Get the free Savings Tools lesson plan 2.4 - RCAS - public rcas

Show details

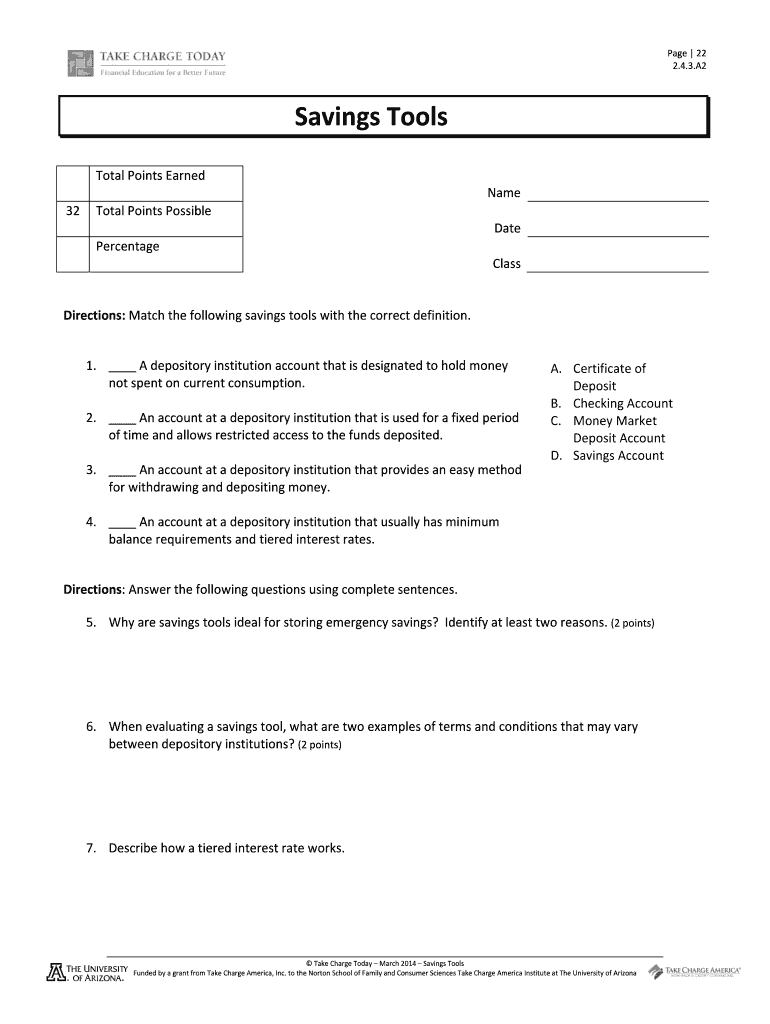

Page 22 2.4.3. A2SavingsTools TotalPointsEarned 32 TotalPointsPossible Name DatePercentage Class Directions:Matchthefollowingsavingstoolswiththecorrectdefinition. 1. Adepositoryinstitutionaccountthatisdesignatedtoholdmoney

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign savings tools lesson plan

Edit your savings tools lesson plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your savings tools lesson plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit savings tools lesson plan online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit savings tools lesson plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out savings tools lesson plan

How to fill out savings tools lesson plan

01

Start by determining the main objective of the savings tools lesson plan. What specific skills or knowledge do you want the students to gain?

02

Divide the lesson plan into different sections, such as introduction, instructional activities, practice exercises, and evaluation.

03

Begin the lesson plan with an engaging introduction that highlights the importance of saving money and the benefits of using savings tools.

04

Provide clear instructions and step-by-step guidance on how to fill out savings tools, such as budget spreadsheets, savings calculators, or financial planning apps.

05

Include interactive activities to actively involve the students in the learning process, such as group discussions, role-plays, or case studies.

06

Offer practical examples and real-life scenarios to help students understand the practical application of savings tools.

07

Provide opportunities for hands-on practice where students can apply their knowledge and skills in completing different savings tools.

08

Incorporate visual aids, such as charts, graphs, or infographics, to enhance understanding and make the lesson plan more visually appealing.

09

Wrap up the lesson plan with a summary of key points and reinforce the importance of utilizing savings tools for financial stability and achieving financial goals.

10

Evaluate the effectiveness of the lesson plan by conducting assessments or quizzes to measure the students' comprehension and retention of the concepts.

11

Make any necessary adjustments or improvements to the lesson plan based on the feedback and results of the evaluation.

Who needs savings tools lesson plan?

01

Students who are learning about personal finance and want to develop essential money management skills.

02

Individuals who have just started their careers and want to establish good saving habits and financial stability.

03

Young adults who are planning for major life events, such as buying a house, starting a family, or pursuing higher education.

04

People who want to improve their understanding of different savings tools available in the market and make informed decisions.

05

Educational institutions, such as schools, colleges, or universities, that incorporate financial literacy into their curriculum.

06

Financial literacy programs or organizations that aim to educate individuals about the importance of saving and making smart financial choices.

07

Employers or human resources departments that offer financial wellness programs to their employees.

08

Anyone who wants to enhance their financial literacy and gain practical knowledge on using savings tools to achieve their financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my savings tools lesson plan directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your savings tools lesson plan and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I modify savings tools lesson plan without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including savings tools lesson plan, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I fill out savings tools lesson plan on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your savings tools lesson plan. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is savings tools lesson plan?

Savings tools lesson plan is a comprehensive financial education plan that provides individuals with information and resources to help them achieve their savings goals.

Who is required to file savings tools lesson plan?

Financial institutions, including banks, credit unions, and investment firms, are required to file savings tools lesson plan.

How to fill out savings tools lesson plan?

Savings tools lesson plan can be filled out online or in paper form, depending on the requirements of the financial institution.

What is the purpose of savings tools lesson plan?

The purpose of savings tools lesson plan is to educate individuals on the importance of saving, investing, and managing their finances effectively.

What information must be reported on savings tools lesson plan?

Savings tools lesson plan must include information on the different savings and investment options available, as well as tips on how to save and invest wisely.

Fill out your savings tools lesson plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Savings Tools Lesson Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.