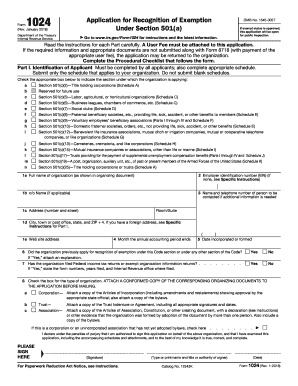

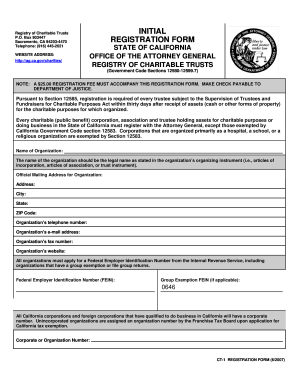

IRS CT-1 2019 free printable template

Get, Create, Make and Sign IRS CT-1

How to edit IRS CT-1 online

Uncompromising security for your PDF editing and eSignature needs

IRS CT-1 Form Versions

How to fill out IRS CT-1

How to fill out IRS CT-1

Who needs IRS CT-1?

Instructions and Help about IRS CT-1

Music Laughter Music hello guys Evans here and welcome to this video so in this video I'm going to be solving the October November 2018 GCC ICT pepper 2 well be looking at a section on data database which is simply data manipulation so just resize them you're now going to prepare some reports using the data tables in a database make sure all currency values displayed same current symbol of your choice and I said to the zero decimal places deaths are to be displayed in this format dd MMM and why why why is Stephanie to import the file into 18 as to Mr CSV into a server data this package, and you're going to use these field names and the types so for the field names all of them that members' member date all of them as text formatted it, but it should be in this format DD MMM three Ms rather and two wise things above that date is that one, so that's the medium yet okay, and you set the customer number field as primary key, and you save the data so let's go ahead and do just that, so I'm going to open up my ancestry to black with a bit I'm going to call this one is an October underscore November 2018 paper too okay um so create it okay all right so the next thing that we will do is to import that file so go to external data and text file and import Music work okay, so it's supposed to be in this for there some going to go inside this for that its called customize I guess customize the CSV this is the one here bought it, and now you go through the normal step of important for okay, so I guess you guys are quite familiar now this state, so you can go ahead and change the data types from here if you want, or you can click on advanced, and you will see the data types listed here all of them are short text, but member debt is debt with tab which with which is what we want the other thing that we want is to make sure that your order date is set as DM Y which is their month year and that leading zeros are also allowed in your document so if it is possible to have a four-digit year its till be possible but if it doesn't work out then don't stress yourself its fine the ahead good next and set your own primary key we are setting the customer number field as primary key, so customer number is this one and set it as primary key okay, so I'll call this one as my customer tip oh okay finish all right good and then the next question asks us to provide evidence showing the field names and data types used in the table place this in your FJ statement okay so go ahead and change it to thank you, and you're supposed to get evidence of this so our get evidence before I close this window let me change the get format so that it is to medium debt so in case you cannot see medium tech like this please you can type in the date format from here DD & — MMM like that — why and that should be able to give you the medium debt on some visions of axis you will not be able to get these gets listed here and so then a bit will be different for you — to do that, so that's that's that,...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS CT-1 to be eSigned by others?

Where do I find IRS CT-1?

Can I create an eSignature for the IRS CT-1 in Gmail?

What is IRS CT-1?

Who is required to file IRS CT-1?

How to fill out IRS CT-1?

What is the purpose of IRS CT-1?

What information must be reported on IRS CT-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.