MD Comptroller MW506A 2019 free printable template

Show details

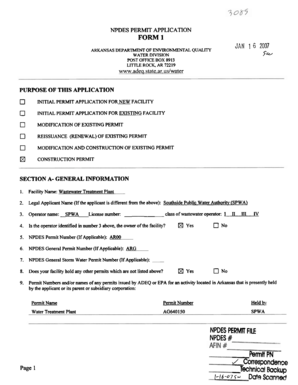

FORM MW506A COM/RAD-042 REV. 06/17 17-49 AMENDED RETURN MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD COMPTROLLER OF MARYLAND REVENUE ADMINISTRATION DIVISION 110 CARROLL STREET ANNAPOLIS MD 21411-0001 FEIN CORRECTION FOR PERIOD YEAR YYYY PREVIOUSLY REPORTED MARYLAND STATE INCOME TAX WITHHELD. REMITTED AMOUNT. CORRECTED AMOUNTS CREDIT/OVERPAYMENT REFUND. UNDERPAYMENT/REMITTANCE. MAKE CHECKS PAYABLE TO COMPTROLLER OF MD. - WH TAX I certify that this information is to the best of my knowledge...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign maryland form 506

Edit your maryland form 506 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maryland form 506 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit maryland form 506 online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit maryland form 506. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Comptroller MW506A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out maryland form 506

How to fill out MD Comptroller MW506A

01

Begin by downloading the MD Comptroller MW506A form from the official Maryland Comptroller's website.

02

Fill in your business information at the top of the form, including your name, address, and federal employer identification number (FEIN).

03

Indicate the type of withholding period by selecting the corresponding checkbox.

04

Enter the total amount of wages subject to withholding in the appropriate section based on your payroll data.

05

Calculate the Maryland withholding tax by applying the correct tax rate to the taxable wages.

06

Report any adjustments or credits, if applicable, in the designated areas.

07

Review the completed form for accuracy and ensure all required fields are filled out.

08

Sign and date the form before submitting it to the Maryland Comptroller's Office.

Who needs MD Comptroller MW506A?

01

Businesses and employers who are required to withhold Maryland state income tax from employees' wages must complete the MD Comptroller MW506A form.

02

It is necessary for any entity that pays wages subject to state withholding tax in Maryland.

Instructions and Help about maryland form 506

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Maryland tax return?

If you are a Maryland resident, you are required to file a Maryland income tax return if you are required to file a federal income tax return, and your gross income equals or exceeds the level for your filing status in Filing Requirements see above and in Instruction 1 of the Maryland resident tax booklet.

What happens if you don't file taxes in Maryland?

If you don't file by the due date of the tax return, you may have to pay a failure to file penalty. The penalty is 5% of the tax not paid by the due date for each month or part of a month that the return is late.

How much do I have to make to file taxes in Maryland?

Possibly. Single taxpayers under 65 are not required to file a Maryland income tax return unless their Maryland gross income was $10,400 or more in 2017. Maryland gross income is federal gross income (but do not include Social Security or Railroad Retirement income) plus Maryland additions.

Who is exempt from Maryland state taxes?

You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. For more information and forms, visit the university Tax Office website.

Am I required to file a Maryland state tax return?

If you are a Maryland resident, you are required to file a Maryland income tax return if you are required to file a federal income tax return, and your gross income equals or exceeds the level for your filing status in Filing Requirements see above and in Instruction 1 of the Maryland resident tax booklet.

Where do I mail mw506a?

110 Carroll Street, Annapolis, Maryland 21411-0001 I declare under the penalties of perjury that this return (including any accompanying schedules and statements) has been examined by me and to the best of my knowledge is a true, correct and complete return.

Are Maryland tax forms available?

Forms are available for downloading in the Resident Individuals Income Tax Forms section below. Instructions for filing personal state and local income taxes for full- or part-year Maryland residents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send maryland form 506 for eSignature?

To distribute your maryland form 506, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete maryland form 506 online?

Completing and signing maryland form 506 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out the maryland form 506 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign maryland form 506 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is MD Comptroller MW506A?

MD Comptroller MW506A is a tax form used in Maryland to report withholding tax information for employees and payments made to non-residents.

Who is required to file MD Comptroller MW506A?

Employers in Maryland who withhold income tax from employees' wages and those making payments to non-residents are required to file MD Comptroller MW506A.

How to fill out MD Comptroller MW506A?

To fill out MD Comptroller MW506A, employers must provide information such as the total amount of withholding, employee details, and any payments made to non-residents. Detailed instructions are provided on the form.

What is the purpose of MD Comptroller MW506A?

The purpose of MD Comptroller MW506A is to ensure accurate reporting and payment of Maryland state income taxes withheld from employees and payments made to non-residents.

What information must be reported on MD Comptroller MW506A?

Information required on MD Comptroller MW506A includes the total tax withheld, employer identification details, employee names, addresses, social security numbers, and any other relevant payment information.

Fill out your maryland form 506 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maryland Form 506 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.