CT PC-901CI 2019-2025 free printable template

Show details

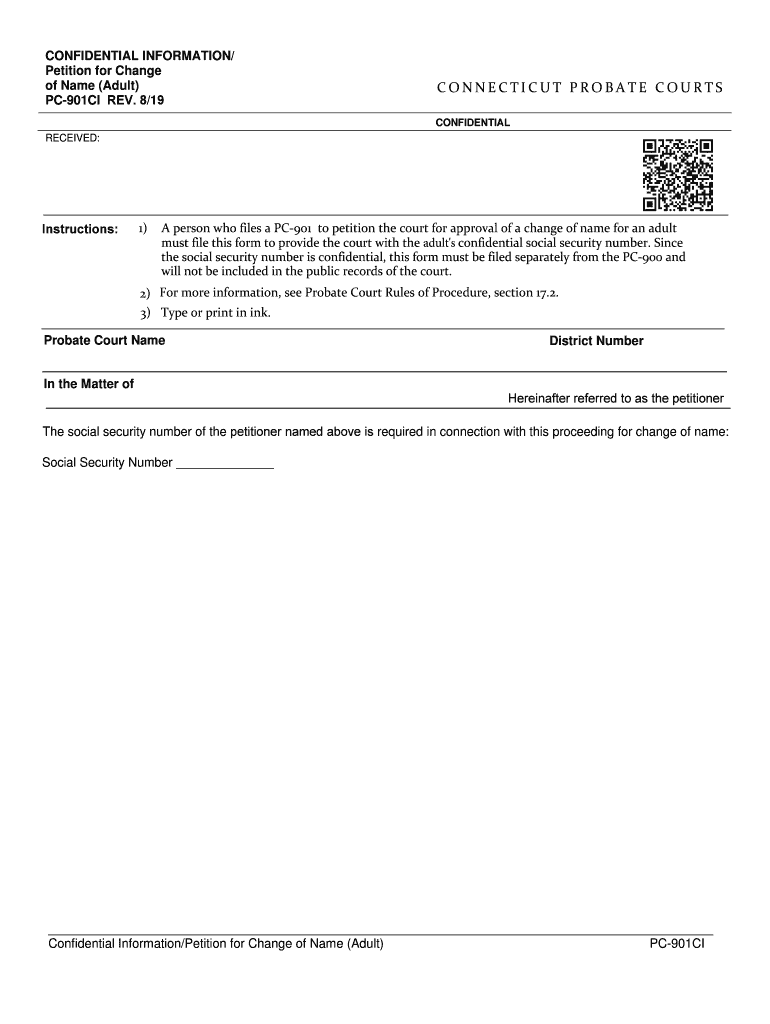

CONFIDENTIAL INFORMATION/

Petition for Change

of Name (Adult)

PC901CI REV. 8/19RESETCONNECTICUT PROBATE COURTS

CONFIDENTIALRECEIVED:Instructions:1)A person who files a PC901 to petition the court

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pc 901ci form connecticut

Edit your probate certificates connecticut form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form order form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing judiciary connecticut online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit probate involving connecticut form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out judicial connecticut administration form

How to fill out CT PC-901CI

01

Obtain the CT PC-901CI form from the official Connecticut government website or your local tax office.

02

Fill in your personal identification information, including your name, address, and Social Security number.

03

Specify the type of income you are reporting and the corresponding amounts.

04

Complete the sections regarding deductions, credits, and any adjustments.

05

Review the form for accuracy and completeness.

06

Sign and date the form at the designated section.

07

Submit the completed form to the appropriate state tax authority by the deadline.

Who needs CT PC-901CI?

01

Individuals who have earned income and are required to report it for state tax purposes in Connecticut.

02

Taxpayers seeking to claim deductions or credits related to their income.

03

Anyone who has received certain types of income that necessitate the filing of CT PC-901CI.

Fill

pc 901

: Try Risk Free

People Also Ask about

Can you look up restraining orders in CT?

Who has access to it? The Connecticut automated registry of protective orders contains all restraining orders that have been issued by the Connecticut courts, and all foreign orders of protection that have been registered with the Superior Court.

What is CT court?

Connecticut courts are courts of general jurisdiction, meaning that they handle most criminal matters and a variety of civil matters, including contracts, personal injury cases, divorce (called “dissolution of marriage”) and other legal disputes.

What is a caseflow request in CT?

Caseflow Management is a system by which the Court intervenes in proceedings which are progressing slowly to help parties bring them to a timely resolution.

What are the four types of state courts in CT?

The Superior Court has four principal trial divisions: civil, criminal, family and housing.

What is the dress code for Connecticut court?

Business casual attire is acceptable, clothing such as tank or halter tops, shorts, t-shirts, blue jeans or sweat pants is not appropriate to wear while you are sitting as a juror. You may wish to bring a sweater or jacket as temperatures can vary in the courtrooms.

Are court records public in Connecticut?

Court records in Connecticut are public records and are available to anyone.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CT PC-901CI on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing CT PC-901CI.

How do I edit CT PC-901CI on an iOS device?

Use the pdfFiller mobile app to create, edit, and share CT PC-901CI from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How can I fill out CT PC-901CI on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your CT PC-901CI. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is CT PC-901CI?

CT PC-901CI is a form used in Connecticut for reporting the Partnership or Limited Liability Company (LLC) income for tax purposes.

Who is required to file CT PC-901CI?

Partnerships and Limited Liability Companies in Connecticut that have income, deductions, or credits must file CT PC-901CI.

How to fill out CT PC-901CI?

To fill out CT PC-901CI, begin by providing the entity's identification information, then input income, deductions, and credits as required on the form, ensuring all figures are accurate and comply with state tax regulations.

What is the purpose of CT PC-901CI?

The purpose of CT PC-901CI is to report the income, deductions, and credits of partnerships and LLCs, allowing the state to assess tax liability accurately.

What information must be reported on CT PC-901CI?

Information that must be reported on CT PC-901CI includes the partnership or LLC's name, address, federal identification number, total income, total deductions, and any tax credits claimed.

Fill out your CT PC-901CI online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT PC-901ci is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.