UT TC-891 2012 free printable template

Show details

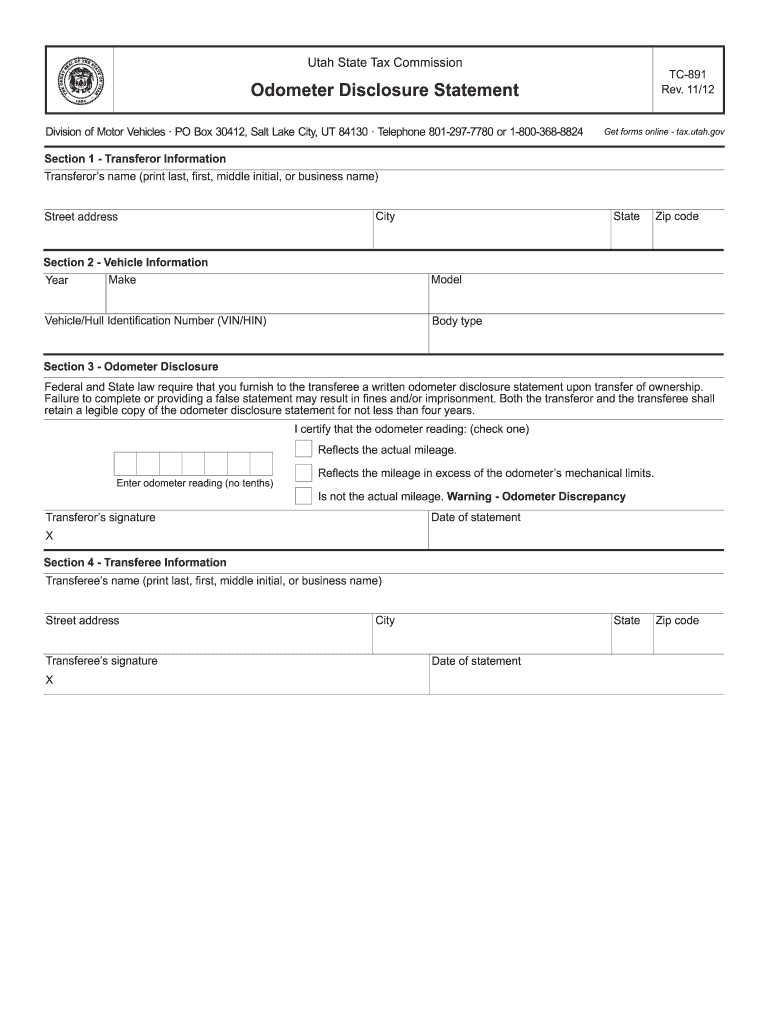

Clear form Utah State Tax Commission TC891 Rev. 11/12Odometer Disclosure Statement Division of Motor Vehicles PO Box 30412, Salt Lake City, UT 84130 Telephone 8012977780 or 18003688824Get forms online

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-891

Edit your UT TC-891 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-891 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UT TC-891 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UT TC-891. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-891 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-891

How to fill out UT TC-891

01

Gather all necessary information and documents required for filling out UT TC-891.

02

Begin by entering your personal information, including name, address, and contact details in the designated fields.

03

Fill in the date of the transaction related to UT TC-891.

04

Provide the details of the property involved in the transaction, including its description and location.

05

Include any applicable financial information, such as purchase price or assessed value.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submission.

Who needs UT TC-891?

01

Individuals or entities involved in property transactions in Utah.

02

Real estate agents and professionals managing property sales.

03

Tax professionals assisting clients with property tax-related matters.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from odometer reporting in Utah?

Odometer mileage disclosure statements do not need to be given for vehicles having a gross vehicle weight rating of 16,000 pounds or more, vehicles 20 years old or older, or vehicles sold directly by the manufacturer to any agency of the United States Government (UCA §41-1a-902).

Can you sell a car if the odometer doesn't work?

When you sell a car, the odometer must be accurate. Lower mileage increase the vehicle's value. So some car owners may be tempted to dial back the odometer before selling their car. It's actually quite illegal, ing to the Federal statute 49 U.S. Code § 32703.

Why does odometer say exempt?

When a car is sold in this scenario, the mileage is marked on the title as “exempt.” This is simply stating that the car has been around too long to reliably verify its mileage.

What is an odometer disclosure Colorado?

What is the odometer disclosure statement Colorado? COLORADO ODOMETER DISCLOSURE STATEMENT Federal law requires that you state the mileage upon transfer of ownership. Failure to complete or providing a false statement may result in fines and/or imprisonment.

What does exempt from odometer reporting mean on Carfax?

It means that it's exempt from federal odometer disclosure laws so no one has to legally guarantee them to be accurate due to the age and or class of vehicle, Over 10 years old is exempt.

Who is exempt from odometer reading USA?

Both of these practices are illegal under federal law. In fact, sellers are required to provide a written disclosure to the buyer if the mileage indicated on the odometer is incorrect. However, when the car in question is 10 years old or older, it is exempt from the written disclosure requirement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send UT TC-891 for eSignature?

Once your UT TC-891 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an electronic signature for the UT TC-891 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your UT TC-891 in minutes.

How do I edit UT TC-891 on an iOS device?

Create, modify, and share UT TC-891 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is UT TC-891?

UT TC-891 is a tax form used in the state of Utah for reporting certain tax information related to pass-through entities.

Who is required to file UT TC-891?

Pass-through entities such as partnerships and S corporations are required to file UT TC-891 if they have Utah-sourced income.

How to fill out UT TC-891?

To fill out UT TC-891, follow the instructions on the form, providing information about the entity, income, deductions, and the distribution of income to partners or shareholders.

What is the purpose of UT TC-891?

The purpose of UT TC-891 is to report the income, deductions, and other information necessary to determine the tax liability of partners or shareholders of pass-through entities in Utah.

What information must be reported on UT TC-891?

The information that must be reported on UT TC-891 includes entity details, income and deductions, and distributions to each partner or shareholder.

Fill out your UT TC-891 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-891 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.