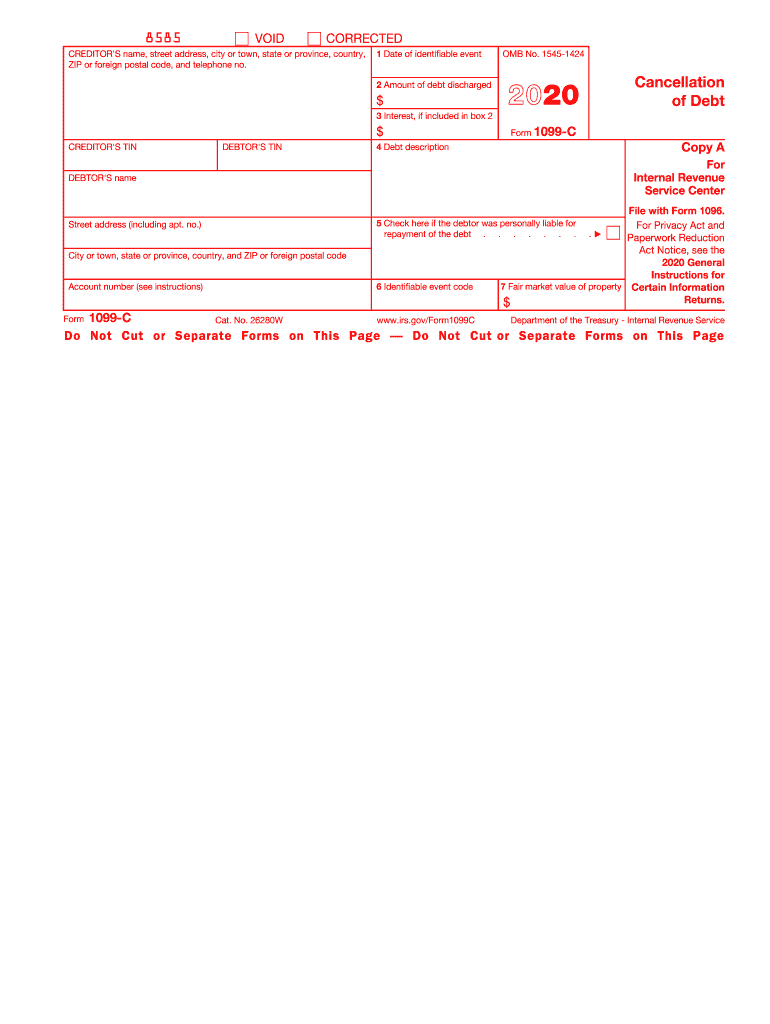

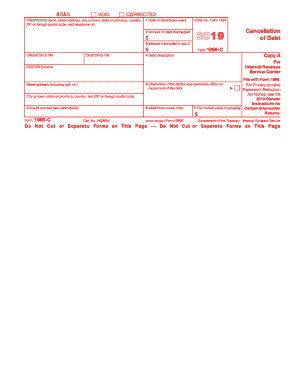

What is Form 1099-C?

The primary purpose of Form 1099-C (Cancelled Debt Form) is to report to the IRS that the creditor has canceled the taxpayer's debt(s) in less than the total amount they owe. The taxpayer must include this amount in their income tax return form.

Who must file Form 1099-C?

According to the IRS, any debt you owe that is canceled, forgiven, or discharged counts as taxable income. 1099-C Form informs the IRS about a debt that has been canceled or wiped out in bankruptcy. A creditor or money lender must file this form to report a debt cancellation of more than $600 to the debtor and the IRS.

What other documents must accompany IRS Form 1099-C?

Form 1099-C Cancellation of Debt must be filed with 1096 Form and Form 1099-A (if applicable). The taxpayer may need to attach other forms upon request. You must report the information from your Form 1099-C on the canceled debt in your income tax return. However, there are some exclusions to this requirement. For instance, if the debt is canceled in a bankruptcy case, you don’t need to include it in your gross income. To check the list of all exclusions, please visit the IRS website.

What information should be provided in 1099-C Form?

The creditor must indicate the name of the creditor and the debtor, TIN (Taxpayer Identification Number), Federal Identification Number, address, and date of the cancellation. The document must describe the debt, list the total amount forgiven, and provide a reasonable market value of the property if real estate is involved.

How do I fill out Form 1099-C?

You can find the editable and printable version of 1099-C Form on the IRS website. Or you may fill it out online using pdfFiller, a robust and easy-to-use PDF editing solution with eSignature functionality that helps you quickly complete the document.

Follow this guide to complete Form 1099-C in pdfFiller:

- Click the Get Form button.

- Follow the green pointer on the left to identify and fill out the required fillable fields.

- To complete the form, use the checkmarks, cross icons, and other annotation and text manipulation tools.

- Complete your 1099-C Form.

When is IRS Form 1099-C form due?

Form 1099-C needs to be submitted to the debtor by the 31st of January, 2021 and to IRS by February 28th, 2021. If you file the form electronically with the IRS, the deadline is March 31st.

Where do I send the completed Form 1099-C?

The completed form is filed with the local IRS office and sent to the debtor for the record.