Get the free Accounting Guide for Nonprofit Organizations

Show details

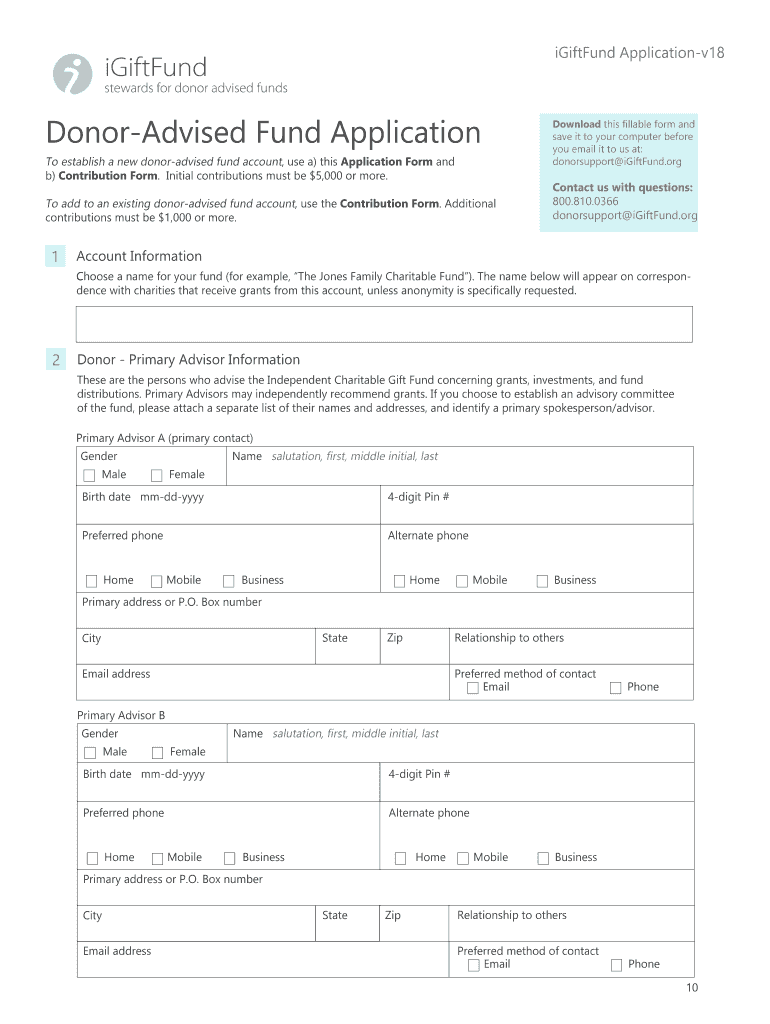

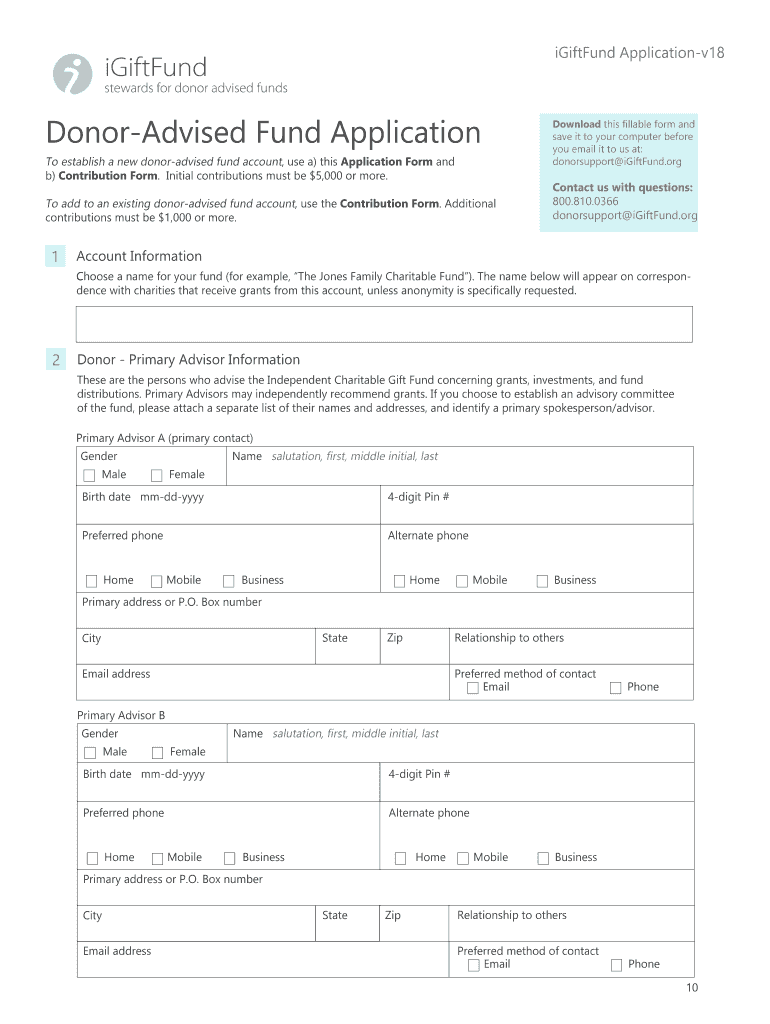

Program Description & Guidelines This booklet describes the program and guidelines of the Independent Charitable Gift Fund, and governs the operation of our donor advised funds. Table of Contents

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounting guide for nonprofit

Edit your accounting guide for nonprofit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounting guide for nonprofit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accounting guide for nonprofit online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit accounting guide for nonprofit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounting guide for nonprofit

How to fill out accounting guide for nonprofit

01

Step 1: Gather all the necessary financial documents and records for your nonprofit organization, such as bank statements, invoices, receipts, and expense reports.

02

Step 2: Familiarize yourself with the accounting principles and guidelines specific to nonprofit organizations. This includes understanding concepts such as fund accounting, restricted funds, and financial accountability.

03

Step 3: Create a chart of accounts tailored to your nonprofit's specific needs. This will help you categorize and track income and expenses accurately.

04

Step 4: Record all financial transactions in a general journal or accounting software. Be sure to include the date, description, and amount of each transaction.

05

Step 5: Use double-entry bookkeeping to ensure accuracy and maintain a balanced financial system. This means recording both a debit and credit for each transaction.

06

Step 6: Reconcile your bank statements with your accounting records regularly to identify and correct any discrepancies.

07

Step 7: Prepare financial statements such as the Statement of Financial Position (Balance Sheet) and Statement of Activities (Income Statement) to provide an overview of your nonprofit's financial performance.

08

Step 8: Review and analyze your financial statements to identify any areas of concern or improvement. This can help inform financial decision-making and budgeting.

09

Step 9: Maintain proper documentation and file all financial records securely for future reference and auditing purposes.

10

Step 10: Seek professional assistance if needed. If you are unsure about certain accounting procedures or facing complex financial situations, consider consulting with an accountant or nonprofit financial advisor.

Who needs accounting guide for nonprofit?

01

Nonprofit organizations of all sizes and types can benefit from an accounting guide specifically tailored to their needs.

02

Board members and executive directors of nonprofits often require an accounting guide to ensure proper financial management and compliance with legal and regulatory requirements.

03

Accountants and bookkeepers working for nonprofit organizations may also refer to an accounting guide for guidance and best practices in recording, reporting, and analyzing financial information.

04

Donors and grantors who support nonprofit organizations may request or require financial reports prepared in accordance with a standardized accounting guide.

05

Auditors and regulatory authorities may refer to an accounting guide when auditing nonprofit organizations to assess financial transparency and compliance.

06

Volunteers and staff members involved in financial management or budgeting processes within a nonprofit organization can benefit from an accounting guide to enhance their understanding of nonprofit accounting principles.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute accounting guide for nonprofit online?

pdfFiller makes it easy to finish and sign accounting guide for nonprofit online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for the accounting guide for nonprofit in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your accounting guide for nonprofit in seconds.

Can I create an eSignature for the accounting guide for nonprofit in Gmail?

Create your eSignature using pdfFiller and then eSign your accounting guide for nonprofit immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is accounting guide for nonprofit?

The accounting guide for nonprofit is a set of guidelines and standards that non profit organizations follow to properly manage their financial transactions and reporting.

Who is required to file accounting guide for nonprofit?

Nonprofit organizations are required to file accounting guide in order to ensure transparency and accountability in their financial operations.

How to fill out accounting guide for nonprofit?

To fill out an accounting guide for nonprofit, organizations need to accurately record all financial transactions, prepare financial statements, and ensure compliance with regulatory requirements.

What is the purpose of accounting guide for nonprofit?

The purpose of accounting guide for nonprofit is to provide a framework for proper financial management, transparency, and accountability within nonprofit organizations.

What information must be reported on accounting guide for nonprofit?

Information such as income, expenses, assets, liabilities, and net assets must be reported on the accounting guide for nonprofit.

Fill out your accounting guide for nonprofit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounting Guide For Nonprofit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.