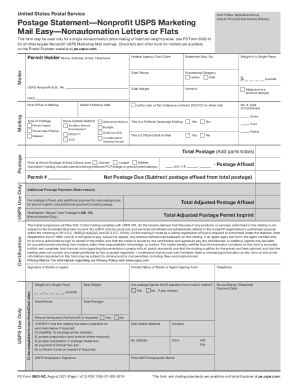

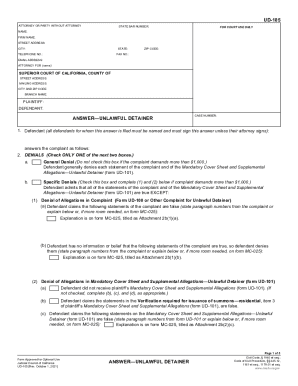

TX Comptroller 50-283 2019 free printable template

Get, Create, Make and Sign TX Comptroller 50-283

Editing TX Comptroller 50-283 online

Uncompromising security for your PDF editing and eSignature needs

TX Comptroller 50-283 Form Versions

How to fill out TX Comptroller 50-283

How to fill out TX Comptroller 50-283

Who needs TX Comptroller 50-283?

Instructions and Help about TX Comptroller 50-283

I'm Octavia I work out of the San Antonio office My name is Daniel I've been with the Comptroller for two and a half years now My name is Laura I work at the Austin Audit office I'm Terrence, and I've been with the Comptroller for eight years My favorite thing about the job is the fact that I get to go to a new office every week I love how family-oriented it feels I love how you get full holidays I love a lot about the Comptrollers' office I think its just one of the perfect jobs out of college My favorite thing about my job I'm not looking at the same spreadsheet over and over I'm not looking at the same tab-returnIm interacting with people Today I might be doing a regular retailer Tomorrow Doing a contractor And it might be the next day I'm doing oil and gas or hotel Sits never boring I've always wanted to work for the state government Because I've heard about the flexible schedules, and you've got that nice work-life balance It allows you the time to reflect and have a stress-free life I feel like my career here at the Comptrollers one with a lot more flexibility And each day were doing things that aren't the same You're not in a rut It keeps your mind sharp And just general activities that you know just the function of doing your job, but there's always something that's mentally stimulating I'm continually surprised by the Comptrollers office and the amount of fun that I'm having This is a great job to have

People Also Ask about

Do senior citizens in Texas have to pay property taxes?

Are Texas property taxes based on market value or appraised value?

What is Section 23.23 of the Texas property tax code?

Is there a limit on how much property taxes can increase in Texas?

At what age can you stop paying property taxes in Texas?

Do over 65 pay property taxes in Texas?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit TX Comptroller 50-283 from Google Drive?

Can I sign the TX Comptroller 50-283 electronically in Chrome?

How can I fill out TX Comptroller 50-283 on an iOS device?

What is TX Comptroller 50-283?

Who is required to file TX Comptroller 50-283?

How to fill out TX Comptroller 50-283?

What is the purpose of TX Comptroller 50-283?

What information must be reported on TX Comptroller 50-283?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.