DC ROD FP 7/C 2019 free printable template

Show details

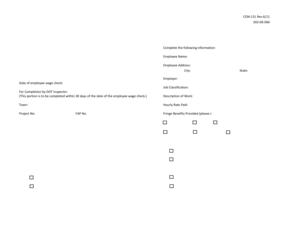

GOVERNMENT OF THE DISTRICT OF COLUMBIA

OFFICE OF THE CHIEF FINANCIAL OFFICER

OFFICE OF TAX AND REVENUE

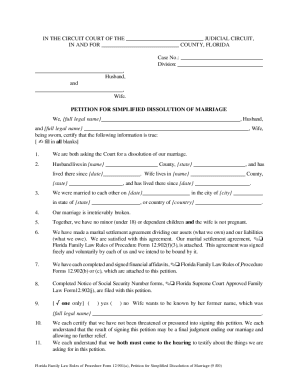

OFFICE OF THE RECORDER OF DEEDSREAL PROPERTY DECORATION AND TRANSFER TAX FORM FP7/GENERAL INSTRUCTIONS

A

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DC ROD FP 7C

Edit your DC ROD FP 7C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DC ROD FP 7C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing DC ROD FP 7C online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit DC ROD FP 7C. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DC ROD FP 7/C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out DC ROD FP 7C

How to fill out DC ROD FP 7/C

01

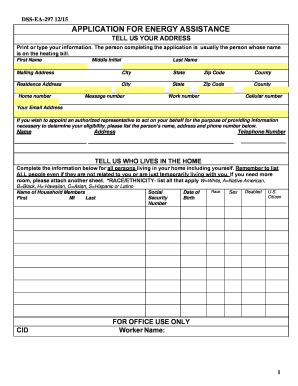

Gather all necessary personal information including your name, address, and contact details.

02

Locate Section A of the DC ROD FP 7/C form and fill in your identification details.

03

Proceed to Section B and provide information regarding your employment or affiliation.

04

In Section C, detail any relevant previous experiences or qualifications related to your application.

05

Complete Section D by answering any specific questions related to the purpose of the form.

06

Review all entries for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Submit the form as instructed, either electronically or via postal service.

Who needs DC ROD FP 7/C?

01

Individuals applying for specific job positions or licenses that require this form.

02

Professionals seeking certification or validation of qualifications.

03

Applicants involved in processes that necessitate personal information disclosure.

Fill

form

: Try Risk Free

People Also Ask about

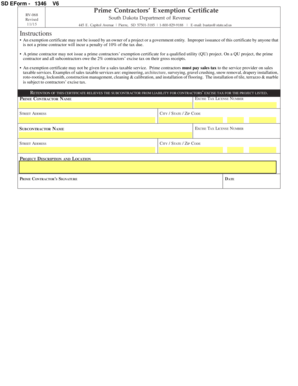

Who pays real estate transfer tax in DC?

In the District of Columbia, both the buyer and seller pay for transfer taxes. See below for examples. Depending on local market conditions, transfer taxes can become a negotiating point during closing.

What is the transfer tax on real property in DC?

1.45% of consideration or fair market value on the entire amount, if transfer is $400,000 or greater. Note: Fair market value is used when the consideration is nominal, i.e. less than 30% of FMV. Each transfer of real property at the time the deed is submitted for recordation.

Who pays transfer taxes in Maryland?

In Maryland, you are responsible for the state and county transfer taxes, as well as the county recordation tax. It is customary for the seller and the buyer to split the total transfer and recordation tax amount equally (if no exemptions apply). The Maryland state transfer tax rate is 0.5%.

What is the transfer tax in DC?

1.1 % of consideration or fair market value for residential property transfers less than $400,000 and 1.45% of consideration or fair market value on the entire amount, if transfer is greater than $400,000.

What is the tax rate for real property in DC?

Overview of District of Columbia Taxes Homeowners in the nation's capital pay some of the lowest property tax rates in the country. In Washington, D.C., the average effective property tax rate is 0.55%. However, the median real estate property tax payment is $3,699, which is higher than the national average.

How do I get a copy of my DC property tax bill?

If you need assistance, call the Customer Service Center at (202) 727-4TAX or contact OTR via email. Mortgage/Title Companies: Visit Real Property Public Extract and Billing/Payment Records.

Who pays for transfer tax in DC?

Some jurisdictions dictate who pays the tax but for the most part, there is no mandate and it's up to the buyer and seller to negotiate who makes the payment. In the District of Columbia, both the buyer and seller pay for transfer taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send DC ROD FP 7C to be eSigned by others?

Once your DC ROD FP 7C is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I sign the DC ROD FP 7C electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your DC ROD FP 7C in seconds.

Can I create an electronic signature for signing my DC ROD FP 7C in Gmail?

Create your eSignature using pdfFiller and then eSign your DC ROD FP 7C immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

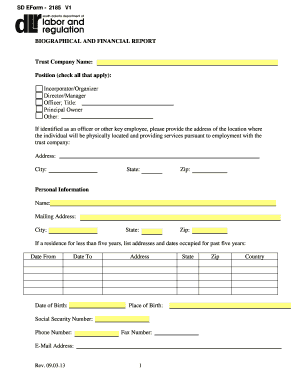

What is DC ROD FP 7/C?

DC ROD FP 7/C is a form used for reporting certain financial information and obligations to the District of Columbia Office of Tax and Revenue.

Who is required to file DC ROD FP 7/C?

Entities and individuals who engage in specific business activities or meet certain financial thresholds within Washington, D.C. are required to file DC ROD FP 7/C.

How to fill out DC ROD FP 7/C?

To correctly fill out DC ROD FP 7/C, provide accurate financial data, including revenue, expenses, and other relevant financial information, following the provided instructions and guidelines.

What is the purpose of DC ROD FP 7/C?

The purpose of DC ROD FP 7/C is to ensure compliance with local financial reporting regulations and to provide the government with necessary data for taxation and revenue collection.

What information must be reported on DC ROD FP 7/C?

Information that must be reported on DC ROD FP 7/C includes detailed financial statements, revenue figures, expense reports, and any pertinent business activity information.

Fill out your DC ROD FP 7C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DC ROD FP 7c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.