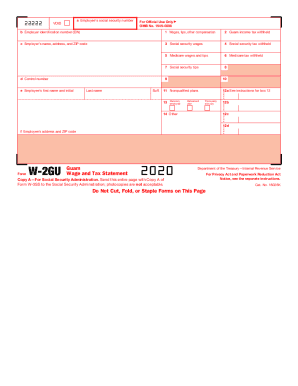

IRS W-3SS 2020 free printable template

Instructions and Help about IRS W-3SS

How to edit IRS W-3SS

How to fill out IRS W-3SS

About IRS W-3SS 2020 previous version

What is IRS W-3SS?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS W-3SS

What should I do if I need to correct a mistake on my IRS W-3SS form?

If you discover an error on your IRS W-3SS after submission, you must submit a corrected form to the IRS. This involves using the same form but marking it as a correction. Ensure that you provide accurate information to avoid any further issues and verify the changes have been accepted by the IRS.

How can I verify the status of my IRS W-3SS filing?

To verify the status of your IRS W-3SS filing, you can use the IRS online tools or contact their support directly. Keep track of any submission confirmation emails or documents you’ve received, which can assist in determining if your submission is being processed without any issues.

What should I do if my IRS W-3SS submission is rejected?

In the event of a rejection, review the rejection codes provided by the IRS to identify and rectify the errors. After corrections are made, you can resubmit your IRS W-3SS electronically or on paper, ensuring all updated information is accurate to prevent future rejections.

Can nonresident foreign payees file an IRS W-3SS?

Yes, nonresident foreign payees can file an IRS W-3SS; however, there are specific requirements and forms unique to foreign individuals. It’s crucial to ensure all applicable regulations are followed to avoid complications with the submission and processing.

What are common errors to look out for when filing the IRS W-3SS?

Common errors when filing the IRS W-3SS include incorrect taxpayer identification numbers, mismatched names, and outdated addresses. Double-check all information against IRS guidelines to minimize the chances of rejection or the need for corrections down the line.

See what our users say