Get the free Qualify for a Small Business Credit CardMillion Mile Secrets

Show details

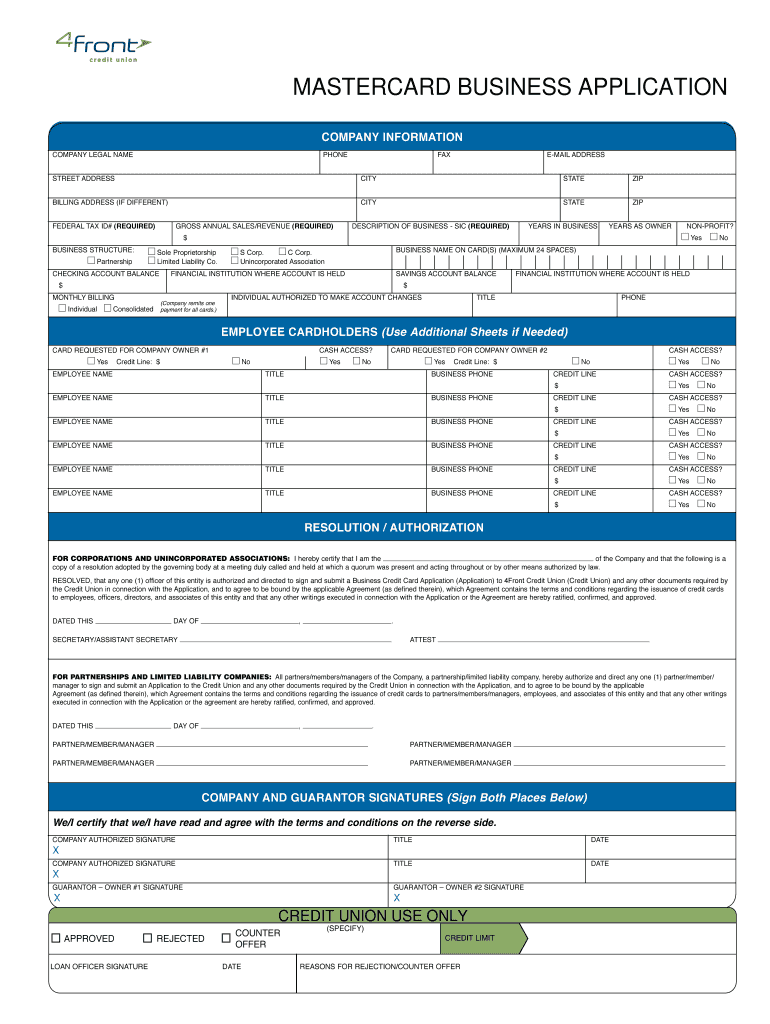

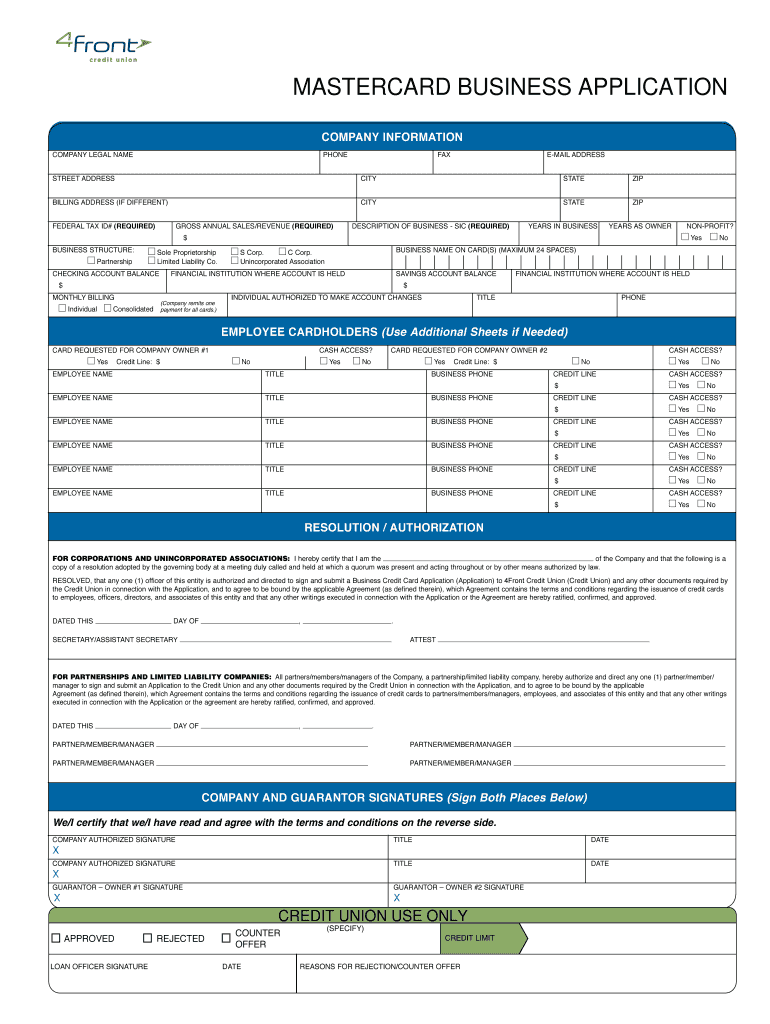

VISA Platinum Business Application MASTERCARD BUSINESS APPLICATION Company Information Company Legal namephoneFaxemaiL address street addressCitystateZipBiLLing address (if different)CitystateZipFederaL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign qualify for a small

Edit your qualify for a small form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your qualify for a small form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit qualify for a small online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit qualify for a small. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out qualify for a small

How to fill out qualify for a small

01

To qualify for a small business loan, follow these steps:

02

Determine the purpose of the loan: Before applying for a small business loan, identify why you need the funds. Whether it's for starting a new business, expanding an existing one, or covering operational expenses, clearly define the purpose.

03

Review your credit score: Lenders often consider your personal and business credit history when evaluating your loan application. Ensure that your credit score is in good standing and take steps to improve it if necessary.

04

Gather necessary documents: Prepare all required financial documents, such as profit and loss statements, balance sheets, and tax returns. Additionally, you may need to provide a business plan and projections to support your loan application.

05

Research lenders and loan options: Explore various lenders, such as banks, credit unions, and online lenders, to find the best loan options for your business. Compare interest rates, repayment terms, and eligibility criteria.

06

Complete the application: Fill out the loan application accurately and provide all requested information. Be prepared to provide details about your business, including its legal structure, industry, and financial history.

07

Submit the application: Submit your loan application along with the required documents. Some lenders may also require a personal guarantee or collateral for the loan.

08

Follow up and respond to queries: Stay in contact with the lender and promptly respond to any queries or requests for additional information. This will help expedite the loan approval process.

09

Review the loan terms: Once approved, carefully review the loan terms and conditions. Understand the interest rate, repayment schedule, and any associated fees.

10

Use the funds responsibly: Once you receive the funds, ensure that you use them responsibly for the specified purpose. Keep track of your business finances and make timely repayments.

11

Monitor your financial health: Regularly monitor your business's financial health and make improvements where needed. Maintaining a good credit score and a strong financial position will open up more opportunities for future loans.

Who needs qualify for a small?

01

Small business owners who need funding for various purposes may qualify for a small business loan. This includes:

02

- Startups looking to fund their initial operations and get their business off the ground.

03

- Existing businesses planning to expand their operations, such as opening new locations or launching new product lines.

04

- Businesses facing temporary cash flow issues and needing working capital to cover operational expenses.

05

- Entrepreneurs looking to purchase equipment, machinery, or other assets essential for their business.

06

- Businesses in need of inventory financing to stock up on products.

07

- Companies aiming to improve their credit profile by taking out a loan and making timely repayments.

08

- Small business owners who want to take advantage of growth opportunities or seize competitive advantages in the market.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send qualify for a small to be eSigned by others?

When you're ready to share your qualify for a small, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for signing my qualify for a small in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your qualify for a small and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I fill out qualify for a small on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your qualify for a small. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is qualify for a small?

Qualify for a small refers to meeting the specific requirements or criteria to be classified as a small business or entity.

Who is required to file qualify for a small?

Any individual or organization seeking to be recognized as a small business or entity is required to file qualify for a small.

How to fill out qualify for a small?

To fill out qualify for a small, you need to provide information about your company size, revenue, number of employees, and other relevant details.

What is the purpose of qualify for a small?

The purpose of qualify for a small is to determine eligibility for certain benefits, programs, contracts, or incentives reserved for small businesses or entities.

What information must be reported on qualify for a small?

Information such as company size, revenue, number of employees, ownership structure, and relevant financial data must be reported on qualify for a small.

Fill out your qualify for a small online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Qualify For A Small is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.