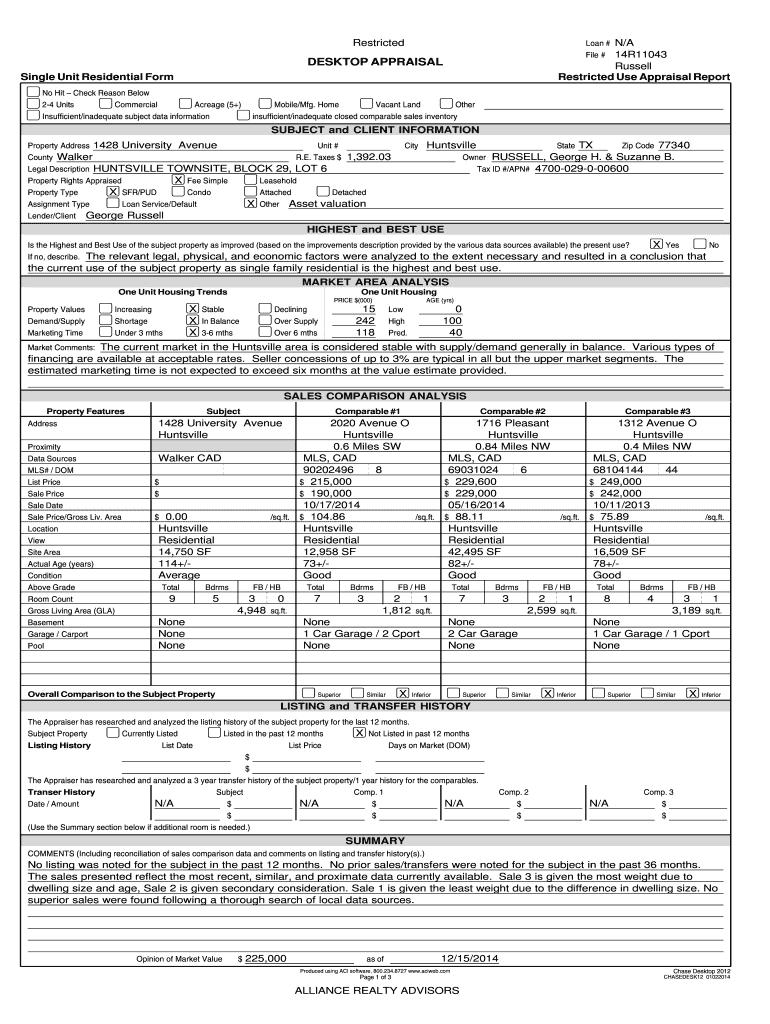

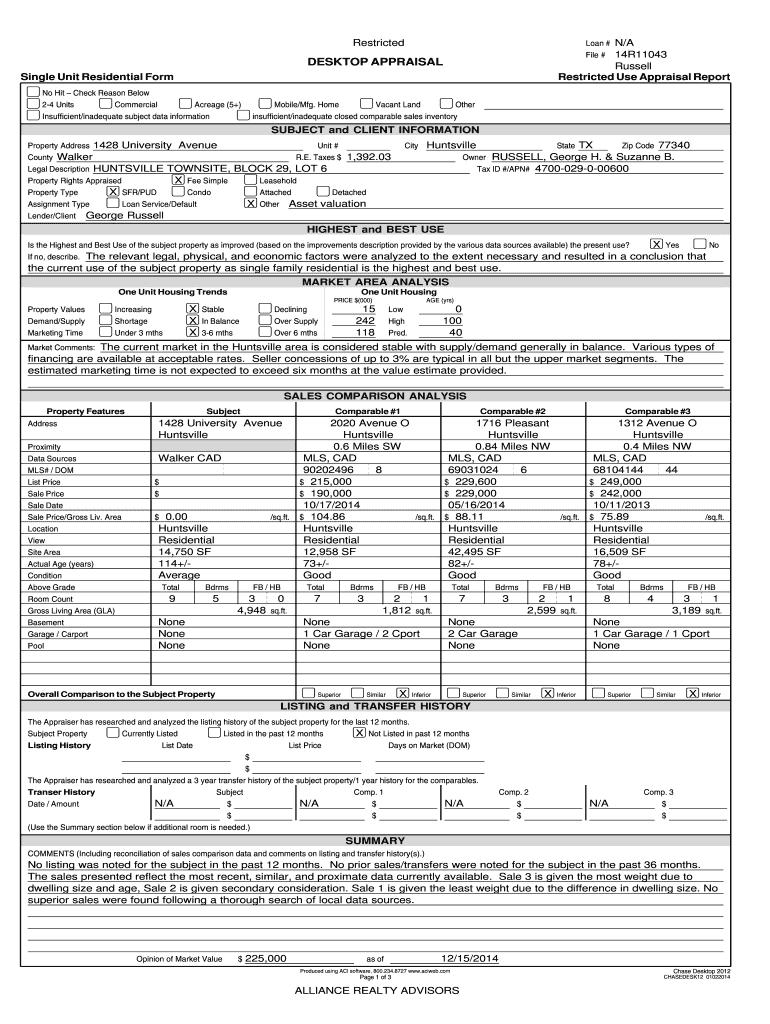

Loan # N/ARestrictedFile # 14R11043DESKTOP APPRAISAL Russell Restricted Use Appraisal Reporting Unit Residential Form No Hit Check Reason Below 24 Units Commercial Acreage (5+) Insufficient/inadequate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small residential income property

Edit your small residential income property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small residential income property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit small residential income property online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit small residential income property. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small residential income property

How to fill out small residential income property

01

Gather all the necessary documents such as rental application forms, lease agreements, and tenant screening criteria.

02

Advertise your property using various platforms like real estate websites, social media, and local classifieds.

03

Show the property to potential tenants and answer any questions they may have.

04

Screen the applicants by verifying their employment, income, credit history, and rental references.

05

Select the most qualified tenant and create a lease agreement with clear terms and conditions.

06

Collect rent and security deposits from the tenant.

07

Conduct regular inspections to ensure the property is well-maintained.

08

Handle any maintenance requests or repair issues promptly.

09

Keep accurate records of income and expenses related to the property for tax purposes.

10

Stay updated with local rental laws and regulations to ensure compliance.

Who needs small residential income property?

01

Small residential income properties are suitable for individuals or entities looking to generate rental income.

02

Real estate investors who are looking for passive income streams.

03

Homeowners who have an additional property and want to earn additional income by renting it out.

04

People who are looking to build wealth through real estate investments.

05

Landlords who want to diversify their investment portfolio.

06

Individuals who want to take advantage of the rental market and its potential for long-term financial stability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in small residential income property without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit small residential income property and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I sign the small residential income property electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your small residential income property in seconds.

How do I complete small residential income property on an Android device?

On an Android device, use the pdfFiller mobile app to finish your small residential income property. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is small residential income property?

Small residential income property is a property that is rented out to tenants and generates income for the owner. Typically, these properties consist of a small number of units, such as single-family homes or small apartment buildings.

Who is required to file small residential income property?

Owners of small residential income properties are required to file the necessary forms with the appropriate tax authorities in order to report their rental income and expenses.

How to fill out small residential income property?

To fill out small residential income property, owners must gather information on their rental income, expenses, and other relevant financial data. This information is then reported on the appropriate tax forms, such as Schedule E of the IRS Form 1040.

What is the purpose of small residential income property?

The purpose of small residential income property is to allow individuals to generate income from renting out properties. This can provide a source of passive income and potentially build wealth over time.

What information must be reported on small residential income property?

Owners of small residential income property must report their rental income, expenses, depreciation, and other financial details on the appropriate tax forms as required by the tax authorities.

Fill out your small residential income property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Residential Income Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.