VA DoT R-1 2015 free printable template

Show details

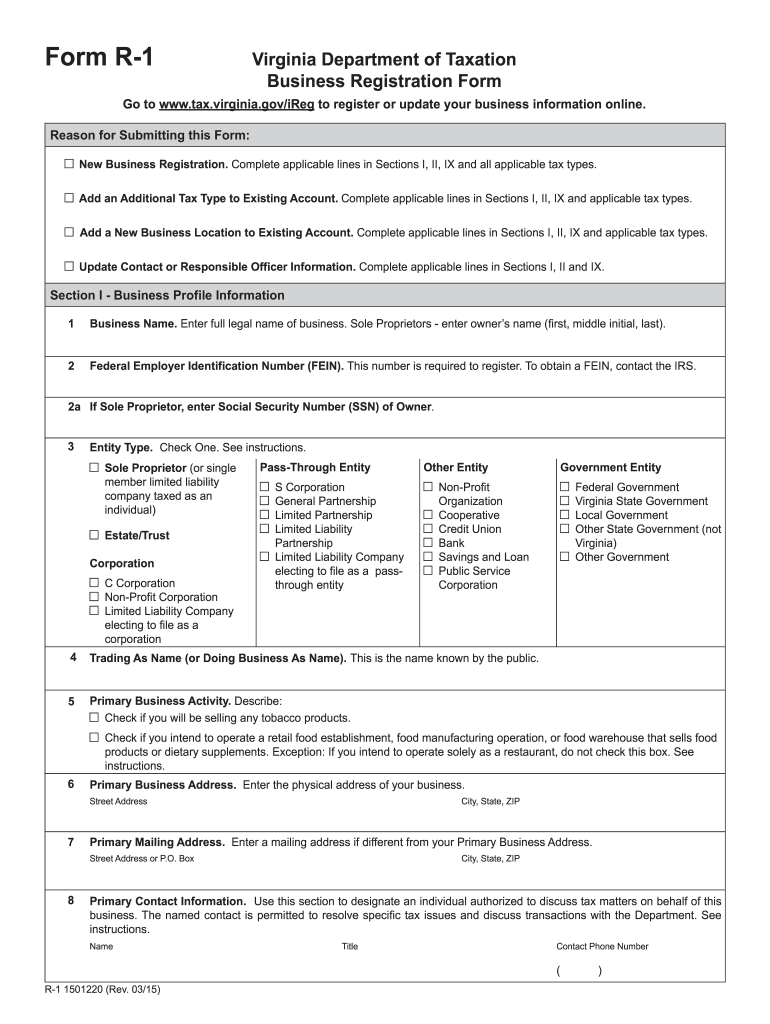

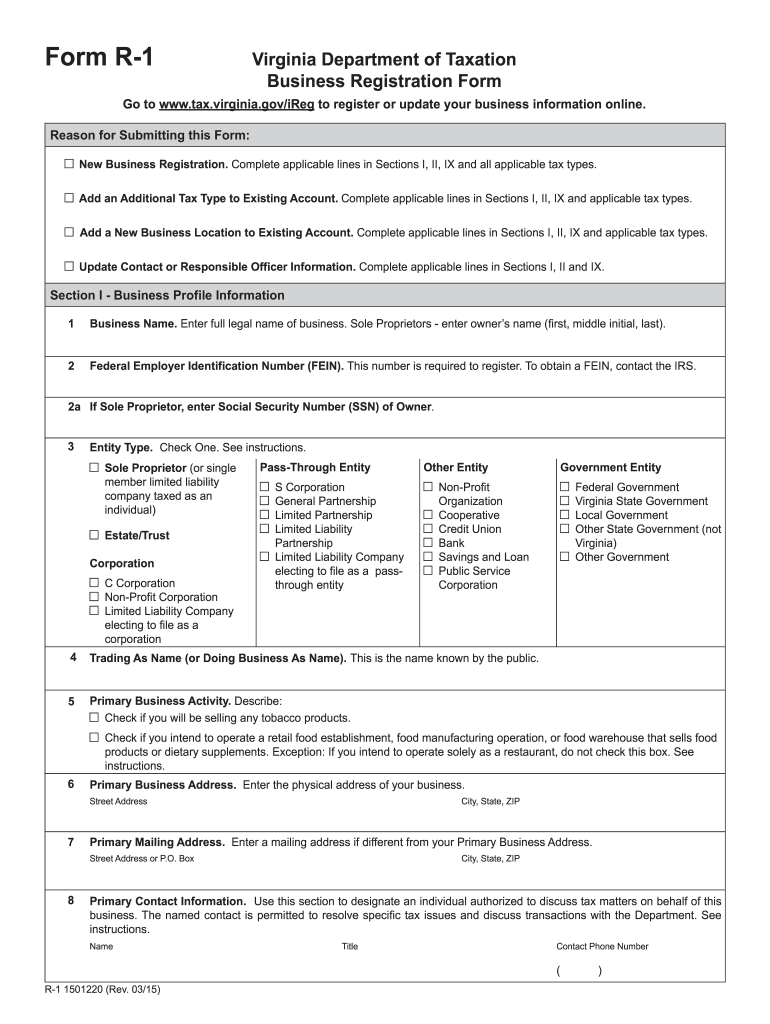

Form R-1 Virginia Department of Taxation Business Registration Form Go to www.tax.virginia.gov/iReg to register or update your business information online. Reason for Submitting this Form: New Business

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign va form r 1

Edit your va form r 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your va form r 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit va form r 1 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit va form r 1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA DoT R-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out va form r 1

How to fill out VA DoT R-1

01

Gather necessary personal information such as your Social Security number, address, and contact information.

02

Obtain the VA DoT R-1 form from the official VA website or a local VA office.

03

Read the instructions carefully to understand the requirements for filling out the form.

04

Fill in your personal information in the designated fields, ensuring accuracy.

05

Provide information about your service history and any relevant medical information.

06

Include details about your dependents if applicable.

07

Review the completed form for any errors or missing information.

08

Sign and date the form at the bottom.

09

Submit the form either online, by mail, or in person at your local VA office as directed.

Who needs VA DoT R-1?

01

Veterans seeking disability benefits or compensation.

02

Surviving spouses or dependents applying for benefits.

03

Individuals needing to report changes in their status to the VA.

04

Veterans applying for VA healthcare services.

Fill

form

: Try Risk Free

People Also Ask about

What is the due date for VA state income tax?

The Virginia State Tax Filing deadline remains May 1st. If you have a tax due the state will not charge any penalty until after June 1st.

What is needed to fill out income tax?

In addition to proof of your identity, and the identities of your family members, documents you should bring to a tax preparer include: Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations.

How do I get my VA tax documents?

Resources and support. Call us. 800-698-2411. Visit a medical center or regional office. Find a VA location.

What are the two forms you must have for your tax return?

If you are doing this yourself, your library probably has a Form 1040. Or you can go to the IRS website to print out or fill it out online. W-2: If you work for an employer, you can expect to receive a W-2, which shows how much you earned last year and how much was deducted for taxes and any other withholding.

What is the form for Virginia sales tax registration?

Log into your business online services account or fill out the retail sales and use section on Form R-1. When you complete your registration, you'll receive your 15-digit sales tax account number and your Sales Tax Certificate of Registration (Form ST-4). Be sure to save both.

What do you need to have completed before you fill out your Virginia state income tax form?

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my va form r 1 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign va form r 1 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send va form r 1 to be eSigned by others?

Once your va form r 1 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find va form r 1?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific va form r 1 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

What is VA DoT R-1?

VA DoT R-1 is a form used by the Virginia Department of Taxation to report and remit withholding tax for employees.

Who is required to file VA DoT R-1?

Employers who withhold income taxes from their employees' wages in Virginia are required to file the VA DoT R-1 form.

How to fill out VA DoT R-1?

To fill out VA DoT R-1, employers need to provide their FEIN, the period covered for the withheld taxes, the total amount of wages paid, the total amount of taxes withheld, and any adjustments, if applicable.

What is the purpose of VA DoT R-1?

The purpose of VA DoT R-1 is to ensure that Virginia employers report the correct amount of income tax withheld from employee wages and remit those funds to the state tax authority.

What information must be reported on VA DoT R-1?

The information that must be reported on VA DoT R-1 includes the employer's FEIN, the reporting period, total wages paid, total amount withheld, and any adjustments for over or under withholding.

Fill out your va form r 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Va Form R 1 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.