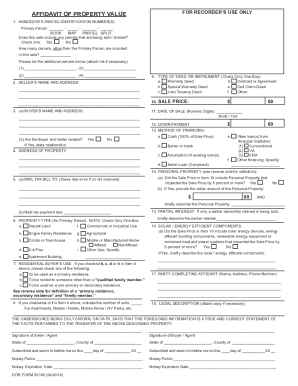

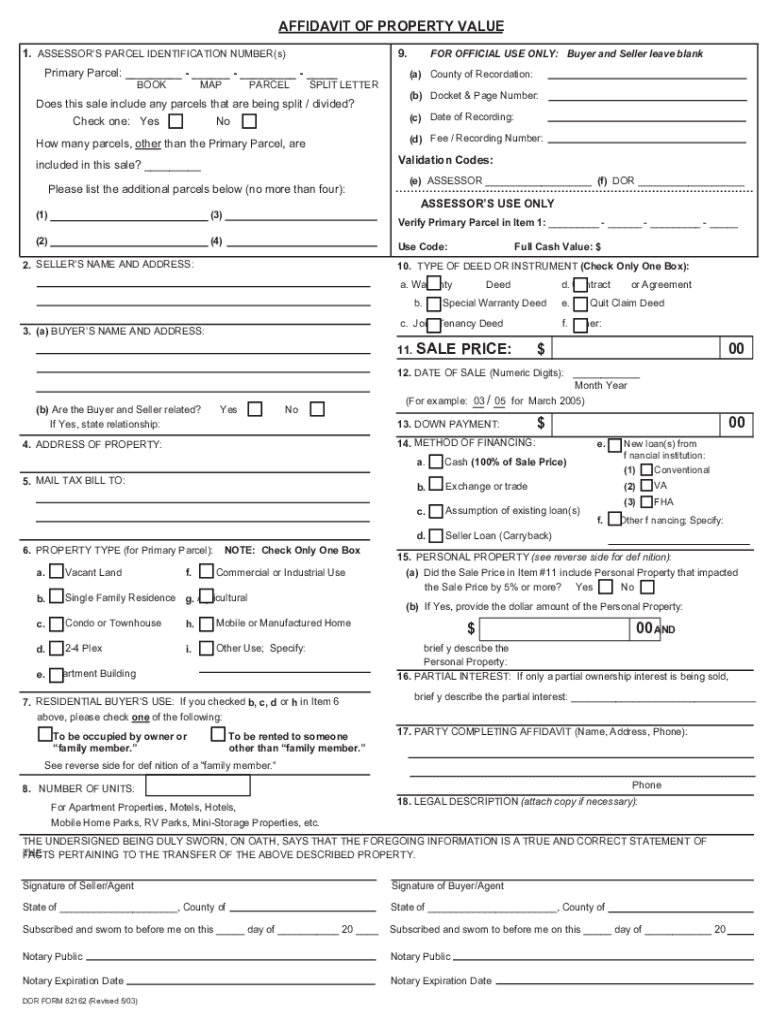

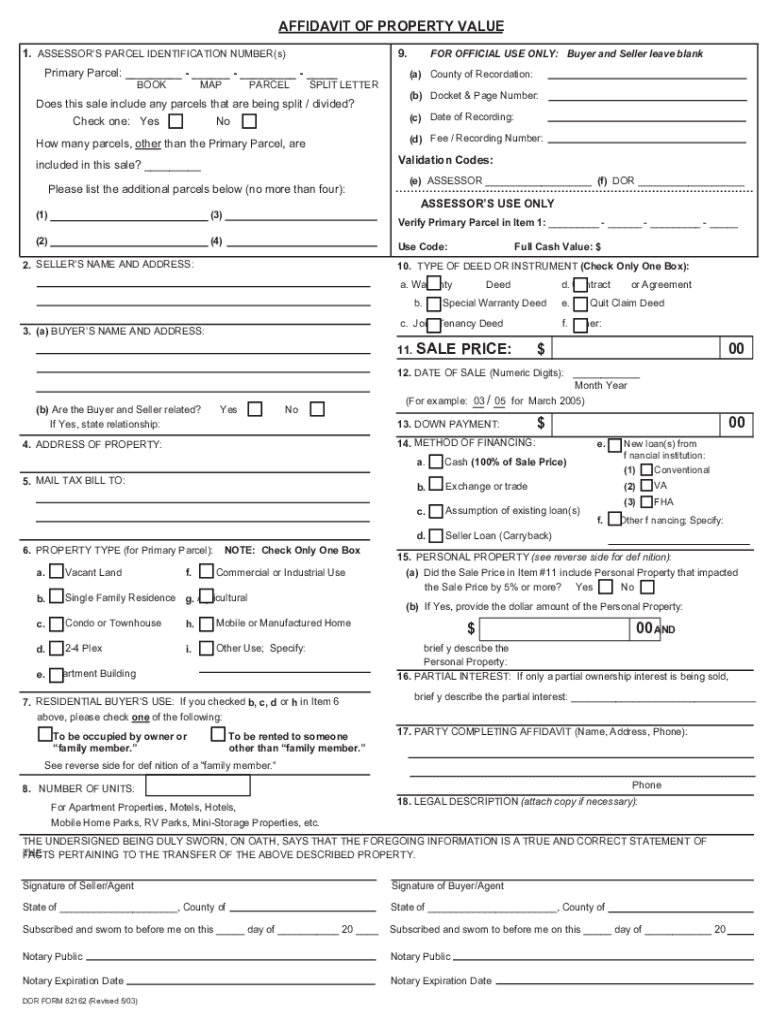

AZ DOR 82162 2003 free printable template

Show details

Print Form INFORMATION FROM THE AZ PINAL COUNTY RECORDER S OFFICE How to Record a Deed and Sales Affidavit Information Blank deed forms are available at office stores and at various websites. A couple of hints regarding a deed that is important to remember. Ensure your names are listed accurately on the document the transferring names will need to be listed in the same manner as they were on the deed when the property was acquired* It is important to list the legal description accurately...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ DOR 82162

Edit your AZ DOR 82162 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ DOR 82162 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AZ DOR 82162 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AZ DOR 82162. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ DOR 82162 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ DOR 82162

How to fill out AZ DOR 82162

01

Obtain the AZ DOR form 82162 from the official Arizona Department of Revenue website or local office.

02

Fill out the top portion with your name, address, and other identifying information.

03

Indicate the type of tax year being reported.

04

Provide details regarding the transactions or activities related to the tax liability being reported.

05

Include any supporting documents as required.

06

Review the form to ensure all information is accurate and complete.

07

Sign and date the form.

08

Submit the form via mail or online, as directed by the instructions.

Who needs AZ DOR 82162?

01

Individuals or businesses that have engaged in transactions that are subject to Arizona tax laws.

02

Taxpayers seeking refunds or wishing to report a tax obligation related to income, sales, or transactions.

03

Anyone required by the Arizona Department of Revenue to provide additional information regarding their tax liability.

Fill

form

: Try Risk Free

People Also Ask about

Who signs Affidavit of value in Arizona?

§§ 11-1133 and 11-1137(B) require all buyers and sellers of real property or their agents to complete and attest to this Affidavit. Failure to do so constitutes a class 2 misdemeanor and is punishable by law.

What is a it 2663 form?

must use Form IT-2663, Nonresident Real Property Estimated. Income Tax Payment Form, to compute the gain (or loss) and. pay the full amount of estimated tax due, if applicable. Use 2023. Form IT‑2663 for sales or transfers of real property that occur after December 31, 2022, but before January 1, 2024.

What is an Affidavit in Arizona?

A written statement of fact, signed and sworn to in front of a notary or a person who has the right to administer an oath .

How do I transfer ownership of a property in NY?

The most common way to transfer land ownership, especially residential property, is with a warranty deed. Warranty deeds not only make it possible for a property owner to transfer ownership to the buyer. But this type of deed also explicitly promises that the title is good and clear of all liens or other issues.

How do I avoid transfer tax in NY?

How To Avoid Paying NYC Transfer Tax? The only way to avoid paying NYC transfer tax is by selling your property through a 1031 exchange. A 1031 exchange allows investors to defer capital gains taxes on investment properties by reinvesting the proceeds from the sale into another qualifying property.

What is an affidavit of value in Arizona?

This form is used to record the selling price, date of sale and other required information about the sale of property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get AZ DOR 82162?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the AZ DOR 82162 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit AZ DOR 82162 online?

With pdfFiller, it's easy to make changes. Open your AZ DOR 82162 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit AZ DOR 82162 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing AZ DOR 82162, you need to install and log in to the app.

What is AZ DOR 82162?

AZ DOR 82162 is a tax form used by individuals and businesses in Arizona to report the sale or transfer of a vehicle.

Who is required to file AZ DOR 82162?

Individuals or businesses that sell or transfer ownership of a vehicle in Arizona are required to file AZ DOR 82162.

How to fill out AZ DOR 82162?

To fill out AZ DOR 82162, provide accurate details about the vehicle, parties involved in the transaction, and relevant dates. Ensure all required fields are completed and sign the document.

What is the purpose of AZ DOR 82162?

The purpose of AZ DOR 82162 is to document the transfer of a vehicle's ownership and ensure proper recording for tax and registration purposes.

What information must be reported on AZ DOR 82162?

AZ DOR 82162 requires reporting information such as the vehicle identification number (VIN), vehicle description, names and addresses of the buyer and seller, sale date, and sale price.

Fill out your AZ DOR 82162 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ DOR 82162 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.