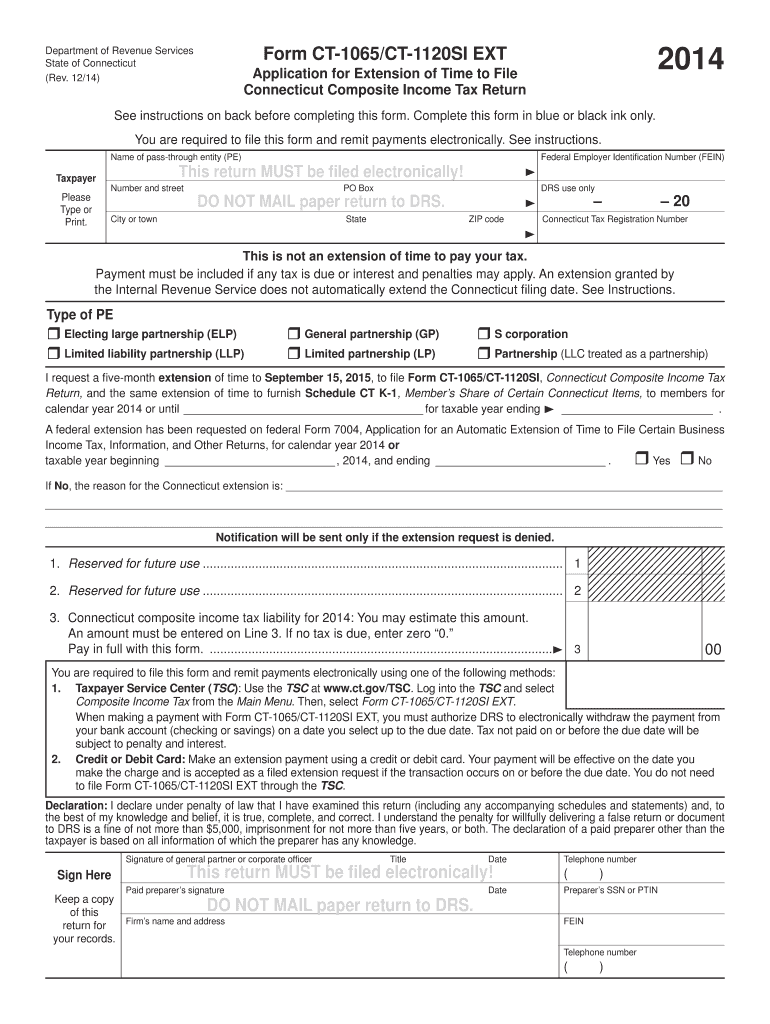

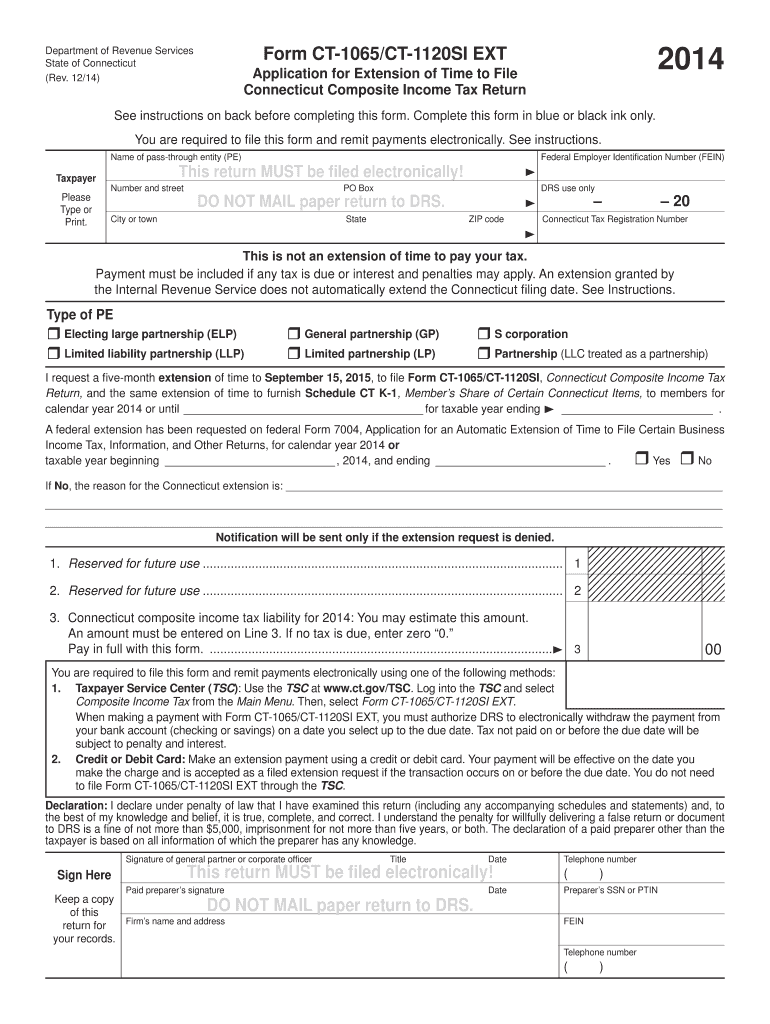

CT DRS CT-1065/CT-1120SI EXT 2014 free printable template

Show details

To DRS is a fine of not more than $5,000, imprisonment for not more than five years, or both. The declaration of a paid ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-1065CT-1120SI EXT

Edit your CT DRS CT-1065CT-1120SI EXT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-1065CT-1120SI EXT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT DRS CT-1065CT-1120SI EXT online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CT DRS CT-1065CT-1120SI EXT. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-1065/CT-1120SI EXT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS CT-1065CT-1120SI EXT

How to fill out CT DRS CT-1065/CT-1120SI EXT

01

Download the CT DRS CT-1065/CT-1120SI EXT form from the Connecticut Department of Revenue Services website.

02

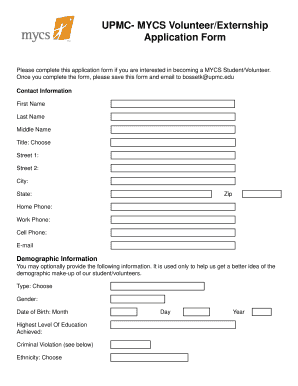

Fill in the taxpayer information including name, address, and identification number.

03

Indicate the type of return you are filing (CT-1065 for partnerships or CT-1120SI for S corporations).

04

Provide the relevant tax year for which you are applying for an extension.

05

Calculate the amount of tax due or the estimated payment based on your business's financial information.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form before the tax filing deadline either electronically or by mail to the appropriate address.

Who needs CT DRS CT-1065/CT-1120SI EXT?

01

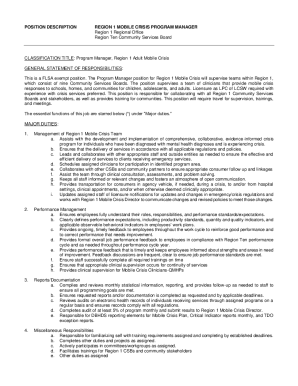

Taxpayers who operate partnerships or S corporations in Connecticut and need additional time to file their tax returns.

02

Businesses that may require more time to prepare their financial statements or gather necessary documentation for accurate tax filing.

Fill

form

: Try Risk Free

People Also Ask about

Is the CT PTE credit refundable?

100% of the tax paid is reported as a refundable credit to PTE members. Elections are due as of the due date of the return (the 15th day of the third month), and estimates are due throughout the year.

How much is CT pass-through entity tax?

Connecticut (CT PET) – Not elective. PTE pays 6.99% of CT source income. Estimated tax is due throughout the year, and the credit is reported on the partners' K-1s. If the credit is reported to another PTE, it passes through to the owners.

How do I file a CT pass-through entity tax?

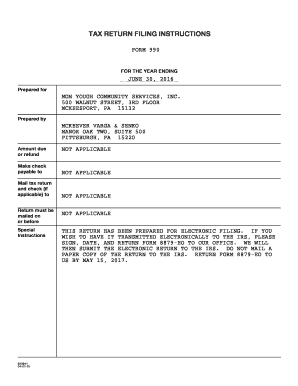

Payments and Form CT-1065/CT-1120SI may be filed through the Taxpayer Service Center (TSC). You may also file electronically by using third party software. If you cannot file and/or pay electronically, you should request a waiver by filing Form DRS-EWVR.

What is CT 1065 CT 1120SI?

Use Form CT-1065/CT-1120SI EXT, Application for Extension of Time to File Connecticut Pass-Through Entity Tax Return, to request a six-month extension of time to file Form CT-1065/CT-1120SI, Connecticut Pass-Through Entity Tax Return, and the same six-month extension of time to furnish Schedule CT K-1, Member's Share

How do I pay my pass-through tax?

The PTE elective tax payment can be made electronically using Web Pay on FTB's website. Entities can use Web Pay to pay for free and to ensure the payment is timely credited to their account.

Is CT car tax deductible?

Personal Property Taxes – You can deduct any personal property taxes that are paid on items such as automobiles or boats as long as the taxes are imposed annually and based on the value of the asset.

How does the CT pass-through entity tax work?

The law imposes a 6.99 percent tax on partnerships, LLCs, and S corporations. The tax is imposed on either the entity's entire Connecticut-sourced taxable income or an alternative tax base, which reduces taxable income by the percentage of nonresident ownership.

Is Connecticut pass-through entity tax deductible?

The net effect of the PET is that each owner of a pass-through entity may deduct for federal income tax purposes substantially all of the Connecticut income tax which would have been payable by the owner prior to the enactment of the PET and which is now being paid by the pass-through entity.

Does Connecticut allow composite returns?

DRS accepts Composite Income Tax returns through the MeF Program.

What is a composite tax return?

Composite return overview Simply stated, a composite return is filed by a pass-through entity and reports the state income of all non-resident owners as one group. If a non-resident owner participates in a composite return, that non-resident is not required to file an individual income tax return.

Does a pass-through entity have to file a tax return?

Each pass-through entity owner reports and pays tax on their share of business income on personal tax Form 1040.

Which states allow composite returns?

State Involvement States that do allow composite returns include: Alabama, Connecticut, Delaware, Idaho, Wisconsin, South Carolina, Massachusetts, Michigan, North Dakota, New Hampshire, Tennessee, Texas, Nebraska, Oklahoma, Utah, Arizona, New York and Vermont, as well as the District of Columbia.

What is a Connecticut pass-through entity?

Connecticut's new pass-through entity tax or PET requires pass-through entities to pay tax at the entity level and provides an offsetting credit against individual income and corporate taxes.

Do I qualify for pass-through tax deduction?

A business owner must have positive taxable income to qualify for a pass-through deduction. Calculating the total taxable income for a year involves taking all of an individual's taxable income from all sources, including sources other than the business, and then subtracting deductions.

What is Form CT 1120SI?

Connecticut uses Form CT-1065/CT-1120SI to prepare a composite return for partners. Before a CT-1065/CT-1120SI can be generated, a partner that is qualified to be included must be set up in federal Basic Partner Data.

Do pass-through entities have to file tax returns?

Pass-through businesses are not subject to the corporate income tax, but instead report their income on the individual income tax returns of owners.

Is CT pass-through entity tax deductible?

The net effect of the PET is that each owner of a pass-through entity may deduct for federal income tax purposes substantially all of the Connecticut income tax which would have been payable by the owner prior to the enactment of the PET and which is now being paid by the pass-through entity.

Who must file a CT 1065?

Every PE that does business in Connecticut or has income derived from or connected with sources within Connecticut must file Form CT‑1065/CT‑1120SI regardless of the amount of its income or loss.

What is a CT 1065?

Taxpayers completing a paper Form CT-1065/ CT-1120SI, Connecticut Composite Income Tax Return, are required to attach a copy of completed federal Form 1065, U.S. Return of Partnership Income, or federal Form 1120S, U.S. Income Tax Return for an S Corporation.

Does CT allow credit for taxes paid to other states?

Returns to be Filed in Connecticut and in the Other State The Connecticut resident will receive credit from Connecticut for income tax paid to the other state on income earned for services performed in the other state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out CT DRS CT-1065CT-1120SI EXT using my mobile device?

Use the pdfFiller mobile app to fill out and sign CT DRS CT-1065CT-1120SI EXT on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete CT DRS CT-1065CT-1120SI EXT on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your CT DRS CT-1065CT-1120SI EXT. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I complete CT DRS CT-1065CT-1120SI EXT on an Android device?

Use the pdfFiller app for Android to finish your CT DRS CT-1065CT-1120SI EXT. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is CT DRS CT-1065/CT-1120SI EXT?

CT DRS CT-1065/CT-1120SI EXT is an extension form used for filing partnerships and S corporations in Connecticut, allowing them to extend the time for filing their state income tax return.

Who is required to file CT DRS CT-1065/CT-1120SI EXT?

Partnerships and S corporations operating in Connecticut that need additional time to file their state tax returns are required to file CT DRS CT-1065/CT-1120SI EXT.

How to fill out CT DRS CT-1065/CT-1120SI EXT?

To fill out CT DRS CT-1065/CT-1120SI EXT, taxpayers must provide their business information, including the name, address, federal ID number, and indicate the type of entity. They also need to specify the extension period requested.

What is the purpose of CT DRS CT-1065/CT-1120SI EXT?

The purpose of CT DRS CT-1065/CT-1120SI EXT is to grant partnerships and S corporations an extension of time to file their income tax returns without incurring penalties for late submission.

What information must be reported on CT DRS CT-1065/CT-1120SI EXT?

CT DRS CT-1065/CT-1120SI EXT must report the entity's name, address, federal identification number, the type of entity, and the period for which the extension is requested.

Fill out your CT DRS CT-1065CT-1120SI EXT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-1065ct-1120si EXT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.