VA DoT R-1 2019 free printable template

Show details

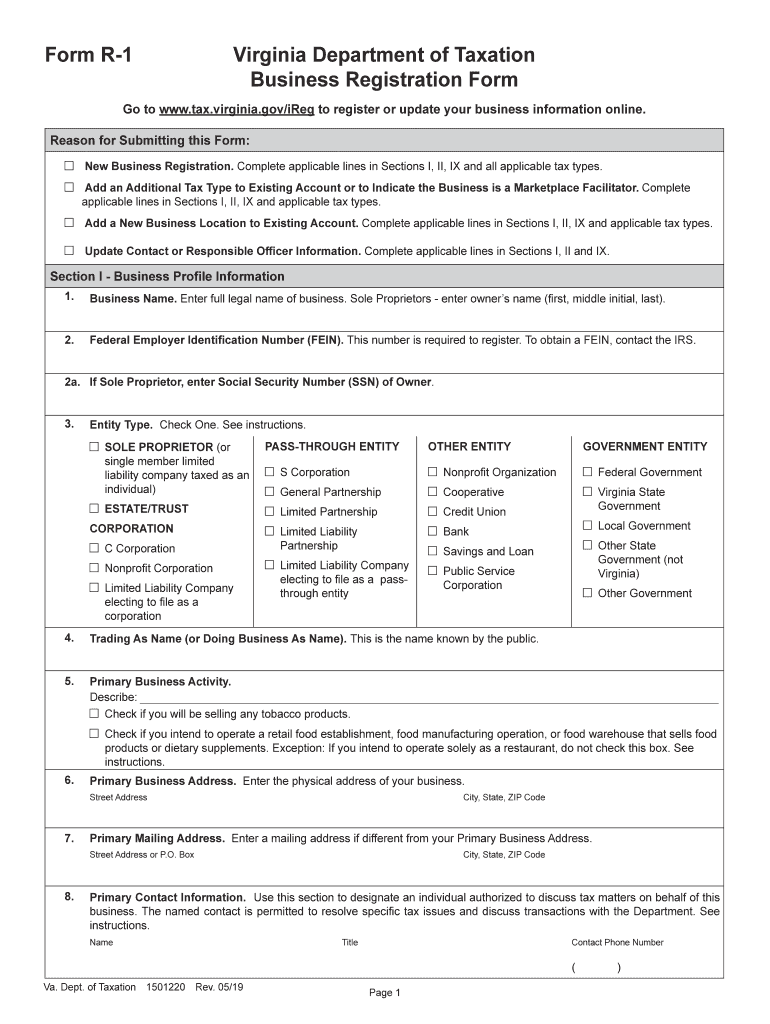

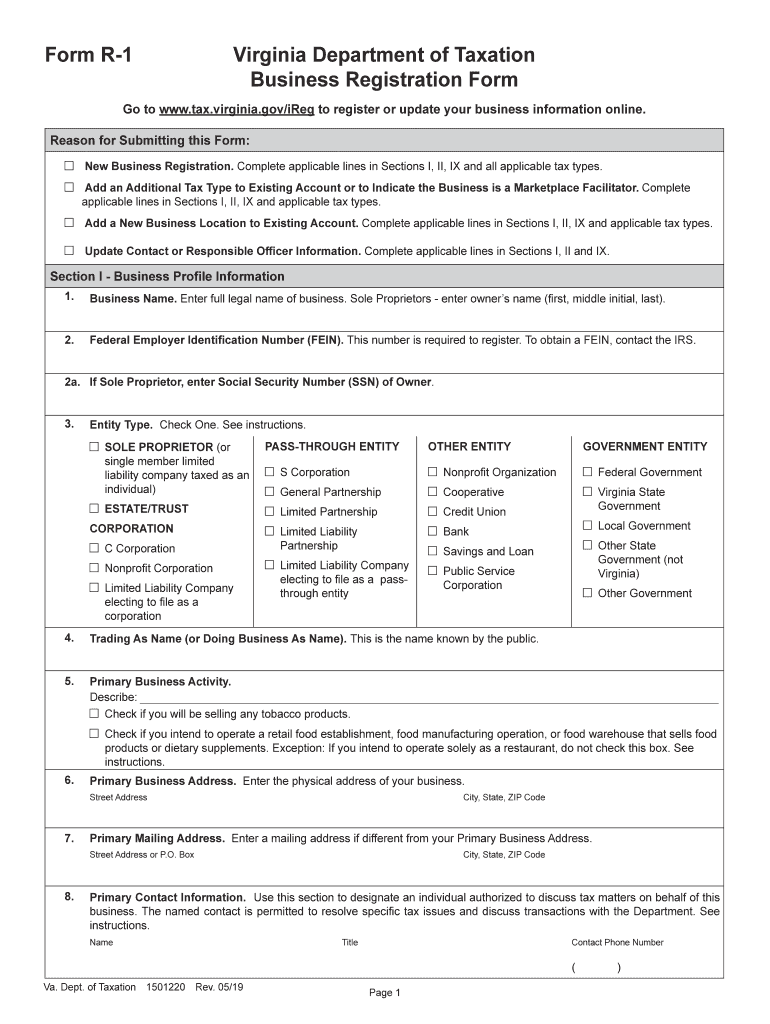

Form R1Virginia Department of Taxation Business Registration Forgo to www.tax.virginia.gov/iReg to register or update your business information online. Reason for Submitting this Form: New Business

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA DoT R-1

Edit your VA DoT R-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA DoT R-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VA DoT R-1 online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit VA DoT R-1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA DoT R-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA DoT R-1

How to fill out VA DoT R-1

01

Obtain the VA DoT R-1 form from the official VA website or your local VA office.

02

Begin by filling out the identification section with your personal details including name, social security number, and contact information.

03

Provide information about your military service, including branch, service dates, and discharge status.

04

Complete the sections regarding your health condition or disability, detailing relevant medical history.

05

Review the financial information section, ensuring to include income sources and dependents if applicable.

06

Carefully read through the form, ensuring all information is accurate and complete.

07

Sign and date the bottom of the form to certify that the information is true.

08

Submit the completed form to the appropriate VA office, either in person or by mail.

Who needs VA DoT R-1?

01

Veterans who are seeking eligibility for benefits related to their health conditions or disabilities.

02

Any service members who require assistance from the VA for claims related to military service.

03

Individuals who are applying for VA health care or disability compensation.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to attach my W-2 to my Virginia state tax return?

You are also required to attach all W-2 and 1099 forms, showing Virginia tax withheld with a single staple at the left center of page 1 of the return.

Where to get Virginia state tax forms?

You may request or download Virginia State Income Tax forms online from the Virginia Department of Taxation or by calling 804-440-2541. Note: Checks should be made payable to the Virginia Department of Taxation.

What forms do I need to file with my Virginia state taxes?

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

Does Virginia require a state tax form?

You must file an income tax return in Virginia if: you are a resident of Virginia, part-year resident, or a nonresident, and.

Do I have to file a Virginia non resident tax return?

Virginia law imposes individual income tax filing requirements on virtually all Virginia residents, as well as on nonresidents who receive income from Virginia sources.

What is Virginia withholding form?

The Virginia Form VA-4, Employee's Virginia Income Tax Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my VA DoT R-1 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your VA DoT R-1 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I edit VA DoT R-1 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign VA DoT R-1 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I fill out VA DoT R-1 on an Android device?

Complete VA DoT R-1 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is VA DoT R-1?

VA DoT R-1 is a form used by the Virginia Department of Taxation that reports sales and use tax collected by businesses.

Who is required to file VA DoT R-1?

Businesses in Virginia that collect sales and use tax are required to file the VA DoT R-1 form.

How to fill out VA DoT R-1?

To fill out VA DoT R-1, businesses must provide details such as their business name, tax registration number, total sales, taxable sales, and the amount of tax collected.

What is the purpose of VA DoT R-1?

The purpose of VA DoT R-1 is to report the total sales and use tax collected by businesses so that the state can ensure compliance and collect the correct amount of tax revenue.

What information must be reported on VA DoT R-1?

The information that must be reported on VA DoT R-1 includes the business name, tax registration number, total sales, taxable sales, and the amount of sales and use tax collected.

Fill out your VA DoT R-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA DoT R-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.