TX Comptroller 50-283 2018 free printable template

Show details

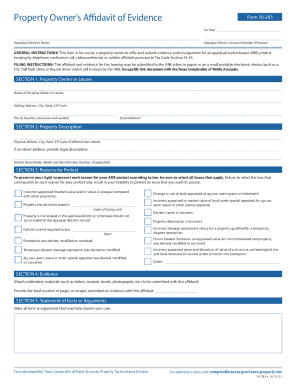

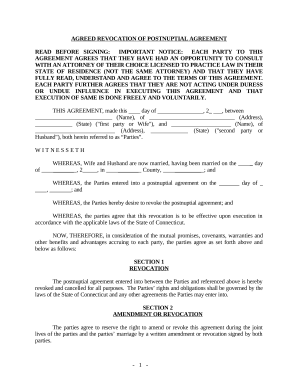

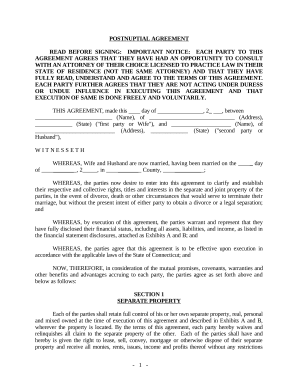

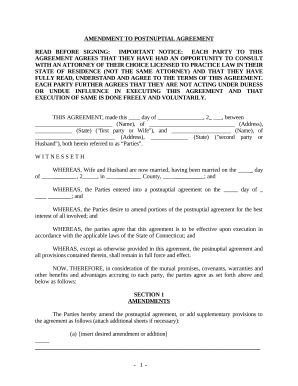

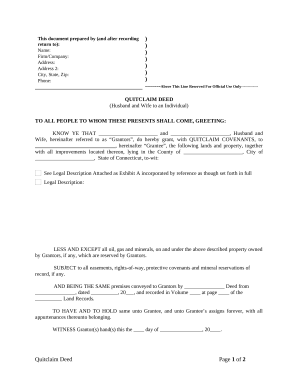

Property Owners Affidavit of EvidenceForm 50283 Appraisal Districts Reappraisal District Account Number (if known)State the tax year(s) for which this protest is filed: GENERAL INSTRUCTIONS: This

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 50-283

Edit your TX Comptroller 50-283 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 50-283 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller 50-283 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit TX Comptroller 50-283. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-283 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 50-283

How to fill out TX Comptroller 50-283

01

Start by downloading the TX Comptroller Form 50-283 from the official Texas Comptroller website.

02

Fill out the top section with the name of the property owner and the address of the property.

03

Provide the type of exemption being applied for in the appropriate section.

04

Include the legal description of the property as indicated, making sure to be as specific as possible.

05

Enter the relevant account number assigned by the appraisal district.

06

Complete the questionnaire sections, providing all requested information truthfully.

07

Sign and date the form.

08

Submit the completed form to your local appraisal district office by the deadline specified.

Who needs TX Comptroller 50-283?

01

Individuals or entities who own property in Texas and are seeking a property tax exemption should fill out TX Comptroller 50-283.

Fill

form

: Try Risk Free

People Also Ask about

How much can property tax increase in Texas?

Texas Property Tax Code Sec 23.23 limits increases of the total assessed value (assessed value = market value minus any exemption value minus current year cap value), to 10% from year to year if the property is under homestead exemption. This 10% increase excludes any new improvements added by the property owner.

At what age can you stop paying property taxes in Texas?

Property Tax and Appraisals The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

What is a personal property tax rendition in Texas?

Rendition Requirements A person or business who owns tangible personal property with an aggregate value of $20,000 or more is required to file a rendition statement. The rendition is to be filed with the county appraisal district where the property is located.

How do I get my property tax statement in Texas?

You can find out how much your current taxes are and make your payment by going to the Property Tax Account Lookup application or you may request a statement by calling us at 972-547-5020 during business hours. You may also fax us at 972-547-5053 with your name, phone number, and question.

What is the 10 percent property tax rule in Texas?

The appraised home value for a homeowner who qualifies his or her homestead for exemptions in the preceding and current year may not increase more than 10 percent per year.

How can I reduce my property taxes in Texas?

The steps below will show you how to lower property taxes in Texas, so you can move forward with your appeal. File a notice of protest. Prepare information for hearing. Attend an informal hearing at the Appraisal District office. Attend an Appraisal Review Board hearing. Appeal through district court or arbitration.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in TX Comptroller 50-283?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your TX Comptroller 50-283 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I make edits in TX Comptroller 50-283 without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing TX Comptroller 50-283 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I edit TX Comptroller 50-283 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing TX Comptroller 50-283 right away.

What is TX Comptroller 50-283?

TX Comptroller 50-283 is a form used in the state of Texas for property owners to apply for exemptions or report certain information related to property taxes.

Who is required to file TX Comptroller 50-283?

Property owners who are seeking tax exemptions or who need to report relevant information regarding their property tax status are required to file TX Comptroller 50-283.

How to fill out TX Comptroller 50-283?

To fill out TX Comptroller 50-283, you must provide accurate property information, including owner details, property location, and the reason for exemption or report. Follow the instructions on the form carefully.

What is the purpose of TX Comptroller 50-283?

The purpose of TX Comptroller 50-283 is to facilitate the application for property tax exemptions or to report relevant property tax information to ensure compliance with Texas tax regulations.

What information must be reported on TX Comptroller 50-283?

Information that must be reported on TX Comptroller 50-283 includes the property owner's name, property address, exemption type, and any additional details specific to the exemption or report being filed.

Fill out your TX Comptroller 50-283 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 50-283 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.