AZ DOR 82162 2013 free printable template

Show details

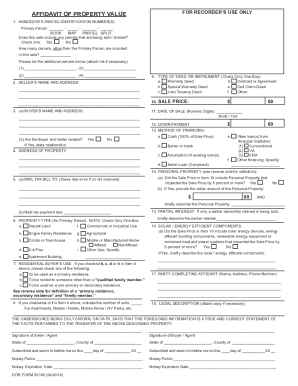

Pronuclear Former RECORDERS USE ONLYAFFIDAVIT OF PROPERTY VALUE 1. ASSESSORS PARCEL IDENTIFICATION NUMBER(S) Primary Parcel: BOOKMAPPARCELSPLIT Does this sale include any parcels that are being split

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ DOR 82162

Edit your AZ DOR 82162 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ DOR 82162 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AZ DOR 82162 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AZ DOR 82162. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ DOR 82162 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ DOR 82162

How to fill out AZ DOR 82162

01

Obtain the AZ DOR 82162 form from the Arizona Department of Revenue website or local office.

02

Fill in your name and contact information at the top of the form.

03

Indicate your reason for completing the form in the designated section.

04

Provide any relevant details required for your specific situation.

05

Review the information you've entered for accuracy.

06

Sign and date the form at the bottom.

Who needs AZ DOR 82162?

01

Individuals or businesses who need to dispute a tax determination or respond to a notice from the Arizona Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

Who determines the value of your property for the purposes of taxation in Arizona?

For additional information regarding the content herein, refer to Overview of the Arizona Property Tax System . The County Assessor is responsible for identifying, classifying, valuing, and assessing all property in the county in ance with state law.

How much are transfer taxes in AZ?

In most states, transfer taxes are typically the responsibility of the seller. Arizona, however, is one of the few states that does not have transfer taxes, which means there's no need to worry about planning for this additional expense.

What is an Affidavit of property value Arizona?

This form is used to record the selling price, date of sale and other required information about the sale of property.

Do I need Affidavit of property value in Arizona?

A.R.S. §§ 11-1133 and 11-1137(B) require all buyers and sellers of real property or their agents to complete and attest to this Affidavit. Failure to do so constitutes a class 2 misdemeanor and is punishable by law.

What is the Arizona Affidavit of Disclosure?

Arizona Affidavit of Disclosure Information. Before a transfer of real property is finalized, Arizona law requires the seller to disclose material facts about the relevant property to the buyer in a seller's disclosure report.

Is there a transfer tax on real property in Arizona?

In most states, transfer taxes are typically the responsibility of the seller. Arizona, however, is one of the few states that does not have transfer taxes, which means there's no need to worry about planning for this additional expense.

What is the difference between full cash value and limited property value in Arizona?

Full cash value shall be used as the basis for the purpose of assessing, fixing, determining and levying secondary property taxes. A.R.S. § 42-11001(5). Limited property value is a value calculated ing to a statutory formula, designed to reduce the effect of inflation on property taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AZ DOR 82162 to be eSigned by others?

When you're ready to share your AZ DOR 82162, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I edit AZ DOR 82162 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing AZ DOR 82162.

How can I fill out AZ DOR 82162 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your AZ DOR 82162. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is AZ DOR 82162?

AZ DOR 82162 is a form used by the Arizona Department of Revenue for the reporting of transaction privilege tax (TPT) exemptions.

Who is required to file AZ DOR 82162?

Businesses or individuals claiming a transaction privilege tax exemption in Arizona are required to file AZ DOR 82162.

How to fill out AZ DOR 82162?

To fill out AZ DOR 82162, provide detailed information regarding the exemption being claimed, including business information, exemption type, and applicable documentation.

What is the purpose of AZ DOR 82162?

The purpose of AZ DOR 82162 is to provide a standard form for taxpayers to claim exemptions from transaction privilege tax under Arizona law.

What information must be reported on AZ DOR 82162?

The information that must be reported on AZ DOR 82162 includes taxpayer identification, the type of exemption claimed, a description of the exempt transaction, and any supporting documentation.

Fill out your AZ DOR 82162 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ DOR 82162 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.