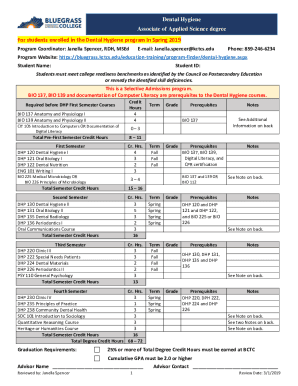

TX Comptroller AP-114 2012 free printable template

Show details

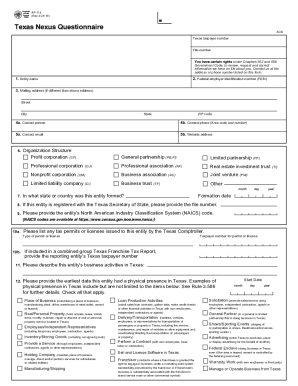

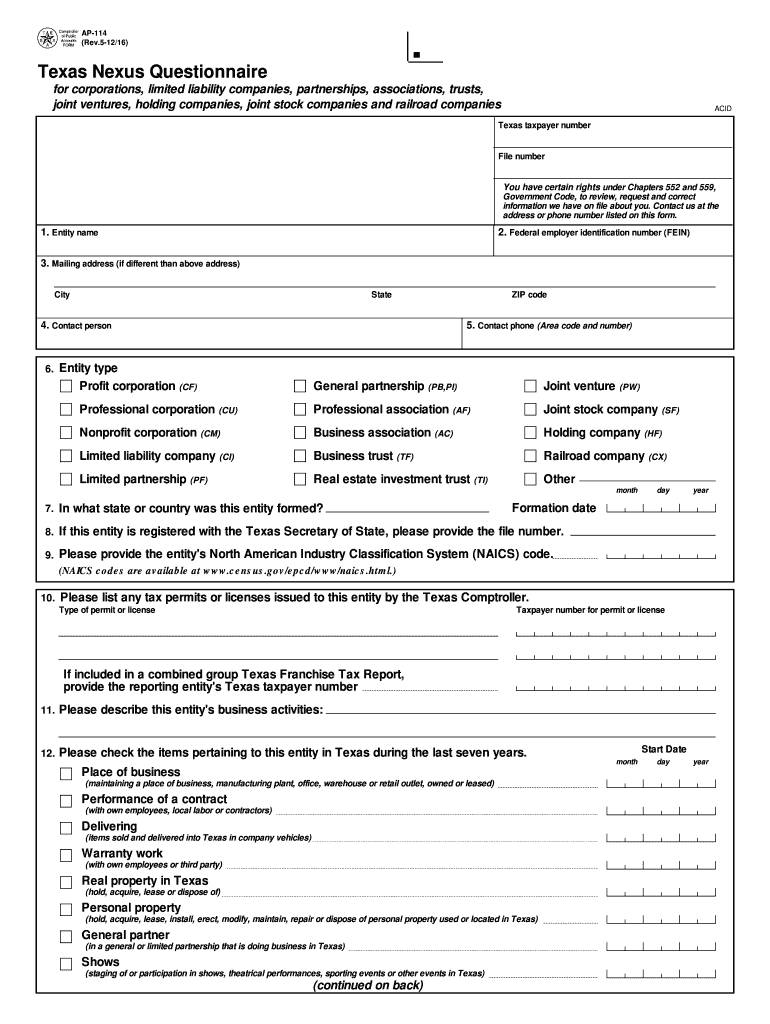

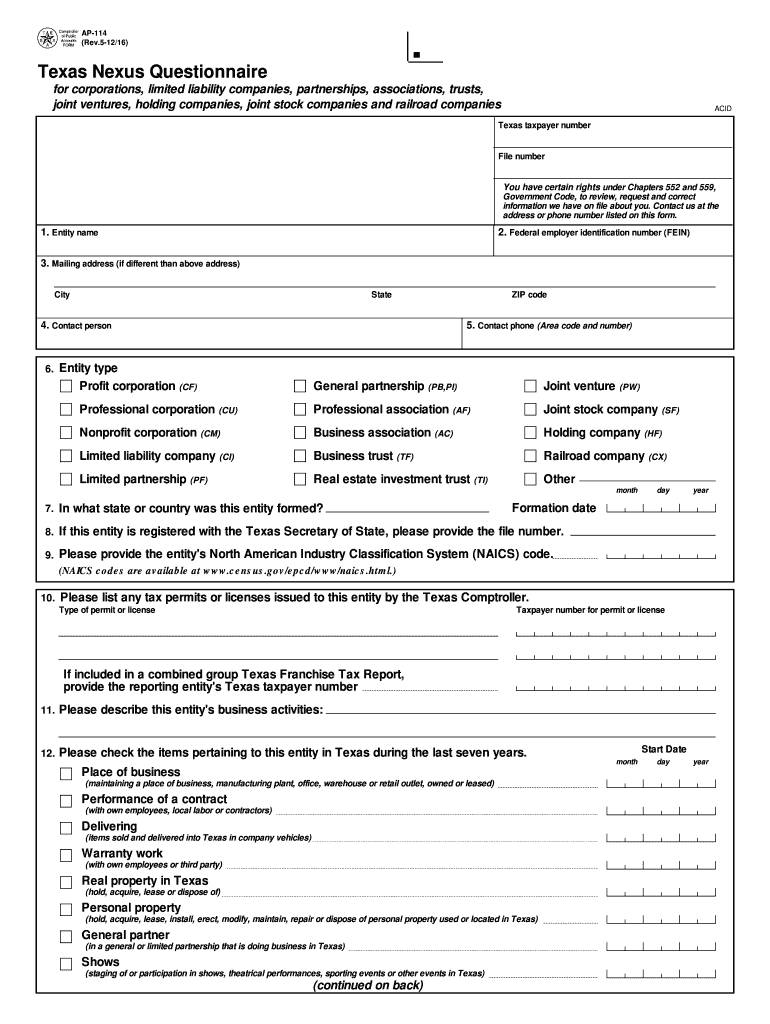

AP-114 Rev.5-12/16 PRINT FORM CLEAR FIELDS Texas Nexus Questionnaire for corporations limited liability companies partnerships associations trusts joint ventures holding companies joint stock companies and railroad companies ACID Texas taxpayer number File number You have certain rights under Chapters 552 and 559 Government Code to review request and correct information we have on file about you. Place of business maintaining a place of business manufacturing plant office warehouse or retail...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller AP-114

Edit your TX Comptroller AP-114 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller AP-114 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX Comptroller AP-114 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX Comptroller AP-114. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller AP-114 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller AP-114

How to fill out TX Comptroller AP-114

01

Begin by downloading the TX Comptroller AP-114 form from the official website.

02

Fill in your business name and address at the top of the form.

03

Enter your Texas tax ID number in the designated field.

04

Provide the name and contact information of the person completing the form.

05

Specify the type of payment being reported (e.g., sales tax, franchise tax).

06

List the amounts being reported for each applicable category.

07

Ensure that all calculations are accurate and totals are provided.

08

Sign and date the form at the bottom to certify the information is correct.

09

Submit the completed form via the method indicated on the form, such as by mail or electronically.

Who needs TX Comptroller AP-114?

01

Businesses operating in Texas that need to report certain tax information.

02

Individuals or entities required to file for tax exemptions or refunds.

03

Tax professionals assisting clients with their Texas tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

Who Must File Texas PIR?

Information Reports: Corporations, LLCs, Limited Partnerships, Professional Associations and financial institutions must file the Public Information Report (PIR). All other entity types must file the Ownership Information Report (OIR).

How much does it cost to file an annual report in Texas?

The filing fee for form 802 is $5. Important Information: The Public Information Report is filed along with the annual franchise tax with the Texas Comptroller of Public Accounts. No additional filings are required by the Texas Secretary of State.

Can I file Form 05-102 online?

No, Form 05-102 can only be e-filed as part of the Texas Franchise Tax return. If separate filing is desired, the form must be paper filed with the taxing authority.

Do I need to file a Texas franchise tax report?

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

How to fill out a Texas franchise tax no tax due report?

1:58 4:50 No tax due information report return select the radio button next to the file no text dueMoreNo tax due information report return select the radio button next to the file no text due information report and select continue. Now select the report year for which you are filing.

How do I file a franchise tax report in Texas?

How to File Your Texas Franchise Tax Report Determine your due date and filing fees. Complete the report online OR download a paper form. (Paper forms not allowed for No Tax Due Information Report.) Submit your report to the Texas Comptroller of Public Accounts.

Who is required to file a Texas franchise tax return?

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

Who must file a Texas no tax due report?

The no tax due threshold is as follows: $1,230,000 for reports due in 2022-2023.

What is a public information report in Texas?

The Public Information Report (“PIR”) and Ownership Information Report (“OIR”) – which are separate from the various Texas franchise tax return forms – provide basic information about a Texas entity including the entity's address and governing authority and must be filed with the Texas Comptroller annually, typically

What is the extended due date for Texas franchise tax return?

(AUSTIN) — In response to the recent winter storm and power outages in the state, Texas Comptroller Glenn Hegar announced today that his agency is automatically extending the due date for 2021 franchise tax reports from May 15 to June 15.

What is the threshold for filing Texas franchise tax?

Tax Rates, Thresholds and Deduction Limits ItemAmountNo Tax Due Threshold$1,230,000Tax Rate (retail or wholesale)0.375%Tax Rate (other than retail or wholesale)0.75%Compensation Deduction Limit$400,0002 more rows

What is the Texas franchise tax no tax due threshold?

Tax Rates, Thresholds and Deduction Limits ItemAmountNo Tax Due Threshold$1,080,000Tax Rate (retail or wholesale)0.475%Tax Rate (other than retail or wholesale)0.95%Compensation Deduction Limit$350,0002 more rows

What is the due date for Texas franchise tax return 2022?

An EFT payor may extend the filing date from May 16, 2022, to Aug. 15, 2022 by timely making an extension payment electronically using TEXNET (tax type code 13080 Franchise Tax Extension) or Webfile.

How do I file an extension on my taxes in Texas?

You can file an extension for your taxes by submitting Form 4868 with the IRS online or by mail. This must be done before the last day for filing taxes.

How do I file an extension for Texas franchise tax?

Use franchise tax Webfile or file Form 05-164, Texas Franchise Tax Extension Request, along with the appropriate payment, on or before the original due date of the report. The extension payment must be at least 90 percent of the tax that will be due with the report filed on or before Nov.

Who has to file a Texas franchise tax report?

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

Do Texans have to file an extension for taxes?

You do not need to file an extension to take advantage of the later filing date -- the extension is granted automatically based on your residency and no paperwork is required.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send TX Comptroller AP-114 to be eSigned by others?

To distribute your TX Comptroller AP-114, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute TX Comptroller AP-114 online?

Easy online TX Comptroller AP-114 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I fill out TX Comptroller AP-114 on an Android device?

Complete TX Comptroller AP-114 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is TX Comptroller AP-114?

TX Comptroller AP-114 is a form used for reporting and remitting sales and use taxes in the state of Texas.

Who is required to file TX Comptroller AP-114?

Businesses and individuals who sell taxable goods or services in Texas are required to file the TX Comptroller AP-114.

How to fill out TX Comptroller AP-114?

To fill out TX Comptroller AP-114, you need to provide business information, report total sales, calculate local and state tax due, and make any applicable deductions.

What is the purpose of TX Comptroller AP-114?

The purpose of TX Comptroller AP-114 is to ensure compliance with Texas tax laws by reporting sales and use taxes collected from customers.

What information must be reported on TX Comptroller AP-114?

The information reported on TX Comptroller AP-114 includes sales made, exemptions, deductions taken, and the total amount of taxes collected.

Fill out your TX Comptroller AP-114 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller AP-114 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.