NJ DoT M-5008-R 2019 free printable template

Show details

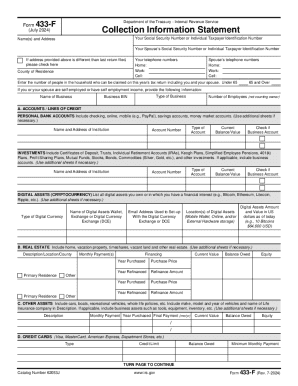

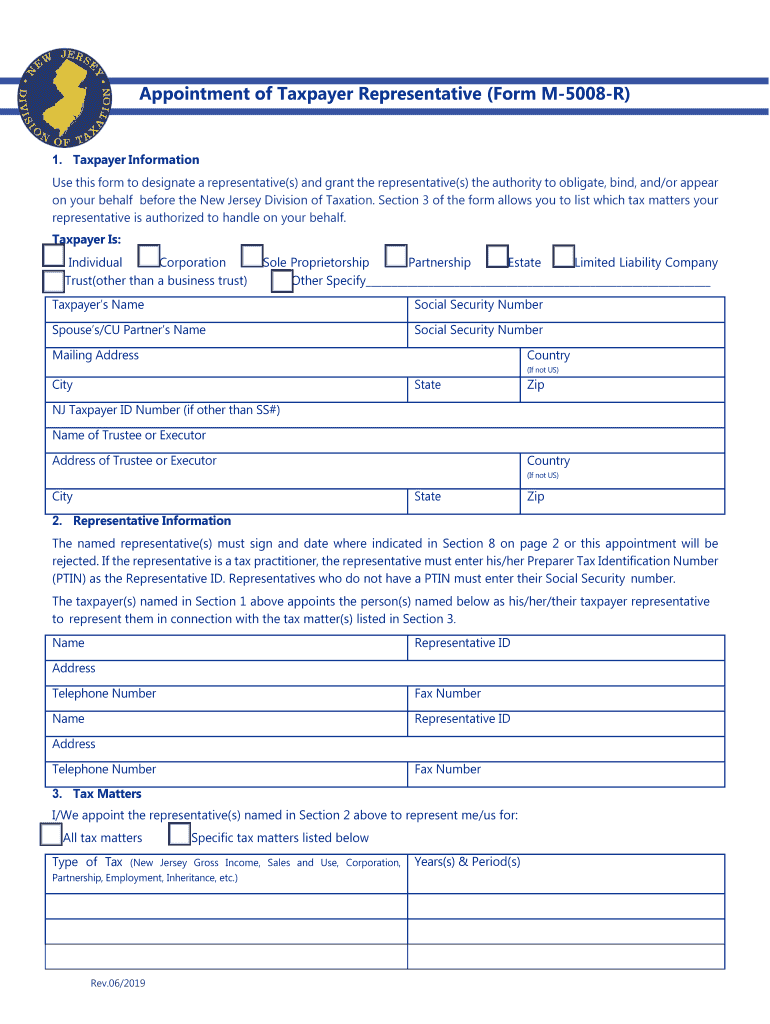

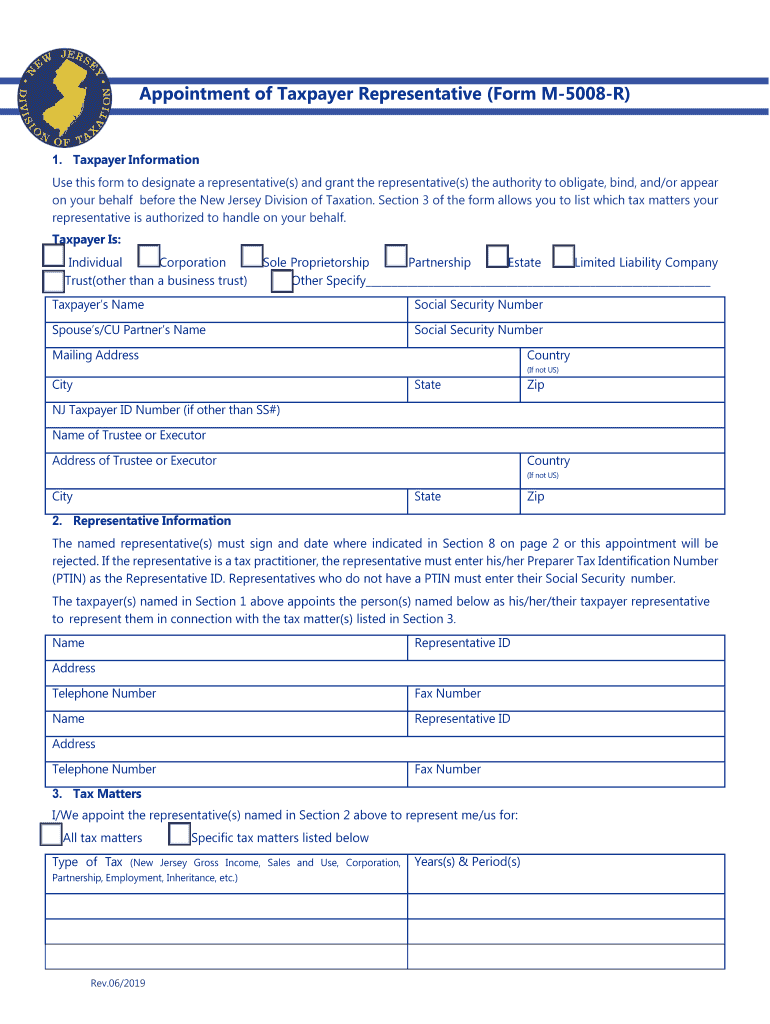

Others. Form M-5008-R must be signed by the taxpayer or by an individual having the authority to act in the name of the taxpayer. For example Form M-5008-R is not required if an individual appears on behalf of a corporate taxpayer with an authorized corporate officer. You must sign and date Form M-5008-R. If a joint gross income tax return has been filed and both husband and wife/both cu partners will be represented by the same individual s both must sign Form M-5008-R unless one spouse/cu...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ DoT M-5008-R

Edit your NJ DoT M-5008-R form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ DoT M-5008-R form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NJ DoT M-5008-R online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NJ DoT M-5008-R. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT M-5008-R Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ DoT M-5008-R

How to fill out NJ DoT M-5008-R

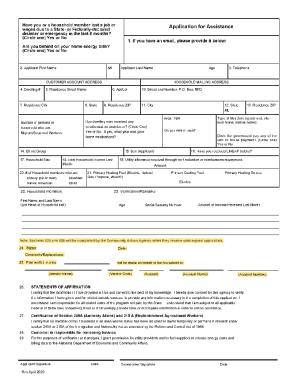

01

Obtain the NJ DoT M-5008-R form from the NJ Department of Transportation website or your local office.

02

Read the instructions included with the form to understand the requirements.

03

Fill out the applicant's information in the designated sections, including name, address, and contact details.

04

Provide vehicle information, including make, model, year, and VIN (Vehicle Identification Number).

05

Indicate the purpose for completing the form, such as a change of ownership or registration.

06

If applicable, attach any required supporting documents, such as proof of identity or previous registration.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form as required.

09

Submit the form to the appropriate NJ DoT office, either in person or via mail as specified in the instructions.

Who needs NJ DoT M-5008-R?

01

Individuals or businesses applying for vehicle registration in New Jersey.

02

Those who need to update vehicle information due to changes in ownership or address.

03

People seeking to register a newly purchased vehicle.

Instructions and Help about NJ DoT M-5008-R

Fill

form

: Try Risk Free

People Also Ask about

What is a 5008 power of attorney in New Jersey?

A New Jersey tax power of attorney form (Form M-5008-R) is used to appoint an agent or an entity to handle a person's taxes with the Division of Taxation. In most cases, the principal will hire a tax accountant or other certified professional to represent them in these matters.

What is a form M 5008 R?

Instructions for Form M-5008-R Use this form to designate a representative(s) and grant the representative(s) the authority to obligate, bind, and/or appear on your behalf before the New Jersey Division of Taxation.

How is NJ late filing penalty calculated?

The Late Filing Penalty is 5% of the tax due for each month (or part of a month) the return is late. The maximum penalty for late filing is 25% of the balance due. We also may charge $100 for each month the return is late. In addition to interest, we may also charge a Late Payment Penalty of 5% of the tax due.

Do I need to file a NJ nonresident tax return?

If you had any income from New Jersey sources while you were a nonresident, you may also need to file a New Jersey nonresident return (Form NJ-1040NR). View additional information on filing a part-year return.

How do I get a sales tax refund in NJ?

The Claim for Refund (Form A-3730) must be filed with documents, such as invoices, receipts, proof of payment of tax, and exemption certificates. These documents must be provided in a format suitable to determine the correctness of the grounds for the refund and the amount of the refund or credit.

How do I pay my NJ gross income tax adjustment?

You will need your social security number and date of birth to pay online. Taxpayers who do not have Internet access can make a payment by e-check by contacting the Division's Customer Service Center at 609-292-6400. Credit card payments can also be made by phone (1-800-2PAYTAX, toll-free).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my NJ DoT M-5008-R in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your NJ DoT M-5008-R and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit NJ DoT M-5008-R straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing NJ DoT M-5008-R.

Can I edit NJ DoT M-5008-R on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign NJ DoT M-5008-R on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is NJ DoT M-5008-R?

NJ DoT M-5008-R is a form used by the New Jersey Department of Transportation to report certain transportation-related information.

Who is required to file NJ DoT M-5008-R?

Entities or individuals involved in specified transportation activities within New Jersey, as mandated by state regulations, are required to file NJ DoT M-5008-R.

How to fill out NJ DoT M-5008-R?

To fill out NJ DoT M-5008-R, individuals should follow the instructions provided on the form, inputting required information accurately and completely.

What is the purpose of NJ DoT M-5008-R?

The purpose of NJ DoT M-5008-R is to collect data on transportation activities for regulatory compliance and planning purposes.

What information must be reported on NJ DoT M-5008-R?

The information that must be reported on NJ DoT M-5008-R includes details about transportation activities, entities involved, and relevant metrics as required by the form.

Fill out your NJ DoT M-5008-R online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ DoT M-5008-R is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.