NJ DoT M-5008-R 2021 free printable template

Show details

Others. Form M-5008-R must be signed by the taxpayer or by an individual having the authority to act in the name of the taxpayer. For example Form M-5008-R is not required if an individual appears on behalf of a corporate taxpayer with an authorized corporate officer. You must sign and date Form M-5008-R. If a joint gross income tax return has been filed and both husband and wife/both cu partners will be represented by the same individual s both must sign Form M-5008-R unless one spouse/cu...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ DoT M-5008-R

Edit your NJ DoT M-5008-R form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ DoT M-5008-R form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NJ DoT M-5008-R online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NJ DoT M-5008-R. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT M-5008-R Form Versions

Version

Form Popularity

Fillable & printabley

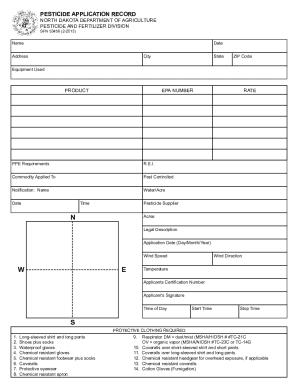

How to fill out NJ DoT M-5008-R

How to fill out NJ DoT M-5008-R

01

Obtain the NJ DoT M-5008-R form from the New Jersey Department of Transportation website or at a local office.

02

Read the instructions carefully to understand the specific requirements for filling out the form.

03

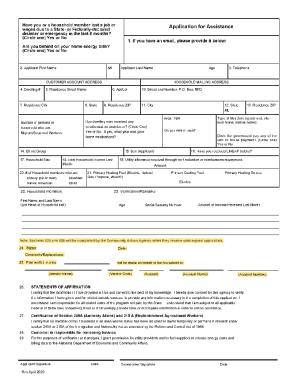

Fill in the applicant's information, including name, address, and contact details.

04

Provide details about the vehicle, including make, model, year, and Vehicle Identification Number (VIN).

05

Indicate the purpose of the application clearly.

06

Complete any additional sections related to the type of request you are making.

07

Review all entered information for accuracy and completeness.

08

Sign and date the form as required.

09

Submit the completed form according to the instructions provided (in person or by mail).

Who needs NJ DoT M-5008-R?

01

Individuals or businesses applying for a specific type of vehicle request with the New Jersey Department of Transportation.

02

Those needing a certificate of title, registration, or any related vehicle documentation in New Jersey.

Instructions and Help about NJ DoT M-5008-R

Fill

form

: Try Risk Free

People Also Ask about

Will you collect New Jersey sales tax and or pay use tax?

Use Tax is owed by New Jersey residents and businesses that buy products out of state, online, or via the mail, and then bring the products to New Jersey or have them shipped here for their use. When you buy a taxable item or service in New Jersey, the seller collects New Jersey Sales Tax from you on the purchase.

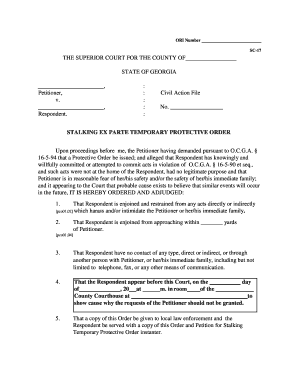

What is the power of attorney form for income tax in New Jersey?

A New Jersey tax power of attorney form (Form M-5008-R) is used to appoint an agent or an entity to handle a person's taxes with the Division of Taxation.

Do I need to file a NJ nonresident tax return?

If you had any income from New Jersey sources while you were a nonresident, you may also need to file a New Jersey nonresident return (Form NJ-1040NR). View additional information on filing a part-year return.

What is a 5008 power of attorney in New Jersey?

A New Jersey tax power of attorney form (Form M-5008-R) is used to appoint an agent or an entity to handle a person's taxes with the Division of Taxation. In most cases, the principal will hire a tax accountant or other certified professional to represent them in these matters.

What items are exempt from sales tax in New Jersey?

The current Sales Tax rate is 6.625% and the specially designated Urban Enterprise Zones rate is one half the Sales Tax rate. Certain items are exempt from sales tax, such as food, clothing, drugs, and manufacturing/processing machinery and equipment. A resale exemption also exists.

What is a form M 5008 R?

Instructions for Form M-5008-R Use this form to designate a representative(s) and grant the representative(s) the authority to obligate, bind, and/or appear on your behalf before the New Jersey Division of Taxation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NJ DoT M-5008-R from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including NJ DoT M-5008-R, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Where do I find NJ DoT M-5008-R?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific NJ DoT M-5008-R and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit NJ DoT M-5008-R online?

The editing procedure is simple with pdfFiller. Open your NJ DoT M-5008-R in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

What is NJ DoT M-5008-R?

NJ DoT M-5008-R is a form used by the New Jersey Department of Transportation for reporting certain transportation-related information.

Who is required to file NJ DoT M-5008-R?

Those who own or operate vehicles subject to specific regulatory requirements in New Jersey are required to file NJ DoT M-5008-R.

How to fill out NJ DoT M-5008-R?

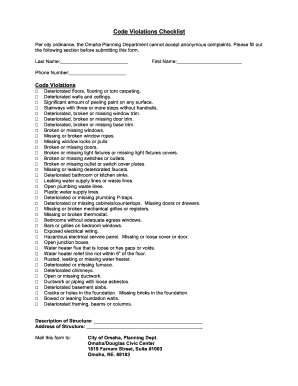

To fill out NJ DoT M-5008-R, you will need to provide information such as your contact details, vehicle information, and any other relevant data as instructed on the form.

What is the purpose of NJ DoT M-5008-R?

The purpose of NJ DoT M-5008-R is to collect data for regulatory compliance and transportation planning within the state of New Jersey.

What information must be reported on NJ DoT M-5008-R?

Information that must be reported on NJ DoT M-5008-R includes vehicle type, ownership details, operational data, and any other specifics required by the state transportation authorities.

Fill out your NJ DoT M-5008-R online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ DoT M-5008-R is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.