WA BLS-700-182 2021-2025 free printable template

Show details

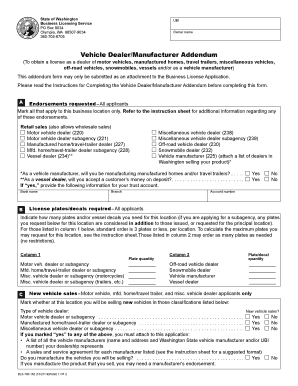

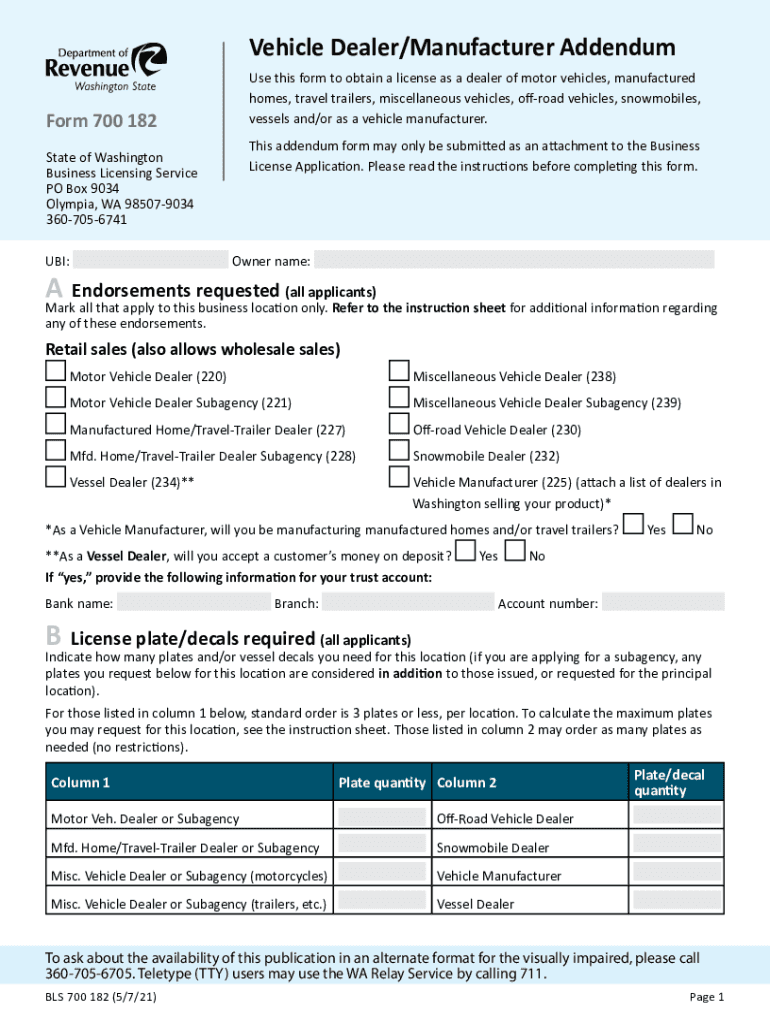

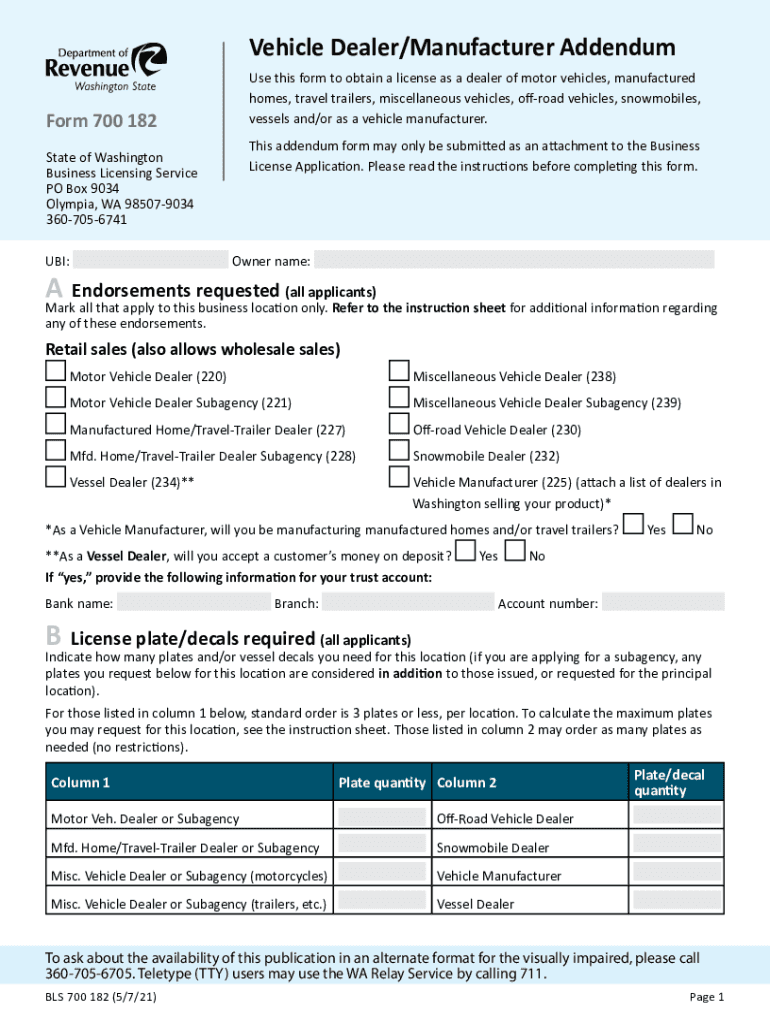

Vehicle Dealer/Manufacturer AddendumVehicle Dealer/Manufacturer Addendum

Use this form to obtain a license as a dealer of motor vehicles, manufactured

homes, travel trailers, miscellaneous vehicles,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign wa revenue form

Edit your wa dor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your washington dor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vehicle dealer online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wa manufacturer form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WA BLS-700-182 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out vehicle wa form

How to fill out WA BLS-700-182

01

Obtain a copy of the WA BLS-700-182 form from the Washington State Department of Health website.

02

Start by filling out the applicant's details in the designated sections, including name, address, and contact information.

03

Provide the required personal identification information, such as date of birth and social security number.

04

Fill out the section related to the purpose of the request, including specifics about the information needed.

05

Review and complete any additional sections as required, such as verifying your identity or providing supporting documentation.

06

Sign and date the form where indicated to certify the information you have provided is accurate.

07

Submit the completed form through the provided submission method (online, mail, or fax) as outlined by the instructions.

Who needs WA BLS-700-182?

01

Individuals seeking to obtain their background check or personal health record.

02

Employers or organizations requiring background information for potential employees.

03

Health care providers who need to verify records for licensing or credentialing purposes.

04

Anyone involved in a legal process who needs to gather specific information related to health or background checks.

Fill

dealer wa

: Try Risk Free

People Also Ask about

Is Washington a good state for taxes?

Washington has a 6.50 percent state sales rate, a max local sales tax rate of 4.00 percent, and an average combined state and local sales tax rate of 9.29 percent. Washington's tax system ranks 15th overall on our 2022 State Business Tax Climate Index.

What is the main products of Washington?

Washington agriculture The Top 10 agricultural commodities are apples, milk, potatoes, wheat, cattle, hops, hay, cherries, grapes, and onions.

Is Washington or Oregon better for taxes?

If you move to the border of the states of Oregon and Washington you can save all sorts of money on taxes—because Washington has no income and lower home prices. Though Oregon has one of the highest income tax rates in the country, the state currently has no sales tax.

When did Washington eliminate income tax?

Washington has evolved from a primarily property-tax state to an excise-tax state and is one of only four states with no form of income tax. Voters overwhelmingly approved an income tax in 1932, but the courts declared it unconstitutional, and several attempts since to pass an income tax have failed.

Is Washington a tax-friendly state?

The Evergreen State is one of nine states with no personal income tax. However, sales taxes in Washington are extremely high. At 9.29%, the state's combined state and local sales tax rate is the 4th-highest in the nation.

What does Washington Department of Revenue do?

Revenue administers about 60 categories of taxes that help fund education, social services, health care, corrections, public safety, natural resource conservation, and other important services counted on by Washington residents. Find out more about what we do.

How do states with no income tax make money?

States without an income tax often make up for the lack of these revenues by raising various other taxes, including property taxes, sales taxes, and fuel taxes. These can add up so that you're paying more in overall taxation than you might have in a state that does tax your income at a reasonable rate.

What is Washington main source of income?

Washington depends more heavily on excise taxes, including the general sales & use tax, selective sales taxes, and the gross receipts tax (business & occupation tax) than most any other state.

What are the tax advantages of living in Washington state?

Washington has no state income tax, which allows residents to get more and save more from each paycheck. This is also one of the few states in the United States that does not have a personal or corporate income tax. Learn more about relocating to a tax-friendly state here.

Is it better to live in a state with no income tax?

As a general rule, states with no income tax have much higher property and sales taxes. So if you move to a state with no income tax but don't make much money, then the money you do make might not go as far. Due to the higher sales taxes, you'll be paying more for goods and services in the state.

Who has to file a Washington state tax return?

Since Washington does not collect an income tax on individuals, you are not required to file a WA State Income Tax Return. However, you may need to prepare and e-file a Federal Income Tax Return.

What is the best state to live in to avoid taxes?

Eight states have no personal income tax, including Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming.Residents of these states pay the least in sales taxes overall: Alaska 1.76% Oregon 0% Delaware 0% Montana 0% New Hampshire 0%

What are the 3 major industries of Washington?

Businesses in Washington employed a total of 3,646,555 people in 2022, with average annual employment growth over the past five years of 1.0%. The top three sectors by total employment are Information, Real Estate and Rental and Leasing, Retail Trade, while the unemployment rate across the state in 2022 was 4.9%.

How does Washington make up for no income tax?

Washington state does not have a personal or corporate income tax. However, people or businesses that engage in business in Washington are subject to business and occupation (B&O) and/or public utility tax. The business's gross receipts determine the amount of tax they are required to pay.

What tax system does the Washington State have?

Washington state does not have a personal or corporate income tax. However, people or businesses that engage in business in Washington are subject to business and occupation (B&O) and/or public utility tax. The business's gross receipts determine the amount of tax they are required to pay.

How does Washington have no income tax?

How Companies Pay. Like residents, Washington businesses get to skip a state income tax. Instead, Washington imposes a “business and occupation” tax based on corporations' sales or products' value. Rates vary by industry, with radioactive waste disposal taxed the highest, at 3.3 percent.

What is Washington's main source of revenue?

Washington depends more heavily on excise taxes, including the general sales & use tax, selective sales taxes, and the gross receipts tax (business & occupation tax) than most any other state.

Why does Washington have low taxes?

Due to the inadequacy of its sales-based tax system, Washington is a low-tax state. Enacted in 1993, Initiative 601 required a two-thirds vote of the Legislature to raise taxes. For 20 years, the supermajority rule thwarted tax increases that could have counteracted the inadequacy of the Washington tax system.

Is Washington rich or poor?

Washington is not a poor state. Its 2019 median household income of $78,700 was significantly higher than the $65,700 of the U.S. as a whole, and placed it seventh among the 50 states. [41] In 2019, only New York, Massachusetts, and the District of Columbia had greater GDP per capita.

How does Washington compensate for no income tax?

Washington relies on the sales tax, the business and occupation (B&O) tax, and property tax. Unlike most states, Washington does not have either a personal or corporate net income tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute WA BLS-700-182 online?

pdfFiller makes it easy to finish and sign WA BLS-700-182 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I sign the WA BLS-700-182 electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your WA BLS-700-182 in minutes.

How do I complete WA BLS-700-182 on an Android device?

Use the pdfFiller app for Android to finish your WA BLS-700-182. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is WA BLS-700-182?

WA BLS-700-182 is a form used in Washington State for reporting business ownership information to the Washington State Department of Revenue.

Who is required to file WA BLS-700-182?

Any business operating in Washington State that needs to report its ownership structure is required to file WA BLS-700-182.

How to fill out WA BLS-700-182?

To fill out WA BLS-700-182, enter the business details including the name, address, and ownership information as required. Ensure all information is accurate and complete before submitting.

What is the purpose of WA BLS-700-182?

The purpose of WA BLS-700-182 is to collect accurate ownership information to maintain state business registries and ensure compliance with state laws.

What information must be reported on WA BLS-700-182?

The information that must be reported on WA BLS-700-182 includes the business name, address, owner's names, ownership percentages, and any applicable identification numbers.

Fill out your WA BLS-700-182 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WA BLS-700-182 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.