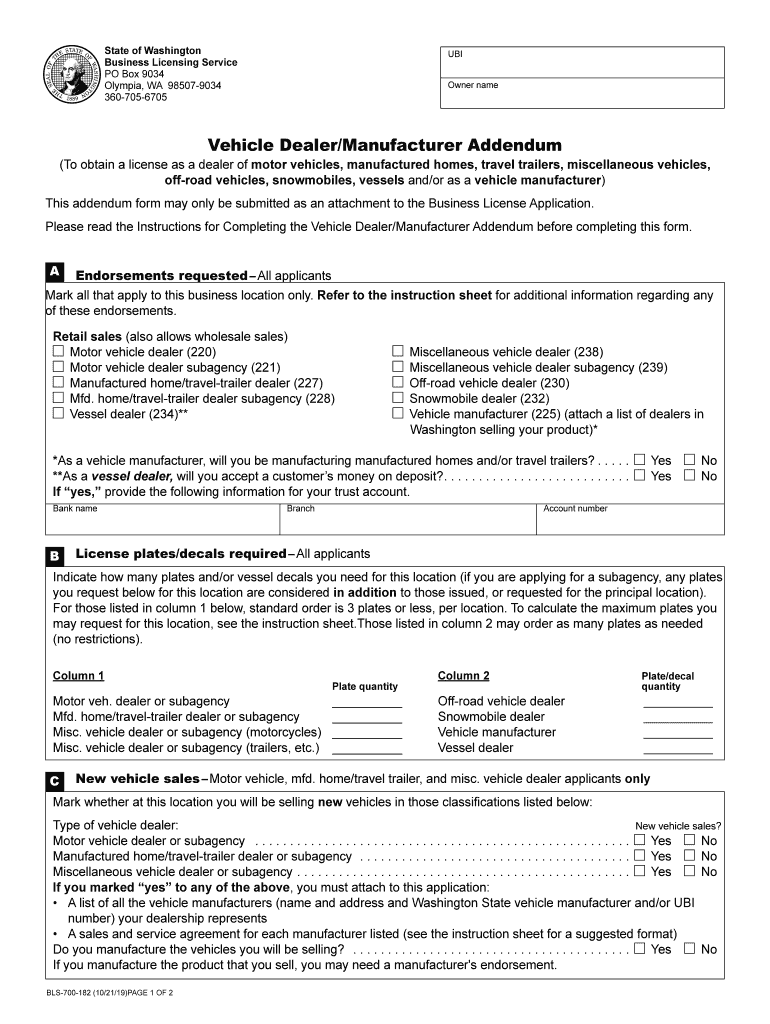

WA BLS-700-182 2019 free printable template

Show details

Click here to START or CLEAR, then hit the TAB buttonState of Washington

Business Licensing Service

PO Box 9034

Olympia, WA 985079034

3607056705UBI

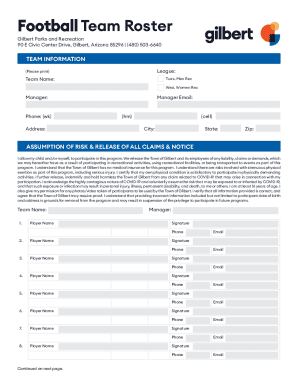

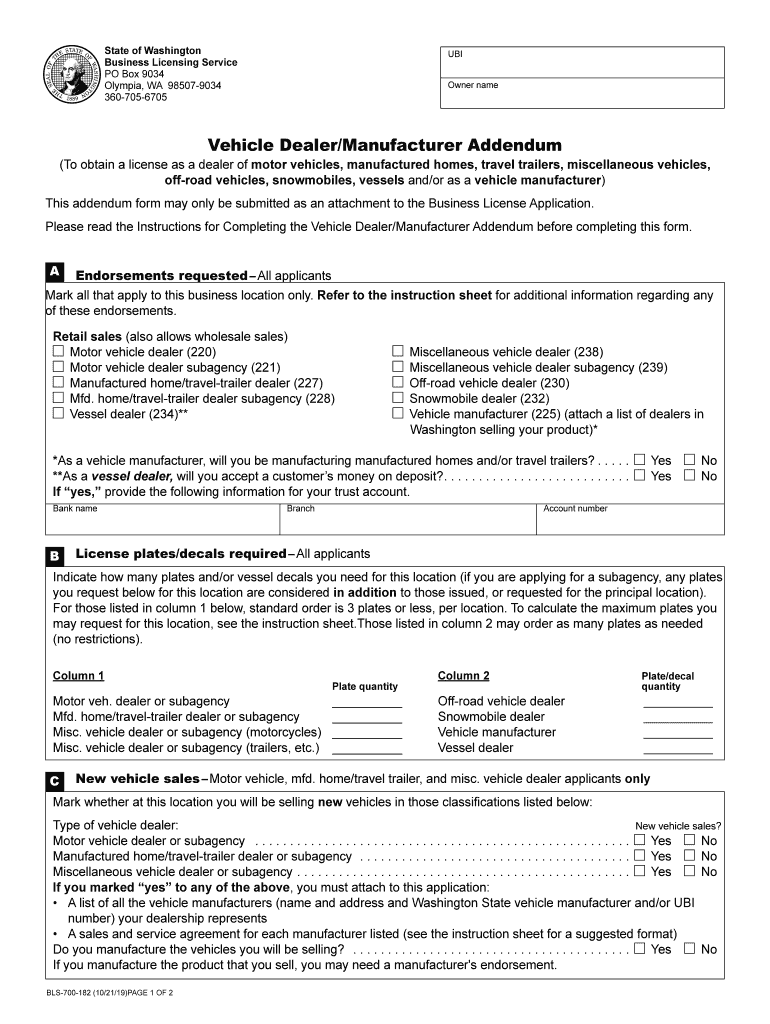

Owner nameVehicle Dealer/Manufacturer Addendum(To

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WA BLS-700-182

Edit your WA BLS-700-182 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WA BLS-700-182 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WA BLS-700-182 online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WA BLS-700-182. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WA BLS-700-182 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WA BLS-700-182

How to fill out WA BLS-700-182

01

Gather all necessary personal information, including your name, address, and contact details.

02

Complete the required section regarding your employment or educational background.

03

If applicable, provide details about any previous actions or requests related to this form.

04

Review the instructions that accompany the form to ensure that all sections are filled out correctly.

05

Sign and date the form where required.

06

Submit the completed form according to the submission guidelines provided.

Who needs WA BLS-700-182?

01

Individuals applying for a specific program or service that requires the WA BLS-700-182 form.

02

Employees or job applicants needing to provide official documentation for their employment verification.

03

Students needing to submit proof of enrollment or other related documentation.

Fill

form

: Try Risk Free

People Also Ask about

Is Washington a good state for taxes?

Washington has a 6.50 percent state sales rate, a max local sales tax rate of 4.00 percent, and an average combined state and local sales tax rate of 9.29 percent. Washington's tax system ranks 15th overall on our 2022 State Business Tax Climate Index.

What is the main products of Washington?

Washington agriculture The Top 10 agricultural commodities are apples, milk, potatoes, wheat, cattle, hops, hay, cherries, grapes, and onions.

Is Washington or Oregon better for taxes?

If you move to the border of the states of Oregon and Washington you can save all sorts of money on taxes—because Washington has no income and lower home prices. Though Oregon has one of the highest income tax rates in the country, the state currently has no sales tax.

When did Washington eliminate income tax?

Washington has evolved from a primarily property-tax state to an excise-tax state and is one of only four states with no form of income tax. Voters overwhelmingly approved an income tax in 1932, but the courts declared it unconstitutional, and several attempts since to pass an income tax have failed.

Is Washington a tax-friendly state?

The Evergreen State is one of nine states with no personal income tax. However, sales taxes in Washington are extremely high. At 9.29%, the state's combined state and local sales tax rate is the 4th-highest in the nation.

What does Washington Department of Revenue do?

Revenue administers about 60 categories of taxes that help fund education, social services, health care, corrections, public safety, natural resource conservation, and other important services counted on by Washington residents. Find out more about what we do.

How do states with no income tax make money?

States without an income tax often make up for the lack of these revenues by raising various other taxes, including property taxes, sales taxes, and fuel taxes. These can add up so that you're paying more in overall taxation than you might have in a state that does tax your income at a reasonable rate.

What is Washington main source of income?

Washington depends more heavily on excise taxes, including the general sales & use tax, selective sales taxes, and the gross receipts tax (business & occupation tax) than most any other state.

What are the tax advantages of living in Washington state?

Washington has no state income tax, which allows residents to get more and save more from each paycheck. This is also one of the few states in the United States that does not have a personal or corporate income tax. Learn more about relocating to a tax-friendly state here.

Is it better to live in a state with no income tax?

As a general rule, states with no income tax have much higher property and sales taxes. So if you move to a state with no income tax but don't make much money, then the money you do make might not go as far. Due to the higher sales taxes, you'll be paying more for goods and services in the state.

Who has to file a Washington state tax return?

Since Washington does not collect an income tax on individuals, you are not required to file a WA State Income Tax Return. However, you may need to prepare and e-file a Federal Income Tax Return.

What is the best state to live in to avoid taxes?

Eight states have no personal income tax, including Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming.Residents of these states pay the least in sales taxes overall: Alaska 1.76% Oregon 0% Delaware 0% Montana 0% New Hampshire 0%

What are the 3 major industries of Washington?

Businesses in Washington employed a total of 3,646,555 people in 2022, with average annual employment growth over the past five years of 1.0%. The top three sectors by total employment are Information, Real Estate and Rental and Leasing, Retail Trade, while the unemployment rate across the state in 2022 was 4.9%.

How does Washington make up for no income tax?

Washington state does not have a personal or corporate income tax. However, people or businesses that engage in business in Washington are subject to business and occupation (B&O) and/or public utility tax. The business's gross receipts determine the amount of tax they are required to pay.

What tax system does the Washington State have?

Washington state does not have a personal or corporate income tax. However, people or businesses that engage in business in Washington are subject to business and occupation (B&O) and/or public utility tax. The business's gross receipts determine the amount of tax they are required to pay.

How does Washington have no income tax?

How Companies Pay. Like residents, Washington businesses get to skip a state income tax. Instead, Washington imposes a “business and occupation” tax based on corporations' sales or products' value. Rates vary by industry, with radioactive waste disposal taxed the highest, at 3.3 percent.

What is Washington's main source of revenue?

Washington depends more heavily on excise taxes, including the general sales & use tax, selective sales taxes, and the gross receipts tax (business & occupation tax) than most any other state.

Why does Washington have low taxes?

Due to the inadequacy of its sales-based tax system, Washington is a low-tax state. Enacted in 1993, Initiative 601 required a two-thirds vote of the Legislature to raise taxes. For 20 years, the supermajority rule thwarted tax increases that could have counteracted the inadequacy of the Washington tax system.

Is Washington rich or poor?

Washington is not a poor state. Its 2019 median household income of $78,700 was significantly higher than the $65,700 of the U.S. as a whole, and placed it seventh among the 50 states. [41] In 2019, only New York, Massachusetts, and the District of Columbia had greater GDP per capita.

How does Washington compensate for no income tax?

Washington relies on the sales tax, the business and occupation (B&O) tax, and property tax. Unlike most states, Washington does not have either a personal or corporate net income tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my WA BLS-700-182 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your WA BLS-700-182 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in WA BLS-700-182?

The editing procedure is simple with pdfFiller. Open your WA BLS-700-182 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out the WA BLS-700-182 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign WA BLS-700-182. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is WA BLS-700-182?

WA BLS-700-182 is a form used in Washington State for business licensing purposes.

Who is required to file WA BLS-700-182?

Businesses operating in Washington State that require a state business license must file WA BLS-700-182.

How to fill out WA BLS-700-182?

To fill out WA BLS-700-182, provide the required business information, including business name, address, and type of business activity, and follow the instructions provided on the form.

What is the purpose of WA BLS-700-182?

The purpose of WA BLS-700-182 is to collect information necessary for issuing a state business license and to ensure compliance with state regulations.

What information must be reported on WA BLS-700-182?

Information that must be reported on WA BLS-700-182 includes the business name, address, owner information, and details about the business operations.

Fill out your WA BLS-700-182 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WA BLS-700-182 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.