VA DoT 763 2019 free printable template

Show details

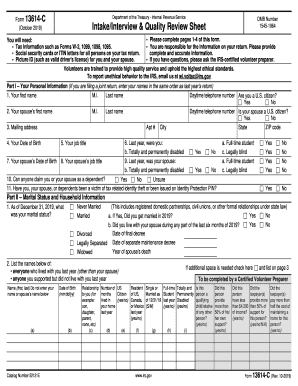

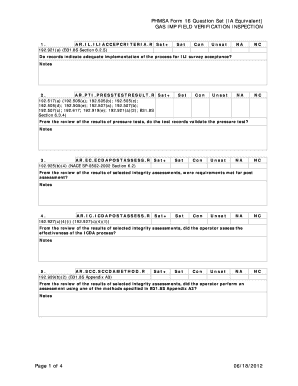

Multiply Line 16 by percentage on Line 17. Income Tax from Tax Table or Tax Rate Schedule. Va. Dept. of Taxation 2601044 Rev. 10/18 For Local Use LTD 2018 FORM 763 Page 2 Your Name Your SSN 20a Your Virginia income tax withheld. 2018 Virginia Nonresident Income Tax Return Page1 Due May 1 2019 Enclose a complete copy of your federal tax return and all other required Virginia enclosures. First Name MI Last Name 6X Your Social Security Number Check if deceased Spouse s First Name Filing...Status 2 Only Spouse s Social Security Number Present Home Address Number and Street or Rural Route LW 7RZQ RU 3RVW 2 FH State State of Residence ZIP Code - Spouse s Birth Date mm-dd-yyyy 1DPH V RU GGUHVV L HUHQW than Shown on 2017 VA Return Dependent on Another s Return Locality Code Overseas on Due Date EIC Claimed on federal return Qualifying Farmer Fisherman or Merchant Seaman. 00 Exemptions Add Sections 1 and 2. Enter the sum on Line 13. Filing Status Enter Filing Status Code in box below....Important - Name of Virginia City or County in which principal place of business employment or income source is located* City OR County Amended Return Check if Result of NOL Check Applicable Boxes Your Birth Date 1 Single. Federal head of household YES 2 Married Filing Joint Return - both must have Virginia income 3 Married Spouse Has No Income From Any Source If Filing Status 3 or 4 enter spouse s SSN in the Spouse s Social Security Number box at top of form and enter Spouse s Name Spouse if 2...or 3 You Dependents You 65 Spouse 65 You or over Blind Total Section 1 X 930 X 800 Adjusted Gross Income from federal return - Not federal taxable income. Additions from Schedule 763 ADJ Line 3. Add Lines 1 and 2. Age Deduction See instructions and the Age Deduction Worksheet. You Enter Birth Dates above. Enter Your Age Deduction on Line 4a and Your Spouse s Age Deduction on Line 4b. Spouse 4a 4b 6RFLDO 6HFXULW FW DQG HTXLYDOHQW 7LHU 5DLOURDG 5HWLUHPHQW FW EHQH WV UHSRUWHG RQ RXU IHGHUDO UHWXUQ....State income tax refund or overpayment credit reported as income on your federal return*. Subtractions from Schedule 763 ADJ Line 7. Add Lines 4a 4b 5 6 and 7. Virginia Adjusted Gross Income VAGI. Subtract Line 8 from Line 3. Itemized Deductions. See instructions. 11 State and local income taxes claimed from Virginia Schedule A if claiming itemized deductions. If claiming itemized deductions subtract Line 11 from Line 10 or enter standard deduction amount. Exemption amount. Enter the total...amount from the Exemption Sections 1 and 2 above. Deductions from Schedule 763 ADJ Line 9. Add Lines 12 13 and 14. Virginia Taxable Income computed as a resident. Subtract Line 15 from Line 9. Percentage from Nonresident Allocation Section on Page 2 Enter to one decimal place only. Nonresident Taxable Income. Multiply Line 16 by percentage on Line 17. Income Tax from Tax Table or Tax Rate Schedule. Va* Dept. of Taxation 2601044 Rev* 10/18 For Local Use LTD 2018 FORM 763 Page 2 Your Name Your SSN...20a Your Virginia income tax withheld.

pdfFiller is not affiliated with any government organization

Instructions and Help about VA DoT 763

How to edit VA DoT 763

How to fill out VA DoT 763

Instructions and Help about VA DoT 763

How to edit VA DoT 763

To edit the VA DoT 763 Tax Form, first download the form in PDF format. Utilize a reliable PDF editor, such as pdfFiller, to make necessary amendments to text fields or checkboxes. Save the changes before printing or sharing the updated document.

How to fill out VA DoT 763

Filling out the VA DoT 763 Tax Form requires accurate information regarding your financial transactions. Follow these steps:

01

Obtain the latest version of the VA DoT 763 form from the official state website or via pdfFiller.

02

Read the instructions carefully to understand the required fields.

03

Enter your personal information, including name, address, and tax identification number.

04

Provide details of each applicable purchase or payment.

Before submitting, review all entries to ensure there are no errors. This is crucial to avoid penalties or delays in processing.

About VA DoT previous version

What is VA DoT 763?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About VA DoT previous version

What is VA DoT 763?

The VA DoT 763 form is a tax document used by the Virginia Department of Taxation. It is utilized to report certain types of financial transactions and is essential for maintaining compliance with state tax laws.

What is the purpose of this form?

The purpose of the VA DoT 763 form is to report sales or use tax related to specific transactions. By completing the form, taxpayers provide the necessary details that ensure compliance with state tax regulations.

Who needs the form?

Individuals and businesses who engage in taxable sales or purchases within Virginia must complete the VA DoT 763 form. This requirement ensures that all applicable taxes are reported and collected appropriately.

When am I exempt from filling out this form?

Exemptions from filling out the VA DoT 763 form typically apply to certain organizations, such as non-profit entities, or transactions that fall under specific thresholds set by the Virginia Department of Taxation. It is crucial to verify your exemption status before determining whether to file.

Components of the form

The VA DoT 763 includes various sections to capture essential information. Key components of the form include:

01

Taxpayer identification details

02

Description of transactions

03

Total sales and use tax amount due

Each section must be completed accurately to ensure proper assessment by the taxation authority.

What are the penalties for not issuing the form?

Failing to submit the VA DoT 763 form can result in penalties imposed by the Virginia Department of Taxation. These penalties may include fines, interest on unpaid taxes, and potential legal consequences.

What information do you need when you file the form?

When filing the VA DoT 763 form, gather the following information:

01

Your name, address, and tax identification number.

02

Details of purchases subject to sales tax.

03

Records of prior tax payments related to these transactions.

Having accurate information ready will facilitate a smoother filing process.

Is the form accompanied by other forms?

The VA DoT 763 does not require attachment to any other forms for submission unless specifically noted in the instructions. However, it is advisable to check the latest guidelines to confirm if any additional documentation is necessary.

Where do I send the form?

After completing the VA DoT 763 form, it should be mailed to the address specified in the filing instructions accompanying the form. Ensure that you use the correct mailing address to avoid delays in processing.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.