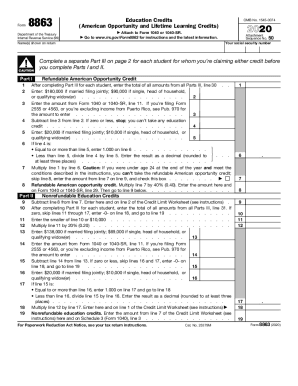

IRS Instruction 8863 2019 free printable template

Show details

Instructions for Form 8863 Department of the Treasury Internal Revenue Service Education Credits American Opportunity and Lifetime Learning Credits General Instructions Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Form 8863 and its instructions such as legislation enacted after they were published go to IRS.gov/Form8863. What s New Limits on modified adjusted gross income MAGI. The...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instruction 8863

Edit your IRS Instruction 8863 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instruction 8863 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Instruction 8863 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS Instruction 8863. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instruction 8863 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instruction 8863

How to fill out IRS Instruction 8863

01

Gather necessary documents: Collect Form 1040, qualifying education expenses, and your Form 1098-T.

02

Ensure you are eligible: Confirm that you or your dependents meet eligibility requirements for educational credits.

03

Complete Part I: Fill out your personal information, including your name, Social Security number, and the tax year.

04

Enter qualifying expenses: Record tuition and related expenses paid during the tax year in Part II.

05

Claim the American Opportunity Credit or Lifetime Learning Credit: Determine which credit you qualify for and complete the corresponding sections.

06

Calculate the credits: Follow the provided instructions to calculate the appropriate credit amounts based on your expenses.

07

Review your entries: Double-check all information for accuracy and completeness.

08

Submit the form: Attach Form 8863 to your tax return and file it with the IRS.

Who needs IRS Instruction 8863?

01

Individuals who are eligible for education credits related to qualified higher education expenses for themselves or their dependents.

02

Taxpayers claiming the American Opportunity Credit or Lifetime Learning Credit on their tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What is the income limit for 8863?

Limits on modified adjusted gross income (MAGI). The lifetime learning credit and the American opportunity credit MAGI limits are $180,000 if you're married filing jointly ($90,000 if you're filing single, head of household, or qualifying surviving spouse). See Table 1 and the instructions for line 3 or line 14.

Who should fill out Form 8863?

If you plan on claiming one of the IRS educational tax credits, be sure to fill out a Form 8863 and attach it to your tax return. These credits can provide a dollar-for-dollar reduction in the amount of tax you owe at the end of the year for the costs you incur to attend school.

What is Form 8862 used for?

Taxpayers complete Form 8862 and attach it to their tax return if: Their earned income credit (EIC), child tax credit (CTC)/additional child tax credit (ACTC), credit for other dependents (ODC) or American opportunity credit (AOTC) was reduced or disallowed for any reason other than a math or clerical error.

What is the education credit for 2019?

It is a tax credit of up to $2,500 of the cost of tuition, certain required fees and course materials needed for attendance and paid during the tax year. Also, 40 percent of the credit for which you qualify that is more than the tax you owe (up to $1,000) can be refunded to you.

What are qualified education expenses?

Qualified expenses are amounts paid for tuition, fees and other related expense for an eligible student that are required for enrollment or attendance at an eligible educational institution. You must pay the expenses for an academic period* that starts during the tax year or the first three months of the next tax year.

What is the tax form 8863 for 2019?

Purpose of Form Use Form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). For 2019, there are two education credits. refundable. The lifetime learning credit, which is nonrefundable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete IRS Instruction 8863 online?

Completing and signing IRS Instruction 8863 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit IRS Instruction 8863 in Chrome?

IRS Instruction 8863 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out IRS Instruction 8863 using my mobile device?

Use the pdfFiller mobile app to fill out and sign IRS Instruction 8863 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is IRS Instruction 8863?

IRS Instruction 8863 provides guidance on claiming education credits, specifically the American Opportunity Credit and the Lifetime Learning Credit, which help taxpayers offset the costs of higher education.

Who is required to file IRS Instruction 8863?

Taxpayers who are eligible to claim education credits for themselves, their dependents, or qualifying individuals must file IRS Instruction 8863 along with their tax return.

How to fill out IRS Instruction 8863?

To fill out IRS Instruction 8863, taxpayers must gather information about qualified education expenses, complete the appropriate sections for the American Opportunity and/or Lifetime Learning credits, and provide necessary identification details for the student.

What is the purpose of IRS Instruction 8863?

The purpose of IRS Instruction 8863 is to instruct taxpayers on how to properly claim educational tax credits to reduce their tax liability based on tuition and related expenses.

What information must be reported on IRS Instruction 8863?

Taxpayers must report information including the name and Social Security number of the student, the qualified education expenses paid, details about the eligible educational institution, and the amount of any grants or scholarships received.

Fill out your IRS Instruction 8863 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instruction 8863 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.