What is Schedule B (form 1040)?

Schedule B for form 1040 or 1040A is called “Interest and Ordinary Dividends.” It serves as an attachment to the tax return report. Taxpayers should fill out the form if they have earned taxable interest or ordinary dividends (exceeding $1,500) that should be added to their total taxable income. The Schedule B form lists all types of interests and dividends received.

Who should file IRS form 1040 Schedule B 2019?

Taxpayers who receive more than $1,500 in taxable interest or ordinary dividends (or both) during the year should file this form.

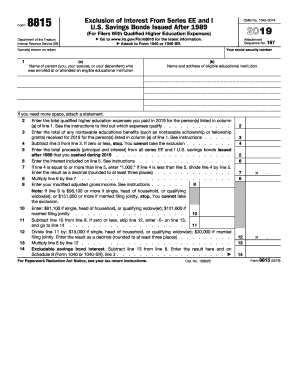

What information do you need when you file Schedule B (form 1040)?

Complete the IRS form in the following manner:

- Indicate the taxpayer and their SSN

- Enumerate financial interests and their amount in Part 1

- List the ordinary dividends and their amount in Part 2

- Report foreign accounts and trusts in Part 3, if applicable.

How do I fill out Schedule B (form 1040) in 2020?

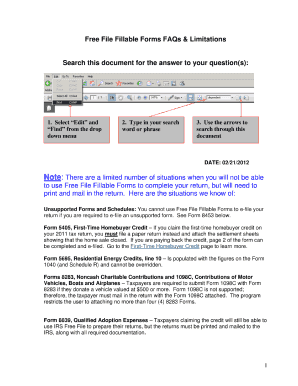

You can save time filing the 1040 Schedule B by completing the form online and submitting it with pdfFiller’s Send via USPS feature. Here is a quick way to do it:

- Click Get Form to view a Schedule B (form 1040) template.

- Complete and sign the form.

- Click Done.

- Click Send via USPS in the right side menu.

- Fill in mailing information.

- Select the terms of delivery.

- Click Send.

pdfFiller will promptly deliver a high-resolution printed copy of the form to the post office.

Is form 1040 Schedule B accompanied by other forms?

Schedule B form is used as a supporting statement to the IRS 1040 or 1040A form. You must file it with the annual tax return.

When is Schedule B (form 1040) due?

Submit the IRS 1040 Schedule B by April 15. However, this year it is April 18, due to a state holiday that falls on April 15.

Where do I send Schedule B form 1040?

Deliver the completed tax return and Schedule B to the local IRS office. Please check the address for your state here.