VA DoT 763 2023 free printable template

Show details

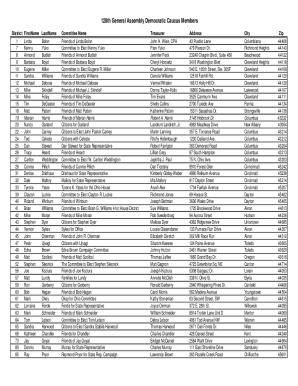

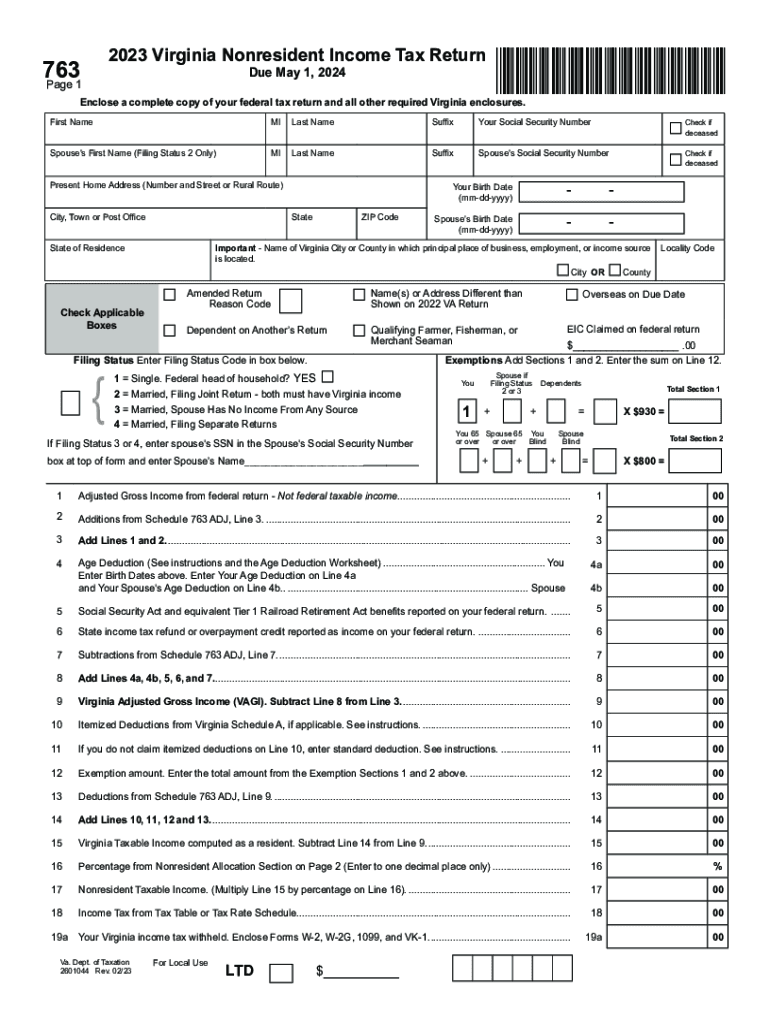

Enclose Forms W-2 W-2G 1099 and VK-1. Va. Dept. of Taxation 2601044 Rev. 02/23 For Local Use LTD 2023 FORM 763 Page 2 Your Name Your SSN 19b Spouse s Virginia income tax withheld. 2023 Virginia Nonresident Income Tax Return Page 1 VA0763123888 Due May 1 2024 Enclose a complete copy of your federal tax return and all other required Virginia enclosures. First Name MI Last Name Suffix Your Social Security Number Check if deceased Spouse s First Name Filing Status 2 Only Spouse s Social Security...Number Present Home Address Number and Street or Rural Route City Town or Post Office State - Spouse s Birth Date mm-dd-yyyy Locality Code Amended Return Reason Code Name s or Address Different than Shown on 2022 VA Return Overseas on Due Date Dependent on Another s Return Qualifying Farmer Fisherman or Merchant Seaman EIC Claimed on federal return. 00 Exemptions Add Sections 1 and 2. Enter the sum on Line 12. Filing Status Enter Filing Status Code in box below. Important - Name of Virginia City...or County in which principal place of business employment or income source is located* City OR County State of Residence Check Applicable Boxes ZIP Code Your Birth Date 1 Single. Federal head of household YES 2 Married Filing Joint Return - both must have Virginia income 3 Married Spouse Has No Income From Any Source If Filing Status 3 or 4 enter spouse s SSN in the Spouse s Social Security Number box at top of form and enter Spouse s Name You Spouse if 2 or 3 Dependents You 65 Spouse 65 You or...over Blind Total Section 1 X 930 X 800 Adjusted Gross Income from federal return - Not federal taxable income. Additions from Schedule 763 ADJ Line 3. Add Lines 1 and 2. Age Deduction See instructions and the Age Deduction Worksheet. You Enter Birth Dates above. Enter Your Age Deduction on Line 4a and Your Spouse s Age Deduction on Line 4b. Spouse 4a 4b Social Security Act and equivalent Tier 1 Railroad Retirement Act benefits reported on your federal return*. State income tax refund or...overpayment credit reported as income on your federal return*. Subtractions from Schedule 763 ADJ Line 7. Add Lines 4a 4b 5 6 and 7. Virginia Adjusted Gross Income VAGI. Subtract Line 8 from Line 3. Itemized Deductions from Virginia Schedule A if applicable. See instructions. If you do not claim itemized deductions on Line 10 enter standard deduction* See instructions. Exemption amount. Enter the total amount from the Exemption Sections 1 and 2 above. Deductions from Schedule 763 ADJ Line 9. Add...Lines 10 11 12 and 13. Virginia Taxable Income computed as a resident. Subtract Line 14 from Line 9. Percentage from Nonresident Allocation Section on Page 2 Enter to one decimal place only. Nonresident Taxable Income. Multiply Line 15 by percentage on Line 16. Income Tax from Tax Table or Tax Rate Schedule. 19a Your Virginia income tax withheld. Enclose Forms W-2 W-2G 1099 and VK-1. 2023 Estimated Tax Payments. 2022 overpayment credited to 2023 estimated tax. Extension Payment - submitted using...Form 760IP. Credit for Low-Income Individuals or Virginia Earned Income Credit from Schedule 763 ADJ Line 17.

pdfFiller is not affiliated with any government organization

Instructions and Help about VA DoT 763

How to edit VA DoT 763

How to fill out VA DoT 763

Instructions and Help about VA DoT 763

How to edit VA DoT 763

To edit the VA DoT 763, you can utilize forms available in platforms like pdfFiller. The tool allows for seamless editing of the document, ensuring that all required information is accurately reflected. Follow these steps to make necessary edits:

01

Upload your current version of the VA DoT 763 to pdfFiller.

02

Select the fields that require changes and input the correct information.

03

Save your edited document to ensure no data is lost.

How to fill out VA DoT 763

Filling out the VA DoT 763 requires careful attention to detail to ensure compliance with reporting requirements. Start by gathering all necessary information such as your identification details, payment records, and pertinent financial data. Follow these steps to complete the form:

01

Review the instructions provided with the form to understand its requirements.

02

Fill in your name, address, and identification number in the designated fields.

03

Accurately report any payments or purchases that are required to be documented.

About VA DoT previous version

What is VA DoT 763?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About VA DoT previous version

What is VA DoT 763?

VA DoT 763, officially known as the Virginia Department of Taxation Form 763, is a tax form utilized for reporting certain payments in Virginia. This form is mainly used by taxpayers to report income and tax withheld that is not recorded on traditional forms like W-2s or 1099s. It serves as a formal record for payment and tax compliance for the state of Virginia.

What is the purpose of this form?

The purpose of the VA DoT 763 is to ensure that specific types of income are reported correctly to the Virginia Department of Taxation. This form helps in documenting amounts subject to taxation, assisting both the taxpayer and the state in maintaining accurate tax records.

Who needs the form?

Individuals or entities who have made payments that fall under the reporting requirements established by the Virginia Department of Taxation are required to use VA DoT 763. This typically includes businesses, contractors, and individuals who have made payments to vendors that need to be reported for tax purposes.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out the VA DoT 763 if their payments do not meet the threshold amounts specified by the Virginia Department of Taxation. Additionally, individuals who receive income reported by other forms such as W-2s or verified 1099s may not need to complete this form.

Components of the form

The VA DoT 763 comprises several key components that include personal identification information, payment details, and signatures where applicable. Each section must be completed accurately to fulfill the reporting requirement effectively.

What are the penalties for not issuing the form?

Failure to issue the VA DoT 763 can result in penalties as outlined by the Virginia Department of Taxation. These penalties may include monetary fines or additional tax liabilities that could accrue due to non-compliance. Therefore, timely and accurate submission is imperative.

What information do you need when you file the form?

When filing the VA DoT 763, you will need crucial information including your taxpayer identification number, the names and addresses of recipients, and details regarding the payments made. It is important to have these details readily available to ensure a smooth filing process.

Is the form accompanied by other forms?

The VA DoT 763 may need to be filed with other related tax forms or documentation depending on the nature of the payments reported. It’s essential to review the filing instructions carefully to ascertain if additional documentation is required.

Where do I send the form?

The VA DoT 763 must be sent to the appropriate address provided by the Virginia Department of Taxation. Ensure to verify the current submission address to avoid any issues with processing your report.

See what our users say