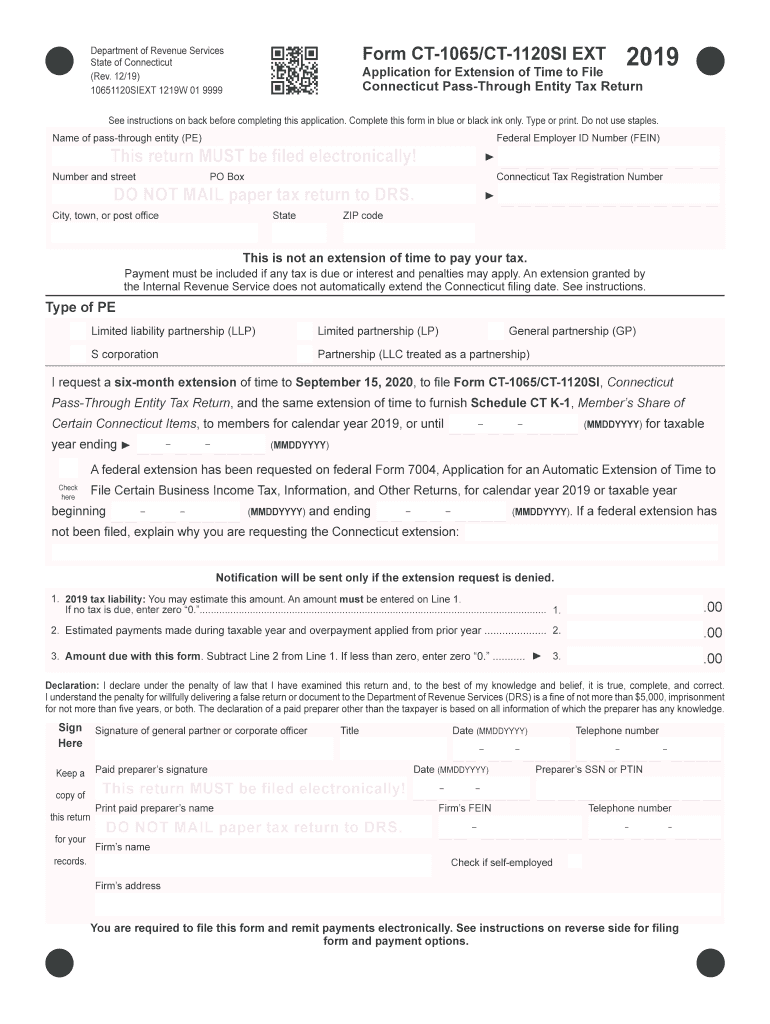

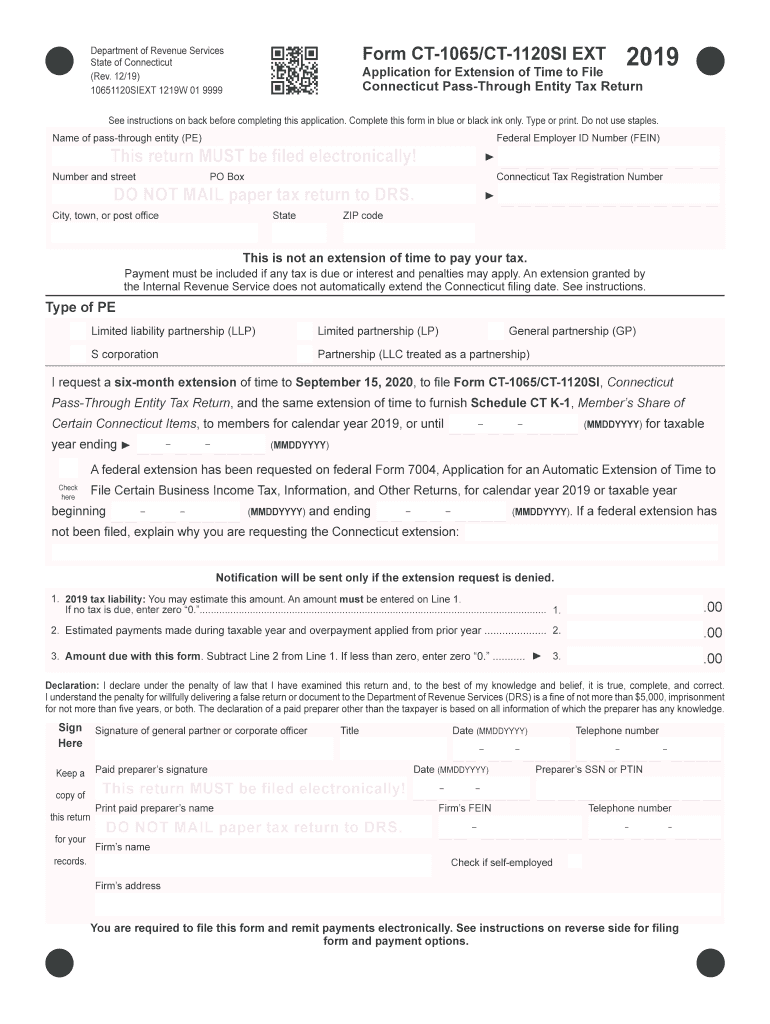

CT DRS CT-1065/CT-1120SI EXT 2019 free printable template

Get, Create, Make and Sign CT DRS CT-1065CT-1120SI EXT

How to edit CT DRS CT-1065CT-1120SI EXT online

Uncompromising security for your PDF editing and eSignature needs

CT DRS CT-1065/CT-1120SI EXT Form Versions

How to fill out CT DRS CT-1065CT-1120SI EXT

How to fill out CT DRS CT-1065/CT-1120SI EXT

Who needs CT DRS CT-1065/CT-1120SI EXT?

Instructions and Help about CT DRS CT-1065CT-1120SI EXT

Hi, this is Evan Hutches on CPA. I do virtual accounting for individuals and small businesses including helping people file their taxes online through screen sharing. If you're in the minority of wanting to file your own taxes or perhaps just don't want to give away your information like your social, are your bank accounts due to the fear of identity theft, I'm here to help. Through screen sharing I can guide you along the complexities are your tax return from start to finish. Now, when I want to do today is show you the S corporation tax return, it's form 1120S. I'm going to guide you through this, how to input the numbers, what the return looks like, what you need to do. One of the things I'm going to do is show you the financials, how to transfer financials from QuickBooks, or another financial system, to the tax return. But first I'm going to just run through really quickly the return itself. You know of course there's a lot of pages involved behind the 1120S, but the form itself is about five pages long. The first page has just some general info: your name, your E.I.N. The date that you formed the S Corporation and so forth. That's the top of it. Then you get to the income portion, and then the deduction portion. Now the deduction has a lot of the main expenses like compensation of officers, rents, taxes, depreciation, and so forth. And then you have another deduction worksheet that just has some less common expenses, but they're still fairly common. Like accounting bank charges dues and subscriptions and so forth. Now, you add up these other deductions with the current deductions, you get total deductions of $281,000...or no, sorry, $484,000. Which, you subtract that from your income, and you come up with their net income: $6,636. Then you scroll on down, and you get to a lot of questions they ask. They ask your accounting method, your business activity. If anyone owns 20 percent or more, or if a corporation owns 20 percent or if anyone owns 50 percent or more. If you filed 1099s and so forth. Then you get to page three. This is a Schedule K. this is, the schedule K transfers over to the K-1. The k-1 is what you used to file your personal taxes. So after you file your S corp, same thing for a partnership, if you filed a 1065, your income and some other information is going to move over to the Schedule K, which transfers to a K1 right here. And you'll print this out or send this to your CPA or whatever to input this on your personal tax return. So that's this part right here. Then you get down to the balance sheets, which is, this won't affect your taxes at all. This is just kinda your bookkeeping balance sheets. It helps you...if you earn less than $250,000, or you have less than $250,000 of assets, you don't necessarily have to file this. I like to do it anyways because it just helps me kind of reconcile everything together. But this is your balance sheet, you're beginning of the year, so that's pretty much last year's balance sheet...

People Also Ask about

Is the CT PTE credit refundable?

How much is CT pass-through entity tax?

How do I file a CT pass-through entity tax?

What is CT 1065 CT 1120SI?

How do I pay my pass-through tax?

Is CT car tax deductible?

How does the CT pass-through entity tax work?

Is Connecticut pass-through entity tax deductible?

Does Connecticut allow composite returns?

What is a composite tax return?

Does a pass-through entity have to file a tax return?

Which states allow composite returns?

What is a Connecticut pass-through entity?

Do I qualify for pass-through tax deduction?

What is Form CT 1120SI?

Do pass-through entities have to file tax returns?

Is CT pass-through entity tax deductible?

Who must file a CT 1065?

What is a CT 1065?

Does CT allow credit for taxes paid to other states?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CT DRS CT-1065CT-1120SI EXT to be eSigned by others?

Where do I find CT DRS CT-1065CT-1120SI EXT?

How do I make edits in CT DRS CT-1065CT-1120SI EXT without leaving Chrome?

What is CT DRS CT-1065/CT-1120SI EXT?

Who is required to file CT DRS CT-1065/CT-1120SI EXT?

How to fill out CT DRS CT-1065/CT-1120SI EXT?

What is the purpose of CT DRS CT-1065/CT-1120SI EXT?

What information must be reported on CT DRS CT-1065/CT-1120SI EXT?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.