TX Comptroller AP-114 2019 free printable template

Show details

AB

CDAP114

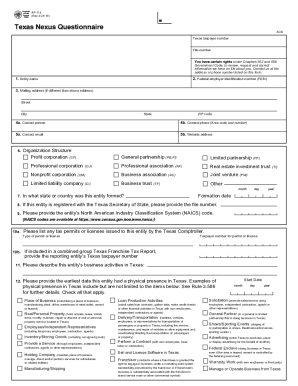

(Rev.319/18)Texas Nexus QuestionnairePRINT FORMER FIELDSACIDTexas taxpayer numbering number under Chapters 552 and 559,

Government Code, to review, request and correct

information we have

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller AP-114

Edit your TX Comptroller AP-114 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller AP-114 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller AP-114 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TX Comptroller AP-114. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller AP-114 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller AP-114

How to fill out TX Comptroller AP-114

01

Obtain the TX Comptroller AP-114 form from the official website or local tax office.

02

Fill in the 'Name and Address' section with the taxpayer's information.

03

Provide the 'Tax Identification Number' which is usually the Federal Employer Identification Number (FEIN).

04

Complete the 'Reporting Period' fields to indicate the time frame for the expense report.

05

Specify the 'Type of Expenditure' in the appropriate section.

06

List all applicable expenditures in detail, including dates, amounts, and descriptions.

07

Ensure that all entries are totaled where required, calculating any necessary subtotals.

08

Review for accuracy and ensure all required signatures are obtained.

09

Make copies of the completed form for your records before submitting.

10

Submit the completed AP-114 form to the TX Comptroller by the deadline.

Who needs TX Comptroller AP-114?

01

Any entity or individual responsible for reporting sales tax exemptions or claiming refunds on taxes paid in Texas needs to fill out the TX Comptroller AP-114 form.

02

This includes businesses, nonprofit organizations, or government entities that have incurred taxable expenses.

Fill

form

: Try Risk Free

People Also Ask about

What establishes nexus in Texas?

Texas Tax Nexus Generally, a business has nexus in Texas when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives.

What is the nexus in the state of Texas?

Texas Tax Nexus Generally, a business has nexus in Texas when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives.

What does it mean to have nexus in Texas?

Generally, a business has nexus in Texas when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives.

Does an employee in Texas create nexus?

The State of Texas considers businesses with a physical presence (i.e., offices, distribution centers, and warehouses), employees residing in the state, independent salespersons, franchisees, agents, or independent contractors to have nexus for sales tax purposes.

Does Texas have trailing nexus?

A few other states imposing trailing nexus rules include Arizona, Massachusetts, Michigan and Texas. Some examples of states that specifically do NOT impose trailing nexus rules include: Florida, Connecticut, Idaho, New York and the District of Columbia.

What determines nexus?

Nexus determination is primarily controlled by the U.S. Constitution, in which the Due Process Clause requires a definite link or minimal connection between a state and the entity it wants to tax, and the Commerce Clause requires substantial presence.

Do I have nexus in Texas?

A foreign (i.e., out-of-state) taxable entity with annual gross receipts of $500,000 or more from business in Texas has economic nexus even if the entity has no physical presence in this state.

How do I know if I have nexus in Texas?

Texas considers a seller or retailer to have physical nexus if you have any of the following in the state: An office or place of business. An employee present in the state. A place of distribution. A warehouse or storage space. A sales or sample room. Another place where business is conducted.

How do I know if I have a nexus?

You might have nexus in a state if you sell goods to a customer in that state. Sales tax is a pass-through tax. Businesses in specific localities or states must collect sales tax from customers at the point of sale. In short, customers are responsible for paying sales tax to the business during a purchase.

Does Texas have a nexus?

A foreign (i.e., out-of-state) taxable entity with annual gross receipts of $500,000 or more from business in Texas has economic nexus even if the entity has no physical presence in this state.

What is the Texas franchise tax threshold for 2022?

For the 2022 report year, a passive entity as defined in Texas Tax Code Section 171.0003; an entity that has total annualized revenue less than or equal to the no tax due threshold of $1,230,000; an entity that has zero Texas gross receipts; an entity that is a Real Estate Investment Trust (REIT) meeting the

What triggers nexus in Texas?

A foreign (i.e., out-of-state) taxable entity with annual gross receipts of $500,000 or more from business in Texas has economic nexus even if the entity has no physical presence in this state.

What is trailing nexus?

Nexus continues even after a person stops activities that originally established nexus. This is often referred to as “trailing nexus.” This one-year trailing nexus concept applies to all taxes you report on the excise tax return, including retail sales tax.

Does having an employee in Texas create nexus?

The State of Texas considers businesses with a physical presence (i.e., offices, distribution centers, and warehouses), employees residing in the state, independent salespersons, franchisees, agents, or independent contractors to have nexus for sales tax purposes.

What creates income tax nexus in a state?

States cannot just impose income tax on a business whenever they want to; first there has to be a connection, called nexus, between the business and the state. In many states, there will be income tax nexus if the business has substantial economic activity there. Most of the time, physical presence is not needed.

What is the economic nexus threshold in Texas?

What's the threshold for economic nexus law in Texas? Threshold: Sales above $500,000 in Texas in the prior 12 months. Summary: Remote sellers with Texas revenues above $500,000 are required to register, collect sales tax on sales that ship to Texas, and remit the sales tax to the state.

What is the nexus threshold in Texas?

What's the threshold for economic nexus law in Texas? Threshold: Sales above $500,000 in Texas in the prior 12 months. Summary: Remote sellers with Texas revenues above $500,000 are required to register, collect sales tax on sales that ship to Texas, and remit the sales tax to the state.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find TX Comptroller AP-114?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific TX Comptroller AP-114 and other forms. Find the template you need and change it using powerful tools.

How do I edit TX Comptroller AP-114 in Chrome?

TX Comptroller AP-114 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I edit TX Comptroller AP-114 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like TX Comptroller AP-114. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is TX Comptroller AP-114?

TX Comptroller AP-114 is a form used for reporting certain transactions related to the purchase of tangible personal property or services in the state of Texas.

Who is required to file TX Comptroller AP-114?

Businesses and individuals engaged in transactions requiring sales tax collection or exemption claims in Texas are typically required to file TX Comptroller AP-114.

How to fill out TX Comptroller AP-114?

To fill out TX Comptroller AP-114, gather the relevant transaction information, enter the necessary details in the provided fields, including seller and buyer information, item descriptions, and applicable tax rates, then submit the form as instructed.

What is the purpose of TX Comptroller AP-114?

The purpose of TX Comptroller AP-114 is to facilitate the collection and reporting of tax information on sales and purchases to ensure compliance with Texas tax laws.

What information must be reported on TX Comptroller AP-114?

Information reported on TX Comptroller AP-114 includes seller and buyer details, transaction date, descriptions of items purchased, quantity, selling price, and the applicable sales tax.

Fill out your TX Comptroller AP-114 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller AP-114 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.