VA VA-8453 2019 free printable template

Get, Create, Make and Sign VA VA-8453

How to edit VA VA-8453 online

Uncompromising security for your PDF editing and eSignature needs

VA VA-8453 Form Versions

How to fill out VA VA-8453

How to fill out VA VA-8453

Who needs VA VA-8453?

Instructions and Help about VA VA-8453

Hello Anthony hello Claudia we're here today to talk about C Corp form 1120 that's right it's a little of a dry subject a little dry, but its important information, but we are the most exciting people on earth, and we're going to make it great sparkling okay, so you have to file I RS form 1120 which is the U.S. corporation tax return you're going to report income gains losses deductions credits, and you're going to figure the income tax liability of the corporation must be filed even if the corporation is in bankruptcy or if they have no taxable income mm-hmm yeah that's right um one of the things about bankruptcy is that you have to stay in compliance with the US tax code in order to stay in bankruptcy and this is even if you're a corporation is going to file a chapter 11 maybe they're able to get off you get some of those taxes away you still have to file you still have to be in compliance and part of the deal is you know bankruptcy is part of you know the benefits of the government well if you want the benefit of the government you have to do the compliance as well do what they say that's right all right so what about due dates okay, so normally this is the way has been is to do the 15th day of the third month after the corporation ends its tax year now its tax year doesn't have to be it's a fiscal year you can pick when you want the fiscal year to end, but you usually see people do a quarterly and so you look March 31st the quarter ends June 30th a September 31st December 31st and thence there are some benefits to that if you have related corporations sometimes you can offload some income to another one to another one, so you're sort of deferring that well we're going to be talking about audits another one there are some things that may benefit, but it also may get a little sketchy and sometimes having the different ones that create so much confusion when you're trying to reconcile bank accounts, and you have different years it can get a little much, and it's hard to keep things up here straight sometimes yep okay so now 2017 filing system a season excuse me for 2016 returns there is a change the due date will now be April 15 yeah so pretty much everything I just said was not valid anymore because March 15th has come and went, and so we're going to be you know the next we're going to be talking about while it's still true for anyone's this year's because there are going to be some corporations with tax their tax deadline ending in this year now what about someone December 30th if not 31st is their tax year yeah it would still be due the March 15th yep that one day that some I don't know yeah I don't know why would somebody could you could do that you could know you can file for extensions is form seven zero four right now it's the six-month extension but next year when the changes come it will only be eligible for a five-month extension bringing the due date to September 15th that they want to keep it in line with the government's fiscal...

People Also Ask about

Do you need to attach W-2 to Virginia tax return?

What do I attach to a paper filed tax return?

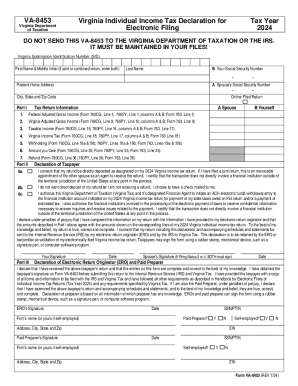

What is VA 8453?

What do I attach to my Virginia Tax return?

Who files form 8453 C?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get VA VA-8453?

How do I edit VA VA-8453 online?

How do I edit VA VA-8453 straight from my smartphone?

What is VA VA-8453?

Who is required to file VA VA-8453?

How to fill out VA VA-8453?

What is the purpose of VA VA-8453?

What information must be reported on VA VA-8453?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.