MD Comptroller MW506A 2016 free printable template

Show details

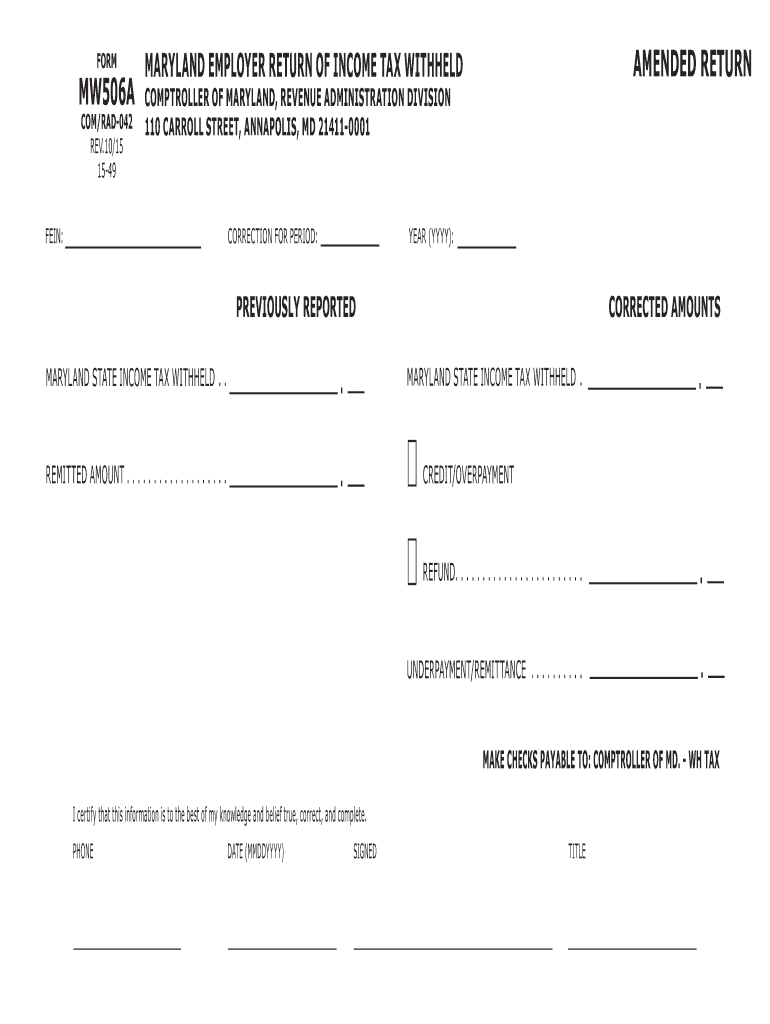

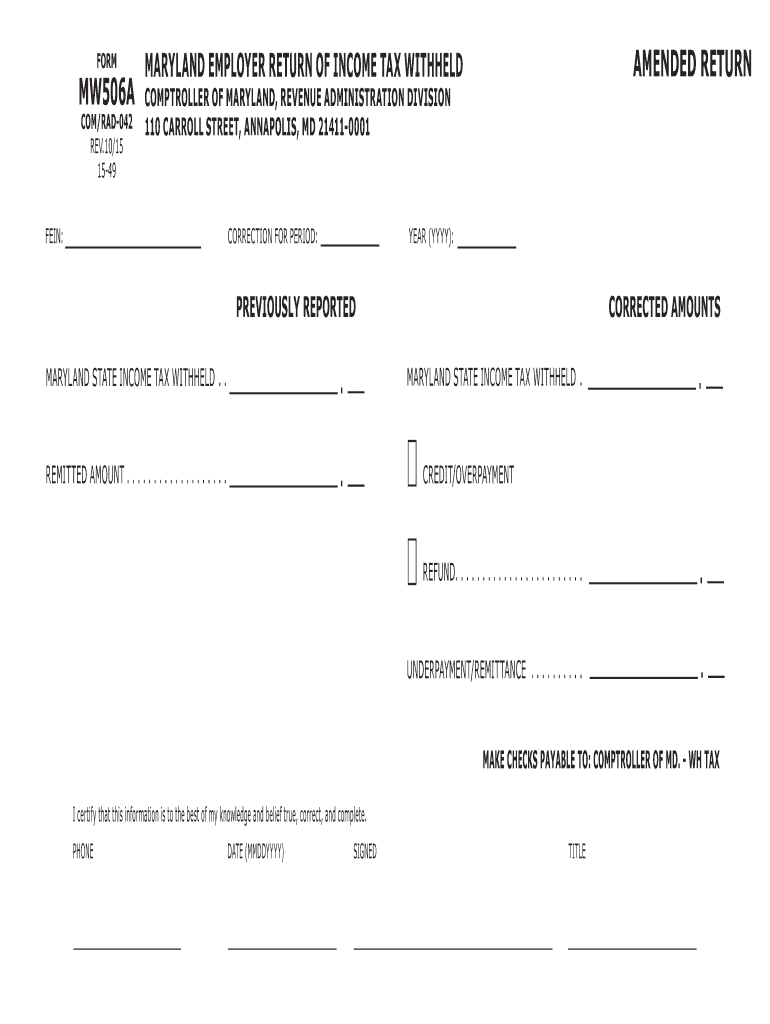

FORM MW506A COM/RAD-042 REV. 10/15 15-49 AMENDED RETURN MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD COMPTROLLER OF MARYLAND REVENUE ADMINISTRATION DIVISION 110 CARROLL STREET ANNAPOLIS MD 21411-0001 FEIN CORRECTION FOR PERIOD YEAR YYYY PREVIOUSLY REPORTED MARYLAND STATE INCOME TAX WITHHELD. REMITTED AMOUNT. CORRECTED AMOUNTS CREDIT/OVERPAYMENT REFUND. UNDERPAYMENT/REMITTANCE. MAKE CHECKS PAYABLE TO COMPTROLLER OF MD. - WH TAX I certify that this information is to the best of my knowledge...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD Comptroller MW506A

Edit your MD Comptroller MW506A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD Comptroller MW506A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MD Comptroller MW506A online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MD Comptroller MW506A. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Comptroller MW506A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD Comptroller MW506A

How to fill out MD Comptroller MW506A

01

Start by downloading the MD Comptroller MW506A form from the official Maryland Comptroller website.

02

Fill in the business information section, including the name, address, and federal employer identification number (FEIN).

03

In the 'Period Covered' section, enter the start and end dates for the reporting period.

04

Report the total gross wages paid to employees during the period in the appropriate section.

05

Calculate and enter the total taxes withheld from wages based on state and federal guidelines.

06

Include any additional deductions or specific exemptions, if applicable to your business.

07

Double-check all entered information for accuracy and completeness.

08

Sign and date the form as required to certify the information provided.

09

Submit the completed MW506A form by the specified due date, electronically or via mail, as instructed.

Who needs MD Comptroller MW506A?

01

Employers in Maryland who are required to report employee wages and tax withholdings to the Maryland Comptroller's office.

02

Businesses that hire employees and need to comply with state payroll reporting requirements.

03

Any entity that pays wages subject to Maryland state income tax withholding.

Instructions and Help about MD Comptroller MW506A

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Maryland tax return?

If you are a Maryland resident, you are required to file a Maryland income tax return if you are required to file a federal income tax return, and your gross income equals or exceeds the level for your filing status in Filing Requirements see above and in Instruction 1 of the Maryland resident tax booklet.

What happens if you don't file taxes in Maryland?

If you don't file by the due date of the tax return, you may have to pay a failure to file penalty. The penalty is 5% of the tax not paid by the due date for each month or part of a month that the return is late.

How much do I have to make to file taxes in Maryland?

Possibly. Single taxpayers under 65 are not required to file a Maryland income tax return unless their Maryland gross income was $10,400 or more in 2017. Maryland gross income is federal gross income (but do not include Social Security or Railroad Retirement income) plus Maryland additions.

Who is exempt from Maryland state taxes?

You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. For more information and forms, visit the university Tax Office website.

Am I required to file a Maryland state tax return?

If you are a Maryland resident, you are required to file a Maryland income tax return if you are required to file a federal income tax return, and your gross income equals or exceeds the level for your filing status in Filing Requirements see above and in Instruction 1 of the Maryland resident tax booklet.

Where do I mail mw506a?

110 Carroll Street, Annapolis, Maryland 21411-0001 I declare under the penalties of perjury that this return (including any accompanying schedules and statements) has been examined by me and to the best of my knowledge is a true, correct and complete return.

Are Maryland tax forms available?

Forms are available for downloading in the Resident Individuals Income Tax Forms section below. Instructions for filing personal state and local income taxes for full- or part-year Maryland residents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MD Comptroller MW506A without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your MD Comptroller MW506A into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send MD Comptroller MW506A for eSignature?

When you're ready to share your MD Comptroller MW506A, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit MD Comptroller MW506A on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share MD Comptroller MW506A from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is MD Comptroller MW506A?

MD Comptroller MW506A is a form used in Maryland for the reporting and remittance of sales and use tax.

Who is required to file MD Comptroller MW506A?

Businesses operating in Maryland that collect sales and use tax from customers are required to file MD Comptroller MW506A.

How to fill out MD Comptroller MW506A?

To fill out MD Comptroller MW506A, businesses must enter their total sales, taxable sales, and the amount of sales tax collected during the reporting period, along with relevant business information.

What is the purpose of MD Comptroller MW506A?

The purpose of MD Comptroller MW506A is to provide the state with data on sales and use tax collection and ensure compliance with tax laws.

What information must be reported on MD Comptroller MW506A?

Information that must be reported includes total sales, total taxable sales, total tax collected, business identification number, and contact information.

Fill out your MD Comptroller MW506A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD Comptroller mw506a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.