Get the free Consolidated Tax Invoice - CardLink

Show details

Consolidated Tax Invoice Driven by CAROLINA Smart Ideas for Better Business Carolina Systems Limited GST No. 30690296 Private Bag 99918, Newmarket, Auckland 1149, New Zealand Phone: +64 9 574 7722

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consolidated tax invoice

Edit your consolidated tax invoice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consolidated tax invoice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consolidated tax invoice online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit consolidated tax invoice. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

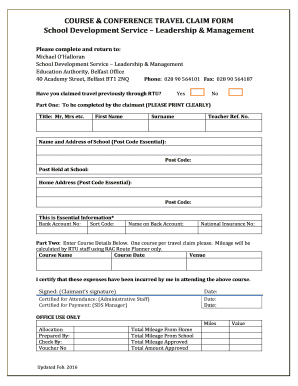

How to fill out consolidated tax invoice

How to fill out consolidated tax invoice

01

To fill out a consolidated tax invoice, follow these steps:

02

Start by entering the name, address, and taxpayer identification number (TIN) of the company issuing the invoice.

03

Next, indicate the invoice number, date, and place of issuance.

04

Include the name and address of the buyer, along with their TIN or identification number if applicable.

05

Specify the description of the goods or services provided.

06

Enter the quantity, unit price, and total amount for each item.

07

Calculate the subtotal by summing up the total amounts.

08

Include any applicable discounts or deductions.

09

Add the value of any taxes or duties levied.

10

Calculate the grand total by adding the subtotal, deductions, and taxes.

11

Finally, include any additional information required by local tax regulations, such as the tax code or payment instructions.

12

Double-check all the entered information for accuracy before submitting the consolidated tax invoice.

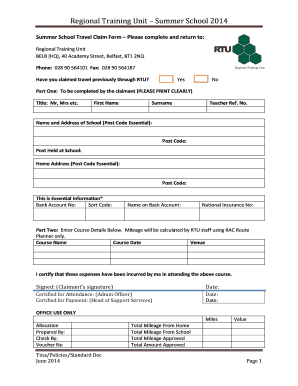

Who needs consolidated tax invoice?

01

Various entities and individuals may require a consolidated tax invoice, including:

02

- Companies that have multiple branches or divisions and want to consolidate their tax reporting.

03

- Business partners or customers who need to reconcile their accounts or claim tax credits.

04

- Government agencies or auditors responsible for verifying tax compliance.

05

- Tax professionals or consultants assisting clients with tax planning and reporting.

06

- Individuals who need to provide documentation for tax purposes.

07

In general, any party involved in business transactions subject to tax regulations can benefit from or require a consolidated tax invoice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify consolidated tax invoice without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including consolidated tax invoice, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I complete consolidated tax invoice online?

Easy online consolidated tax invoice completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for the consolidated tax invoice in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your consolidated tax invoice in seconds.

What is consolidated tax invoice?

Consolidated tax invoice is a single invoice that combines multiple individual invoices into one document for tax reporting purposes.

Who is required to file consolidated tax invoice?

Businesses or individuals who have multiple invoices for the same customer within a specific period may be required to file a consolidated tax invoice.

How to fill out consolidated tax invoice?

To fill out a consolidated tax invoice, gather all individual invoices that need to be consolidated, then combine the information into one document following the required format and reporting all necessary details.

What is the purpose of consolidated tax invoice?

The purpose of consolidated tax invoice is to simplify tax reporting for businesses and individuals with multiple transactions with the same customer, by combining all relevant information into one document.

What information must be reported on consolidated tax invoice?

Information that must be reported on a consolidated tax invoice includes details of all individual invoices being consolidated, such as invoice numbers, dates, amounts, and tax information.

Fill out your consolidated tax invoice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consolidated Tax Invoice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.