Get the free Guarantee Insurance Company - Florida Department of ...

Show details

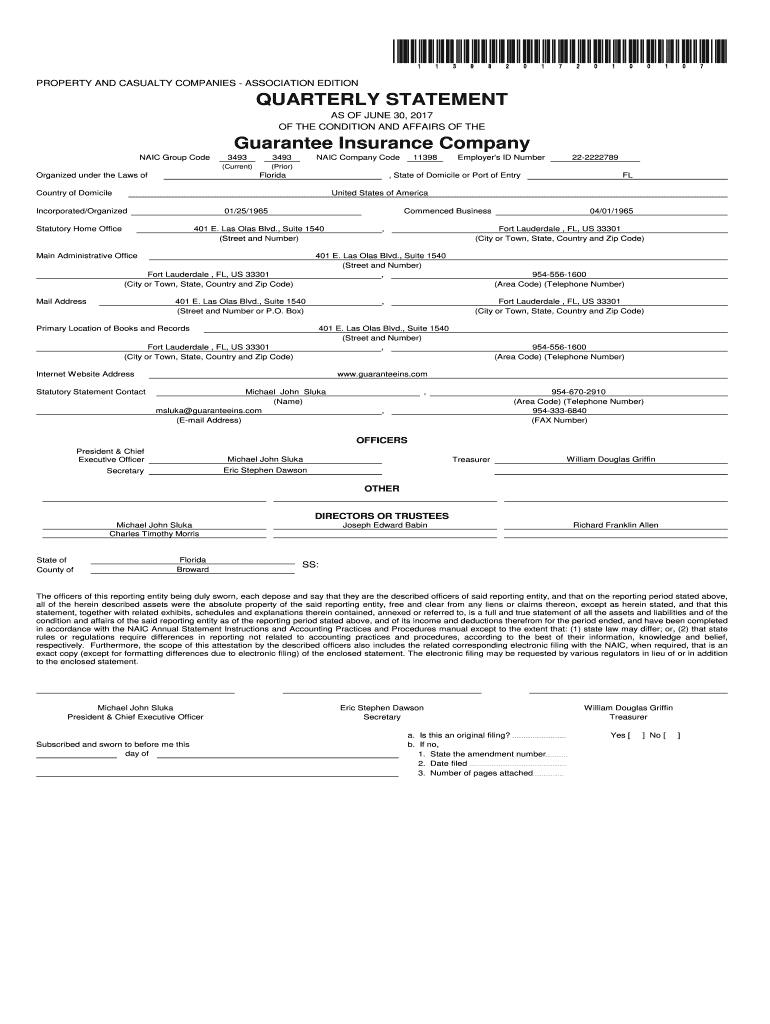

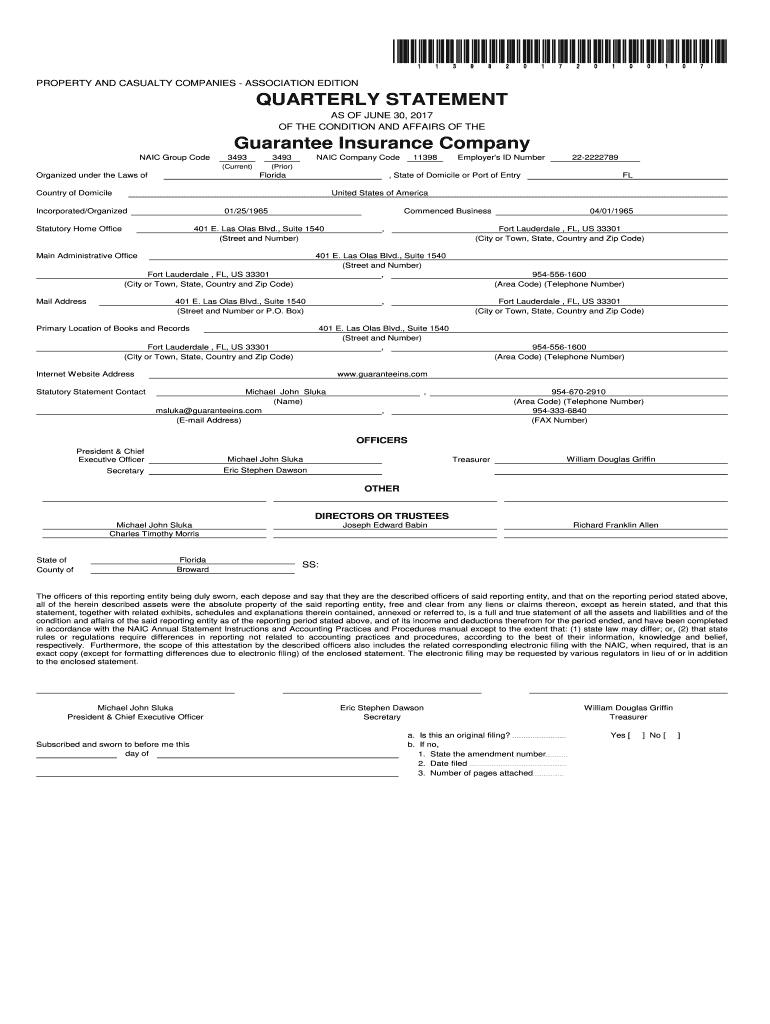

*11398201720100107* PROPERTY AND CASUALTY COMPANIES ASSOCIATION EDITIONQUARTERLY STATEMENT AS OF JUNE 30, 2017, OF THE CONDITION AND AFFAIRS OF Guarantee Insurance Company NAIL Group Code Organized

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guarantee insurance company

Edit your guarantee insurance company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guarantee insurance company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit guarantee insurance company online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit guarantee insurance company. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guarantee insurance company

How to fill out guarantee insurance company

01

Step 1: Start by gathering all the necessary documents required for filling out a guarantee insurance application. These include proof of income, identification documents, and any other relevant paperwork.

02

Step 2: Carefully review the terms and conditions of the guarantee insurance policy to understand the coverage and exclusions. It is essential to understand the scope of the guarantee before filling out the application.

03

Step 3: Fill out the guarantee insurance application form accurately and provide all the requested information. Make sure to double-check all the details before submitting the form.

04

Step 4: Attach the required supporting documents along with the application. This may include bank statements, tax returns, or other financial records that validate your eligibility for guarantee insurance.

05

Step 5: Review the filled-out application once again to ensure that all the information provided is correct and complete. Any errors or missing details could delay the processing of your application.

06

Step 6: Submit the filled-out application form and supporting documents to the guarantee insurance company either in person or through their designated online platform.

07

Step 7: Await the response from the guarantee insurance company. They may contact you for further clarification or additional documents if required.

08

Step 8: Once the application is approved, carefully review the issued guarantee insurance policy document. Make sure to understand the premium payment terms, claim process, and any other relevant information.

09

Step 9: Keep the guarantee insurance policy in a safe place and maintain copies of all related documents for future reference.

10

Step 10: In case of any changes in personal information or circumstances, inform the guarantee insurance company promptly to avoid any issues with future claims or policy renewals.

Who needs guarantee insurance company?

01

Business owners who often engage in financial contracts or agreements that require guarantees may need guarantee insurance. This type of insurance provides protection against the risk of default or non-performance by one party in a contract.

02

Contractors, suppliers, and service providers who are required to provide guarantees as part of their business activities can benefit from guarantee insurance. It offers financial security and mitigates the risk associated with fulfilling contractual obligations.

03

Developers or investors involved in construction projects often require guarantee insurance to secure funding and provide assurance to project stakeholders. It helps protect against potential financial losses and ensures the completion of the project.

04

International traders who engage in import/export transactions may need guarantee insurance to mitigate the risk of non-payment or non-delivery. It provides assurance to both buyers and sellers in cross-border trade.

05

Public sector entities such as government agencies or municipalities may require guarantee insurance from contractors or suppliers to ensure proper performance and fulfillment of contractual obligations.

06

Individuals who plan to apply for loans or mortgages and need to provide a guarantee as collateral can benefit from guarantee insurance. It offers extra protection to lenders and increases the chances of loan approval.

07

Entrepreneurs or startups seeking venture capital funding may need guarantee insurance to provide additional security to investors against the risk of business failure or default.

08

Manufacturers or sellers of high-value goods may require guarantee insurance to offer warranty or performance guarantees to their customers. This can enhance their credibility and protect against potential liability.

09

Real estate developers who undertake major construction projects can benefit from guarantee insurance to safeguard against potential risks and uncertainties in the property market.

10

Service providers who offer professional services such as consulting or advisory services may require guarantee insurance to provide assurances of their expertise and protect against potential professional negligence claims.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify guarantee insurance company without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including guarantee insurance company. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I fill out the guarantee insurance company form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign guarantee insurance company and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit guarantee insurance company on an iOS device?

Use the pdfFiller mobile app to create, edit, and share guarantee insurance company from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is guarantee insurance company?

A guarantee insurance company is a type of insurance company that provides insurance policies to guarantee the performance of a specific obligation or contract.

Who is required to file guarantee insurance company?

Any individual or business entity that offers guarantee insurance policies must file with the appropriate regulatory authorities.

How to fill out guarantee insurance company?

To fill out a guarantee insurance company form, you must provide detailed information about the policies offered, financial stability of the company, and any other relevant details requested on the form.

What is the purpose of guarantee insurance company?

The purpose of a guarantee insurance company is to provide financial protection to parties involved in a contract or obligation in case of default.

What information must be reported on guarantee insurance company?

Information such as policy details, financial statements, underwriting guidelines, and claims history must be reported on guarantee insurance company filings.

Fill out your guarantee insurance company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guarantee Insurance Company is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.