Get the free form 8949 instructions

Show details

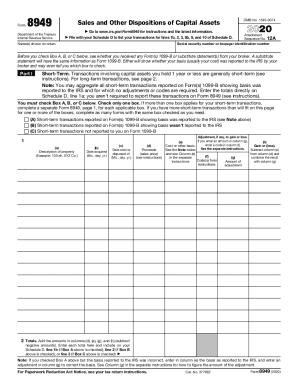

Report these transactions on Part I of Form 8949 or line 1a of Schedule D if you can use Exception 1 under the instructions for Form 8949 line 1. Instructions for Form 8949 Department of the Treasury Internal Revenue Service Sales and Other Dispositions of Capital Assets Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Form 8949 and its instructions such as legislation enacted after they...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8949 instructions

Edit your form 8949 instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8949 instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 8949 instructions online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 8949 instructions. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8949 instructions

How to fill out IRS 8949 Instructions

01

Obtain Form 8949 from the IRS website or your tax preparation software.

02

Gather all transaction records for the sales and exchanges of capital assets.

03

Categorize your transactions as short-term or long-term based on how long you held the asset.

04

Enter the details of each transaction in the appropriate section: Column (a) - Description of property, Column (b) - Date acquired, Column (c) - Date sold, Column (d) - Proceeds (sales price), Column (e) - Cost or other basis, Column (f) - Code (if applicable for adjustments).

05

Calculate the gain or loss for each transaction in Column (g).

06

Totals for short-term and long-term transactions should be summarized at the bottom of the form.

07

Transfer the total gains or losses to Schedule D as needed.

08

Review your completed Form 8949 for accuracy before submitting with your tax return.

Who needs IRS 8949 Instructions?

01

Taxpayers who have sold or exchanged capital assets during the tax year, such as stocks, bonds, or real estate.

02

Individuals who need to report gains or losses from these transactions for accurate tax filing.

03

Taxpayers who received Form 1099-B from brokers or other financial institutions.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to list every stock transaction on form 8949?

Regarding reporting trades on Form 1099 and Schedule D, you must report each trade separately by either: Including each trade on Form 8949, which transfers to Schedule D. Combining the trades for each short-term or long-term category on your Schedule D. Include a separate attached spreadsheet showing each trade.

Do I need to report 8949 form?

Individuals use Form 8949 to report the following. The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not used in your trade or business. Nonbusiness bad debts.

How do I know if I need to file form 8949?

Anyone who has received one or more Forms 1099-B, Forms 1099-S, or IRS-allowed substitutions should file a Form 8949. You may not need to file Form 8949 if the basis for all of your transactions was reported to the IRS, and if you don't need to make any adjustments to those figures.

Who must file form 8949?

Anyone who sells or exchanges a capital asset such as stock, land, or artwork must complete Form 8949. Both short-term and long-term transactions must be documented on the form.

What transactions are not reported on form 8949?

Taxpayers can omit transactions from Form 8949 if: They received a Form 1099-B that shows that the cost basis was reported to the IRS, and. You did not have a non-deductible wash sale loss or adjustments to the basis, gain or loss, or to the type of gain or loss (short term or long term).

Do I have to report every stock transaction 1099-B?

Even though the stock was sold in a single transaction, you must report the sale of the covered securities on two separate 2023 Forms 1099-B (one for the securities bought in April 2022 with long-term gain or loss and one for the securities bought in August 2022 with short-term gain or loss).

Do you have to file a 8949 and Schedule D?

Any year that you have to report a capital asset transaction, you'll need to prepare Form 8949 before filling out Schedule D unless an exception applies. Form 8949 requires the details of each capital asset transaction.

Do I have to report every stock transaction on form 8949?

What you may not realize, is that you'll need to report every transaction on an IRS Form 8949 in addition to a Schedule D. And if you sold stocks for less than you paid for them , you need to report those losses too.

In what circumstance would form 8949 not have to be filed?

Taxpayers can omit transactions from Form 8949 if: They received a Form 1099-B that shows that the cost basis was reported to the IRS, and. You did not have a non-deductible wash sale loss or adjustments to the basis, gain or loss, or to the type of gain or loss (short term or long term).

Do I need to send 8949?

You don't need to manually fill out Form 8949, because we automatically do that when you enter your investment sales or exchanges. If you're paper-filing your return, Form 8949 will simply be included with all your other tax forms when you print them out.

Do I have to list all stock transactions on my tax return?

In general, individual traders and investors who file Form 1040 tax returns are required to provide a detailed list of each and every trade closed in the current tax year.

Do I need to submit form 8949?

If you e-file your return but choose not to report each transaction on a separate row on the electronic return, you must either (a) include Form 8949 as a PDF attachment to your return, or (b) attach Form 8949 to Form 8453 (or the appropriate form in the Form 8453 series) and mail the forms to the IRS.

Is Schedule D the same as form 8949?

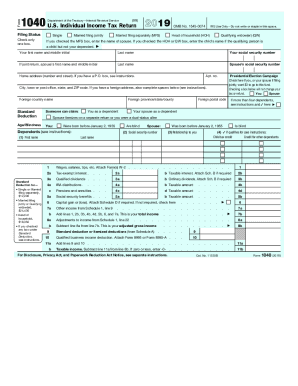

Schedule D of Form 1040 is used to report most capital gain (or loss) transactions. But before you can enter your net gain or loss on Schedule D, you have to complete Form 8949.

Do I have to include Schedule D on my tax return?

Schedule D is required when a taxpayer reports capital gains or losses from investments or the result of a business venture or partnership. The calculations from Schedule D are combined with individual tax return form 1040, where it will affect the adjusted gross income amount.

When can I skip form 8949?

Taxpayers can omit transactions from Form 8949 if: They received a Form 1099-B that shows that the cost basis was reported to the IRS, and. You did not have a non-deductible wash sale loss or adjustments to the basis, gain or loss, or to the type of gain or loss (short term or long term).

Do I have to report every stock transaction on form 8949?

Enter all sales and exchanges of capital assets, including stocks, bonds, and real estate (if not reported on line 1a or 8a of Schedule D or on Form 4684, 4797, 6252, 6781, or 8824). Include these transactions even if you didn't receive a Form 1099-B or 1099-S (or substitute statement) for the transaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 8949 instructions directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your form 8949 instructions and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit form 8949 instructions online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your form 8949 instructions to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out form 8949 instructions using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign form 8949 instructions. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is IRS 8949 Instructions?

IRS 8949 Instructions provide guidance on how to report capital gains and losses from the sale of securities and other capital assets on your tax return.

Who is required to file IRS 8949 Instructions?

Individuals, corporations, partnerships, and estates that have capital gains or losses from the sale of capital assets are required to file IRS 8949.

How to fill out IRS 8949 Instructions?

To fill out IRS 8949, taxpayers must report each transaction, including the date acquired, date sold, proceeds, cost or other basis, and gain or loss, following the format specified in the form.

What is the purpose of IRS 8949 Instructions?

The purpose of IRS 8949 Instructions is to help taxpayers accurately report their capital gains and losses to ensure compliance with tax laws and to determine the correct amount of tax owed.

What information must be reported on IRS 8949 Instructions?

Taxpayers must report information such as the description of the asset, date acquired, date sold, proceeds, cost or other basis, and whether the gain or loss is short-term or long-term.

Fill out your form 8949 instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8949 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.