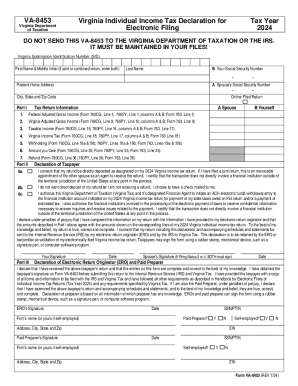

VA VA-8453 2014 free printable template

Get, Create, Make and Sign VA VA-8453

Uncompromising security for your PDF editing and eSignature needs

VA VA-8453 Form Versions

How to fill out VA VA-8453

How to fill out VA VA-8453

Who needs VA VA-8453?

Instructions and Help about VA VA-8453

Hi those of you that have been following the veterans' law blog for a while know that I hate VA form 21 – 41:38 this particular form in the VA inventory is so useless that I have yet to come up with a viable use for this form plus I really truly believe that it slows down your VA claim so want to speed up your VA claim here's what I say don't use VA form 21 – 41:38 my name is Chris added witveteransns'NS law block though I'm an accredited VA attorney, and I've been working with veterans battling the VA for eight years this video is not legal advice this video like all the content on the veteran's law blog is meant to be educational only to teach you what I have learned these last eight years so that you can take back the power in your VA claim or appeal so pop on over to the veteran's law blog thousands of blog posts on VA claims and Appeals topics close to a dozen downloadable e-books and a couple dozen training videos on navigating the VA claims process so stop over to veteran's law blog org today let's get into the meat of today's video blog topic the VA form 21 – 41:38 this forum the VA forum 21:41 30 is the most overused and useless VA for what's more is that there is a better form that you can use that will not only improve your chances of winning your VA claim or appeal, but it will also speed up your claim or appeal, and I'll get into that in just a minute first let's talk a little more about this VA form the 21 – 41:38 I hate it with a passion almost as much as I hate the Boston Red Sox sorry Boston vets I'm a Yankee fan veterans tell me that they use this form all the time though I see him use any time after time see file after seat ball I've reviewed that reviewed thousands of veterans claims files and I see VA form 21 – 41:3everyonehesoloso you might ask why does an attorney hate a form the veterans use all the time and their VA claims it appeals well it's simple and here's the reason the VA form 21 – 41:38 is not only one of the least helpful forms in the entire VA claims form library, but it also has real power to create real problems in a veterans claim or appeal for disability benefits so in today's video I'm going to talk to you about that form I'm going to tell you some of the reasons that I no longer use VA form 21 41:38 and most important I'm going to give you a much more powerful tool that you can use instead so let's dive into it what is VA for 21 – 41:38 this form is titled the statement in support of claim and at its most basic level it's the VA form for a blank sheet of paper here's a copy of a VA form 21 – 41:38 coming up on your screen right now, so you can remember what it looks like in all my years of representing veterans I've reviewed hundreds if not thousands of VA claims files and in those reviews I have seen veterans use VA form 21 – 41 38 in a number of ways I've seen you guys use it to request an update on your claim status I've seen it you use it to submit stories and information that the veteran might think...

People Also Ask about

Do you need to attach W-2 to Virginia tax return?

What do I attach to a paper filed tax return?

What is VA 8453?

What do I attach to my Virginia Tax return?

Who files form 8453 C?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is VA VA-8453?

Who is required to file VA VA-8453?

How to fill out VA VA-8453?

What is the purpose of VA VA-8453?

What information must be reported on VA VA-8453?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.