CA CDTFA-146-RES (Formerly BOE-146-RES) 2019 free printable template

Show details

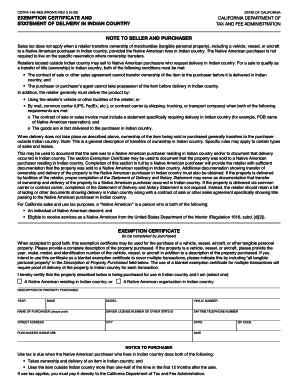

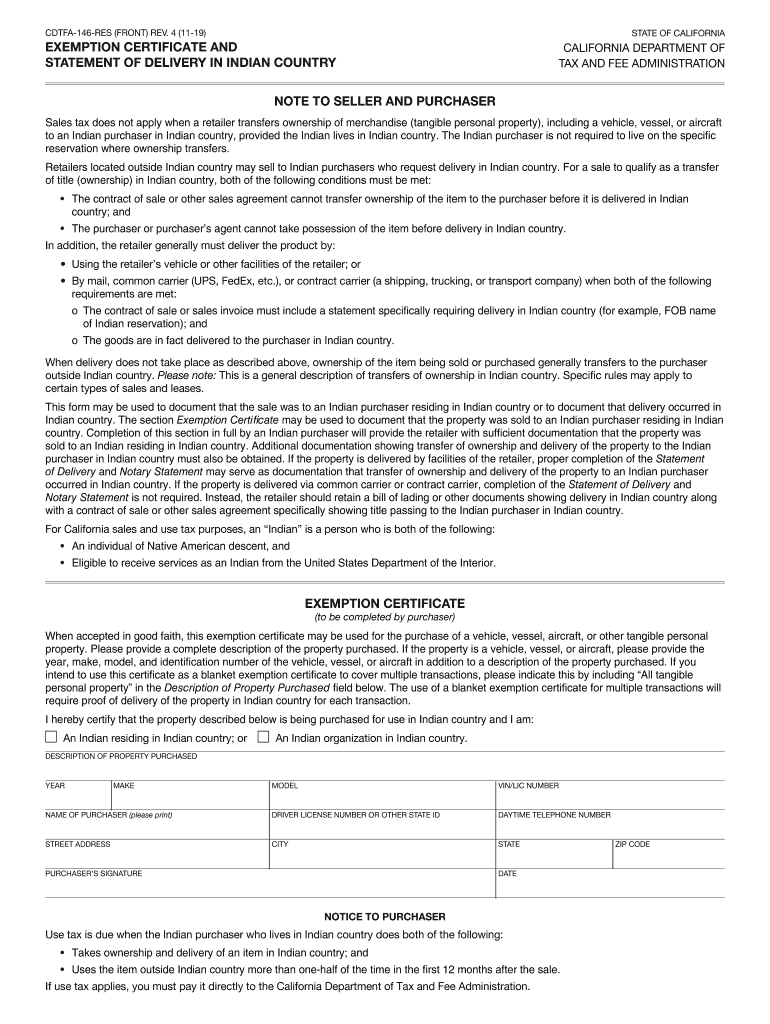

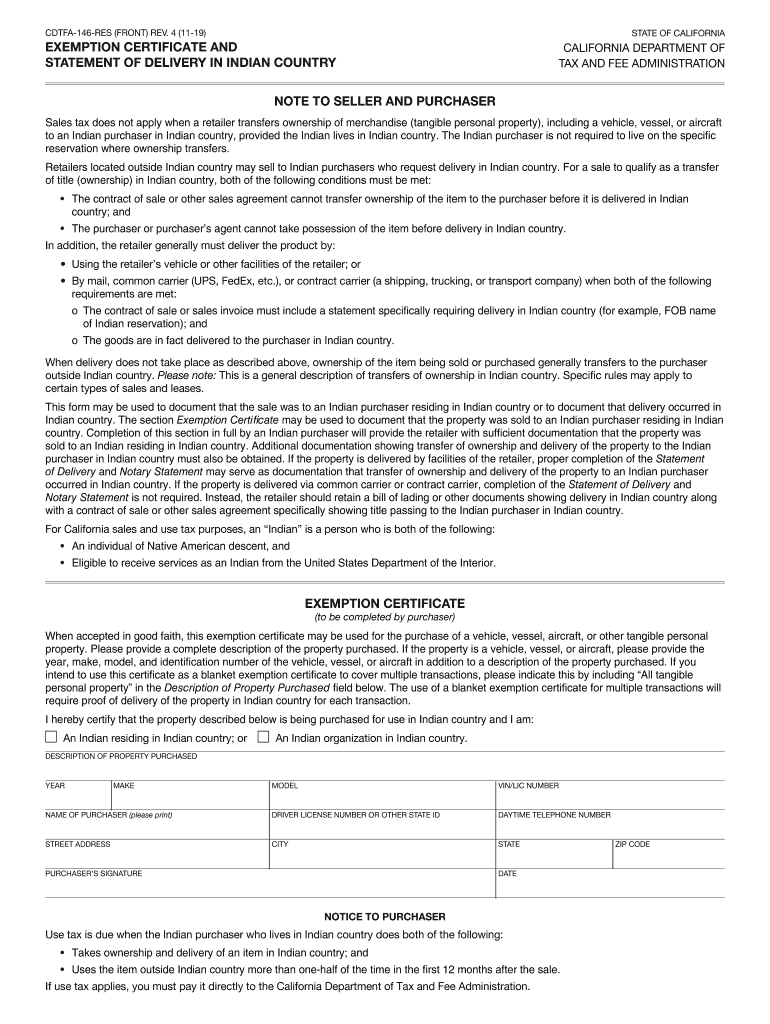

CDTFA146RES (FRONT) REV. 4 (1119)STATE OF CALIFORNIAEXEMPTION CERTIFICATE AND

STATEMENT OF DELIVERY IN INDIAN COUNTRYCALIFORNIA DEPARTMENT OF

TAX AND FEE ADMINISTRATIONNOTE TO SELLER AND PURCHASER

Sales

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-146-RES Formerly BOE-146-RES

Edit your CA CDTFA-146-RES Formerly BOE-146-RES form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-146-RES Formerly BOE-146-RES form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA CDTFA-146-RES Formerly BOE-146-RES online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA CDTFA-146-RES Formerly BOE-146-RES. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-146-RES (Formerly BOE-146-RES) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CDTFA-146-RES Formerly BOE-146-RES

How to fill out CA CDTFA-146-RES (Formerly BOE-146-RES)

01

Obtain the CA CDTFA-146-RES form from the California Department of Tax and Fee Administration (CDTFA) website or local office.

02

Fill in the taxpayer information, including name, address, and contact details.

03

Enter the type of tax or fee related to the refund request in the designated section.

04

Provide a detailed explanation of the reason for the refund request, including transaction dates and amounts.

05

Attach any supporting documentation, such as receipts or invoices, that substantiate the refund request.

06

Sign and date the form to certify that the information provided is accurate to the best of your knowledge.

07

Submit the completed form along with any attachments to the CDTFA via mail or online submission if available.

Who needs CA CDTFA-146-RES (Formerly BOE-146-RES)?

01

Any individual or business entity that seeks a refund of sales and use taxes previously paid to the California Department of Tax and Fee Administration.

02

Taxpayers who have been overcharged on sales transactions subject to sales tax.

03

Entities that have erroneously paid taxes or have returned merchandise after tax was collected.

04

Those who want to claim a refund for taxes paid on exempt purchases.

Fill

form

: Try Risk Free

People Also Ask about

Is it better to claim 1 or 0 on your taxes?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What is an exemption document?

An exemption or resale certificate is a form or document issued by a business to ensure sales tax is not applied to their invoice when they intend to resell their purchase. Sales tax is not used on these purchases because the applicable sales tax will be used on the final sale of the exchanged tangible property.

How many exemptions should I claim?

If you are single and have one job, or married and filing jointly then claiming one allowance makes the most sense. An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately.

How many exemptions should I claim Virginia?

Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption.

What is the tax exemption form for NY?

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

What is the Virginia sales tax exemption?

Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. A common exemption is “purchase for resale,” where you buy something with the intent of selling it to someone else.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get CA CDTFA-146-RES Formerly BOE-146-RES?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the CA CDTFA-146-RES Formerly BOE-146-RES in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete CA CDTFA-146-RES Formerly BOE-146-RES online?

Filling out and eSigning CA CDTFA-146-RES Formerly BOE-146-RES is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit CA CDTFA-146-RES Formerly BOE-146-RES on an Android device?

You can make any changes to PDF files, such as CA CDTFA-146-RES Formerly BOE-146-RES, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is CA CDTFA-146-RES (Formerly BOE-146-RES)?

CA CDTFA-146-RES is a form issued by the California Department of Tax and Fee Administration that is used to report and pay use tax on purchases made for which sales tax was not paid.

Who is required to file CA CDTFA-146-RES (Formerly BOE-146-RES)?

Individuals or businesses that make taxable purchases not subject to sales tax must file CA CDTFA-146-RES. This includes those buying items for use in California without paying sales tax at the time of purchase.

How to fill out CA CDTFA-146-RES (Formerly BOE-146-RES)?

To fill out CA CDTFA-146-RES, you must provide your personal or business information, details of the purchases made, the amount of use tax owed, and sign the form. It is crucial to follow the instructions provided with the form to ensure accurate reporting.

What is the purpose of CA CDTFA-146-RES (Formerly BOE-146-RES)?

The purpose of CA CDTFA-146-RES is to assist taxpayers in reporting and remitting use tax owed on purchases made without paying sales tax. This helps ensure compliance with California tax laws.

What information must be reported on CA CDTFA-146-RES (Formerly BOE-146-RES)?

The information that must be reported on CA CDTFA-146-RES includes the purchaser's name and address, descriptions of the items purchased, dates of purchase, the purchase amounts, applicable use tax rate, and calculation of the total use tax owed.

Fill out your CA CDTFA-146-RES Formerly BOE-146-RES online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-146-RES Formerly BOE-146-RES is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.