OR OR-CPPR 2020 free printable template

Show details

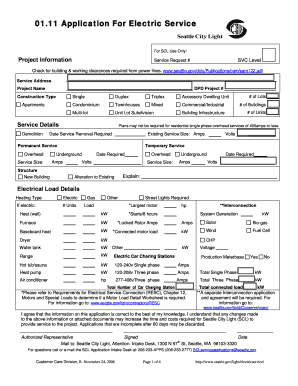

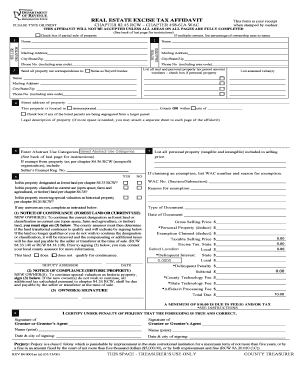

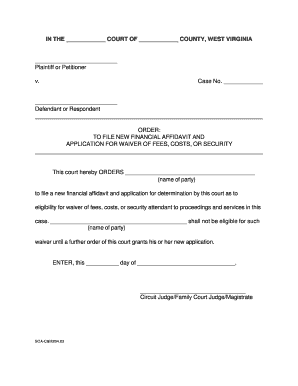

20202020Confidential Personal Property Returner ORC PPR (ORS 308.290)Assessment of Business: Furniture, Fixtures, Equipment, Floating Property, and Leased or Rented Property

ATTENTION: If you did

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR OR-CPPR

Edit your OR OR-CPPR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR OR-CPPR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OR OR-CPPR online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OR OR-CPPR. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR OR-CPPR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OR OR-CPPR

How to fill out OR OR-CPPR

01

Gather all necessary information and documents required to fill out the OR OR-CPPR.

02

Start with the header section by entering your name, address, and contact information.

03

Indicate the purpose of the report in the appropriate section.

04

Fill in the details regarding the incident or information being reported, ensuring accuracy.

05

Include any relevant dates, times, and locations connected to the report.

06

Attach any supporting documentation or evidence that pertains to the report.

07

Review the completed form for any errors or missing information.

08

Sign and date the form as required.

Who needs OR OR-CPPR?

01

Individuals who have experienced an incident that requires documentation.

02

Organizations or agencies reporting incidents for compliance purposes.

03

Legal representatives working on behalf of individuals needing to record incidents.

04

Public safety officials collecting data for statistical or investigative reasons.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 40 Alabama?

Alabama Form 40 is used by full-year and part-year residents to file their state income tax return. The purpose of Form 40 is to calculate how much income tax you owe the state. Nonresident filers will complete Alabama Form 40NR. Taxpayers with simple returns have the option to use Form 40A (Short Form).

What are the Oregon state income tax brackets?

Income Tax Brackets Single FilersOregon Taxable IncomeRate$0 - $3,6504.75%$3,650 - $9,2006.75%$9,200 - $125,0008.75%1 more row • 23-Dec-2021

What is the standard deduction for Oregon income tax?

The state of Oregon offers a standard deduction for its taxpayers. For the 2021 tax year, Oregon's standard deduction allows taxpayers to reduce their taxable income by $2,350 for single filers, $4,700 for those married filing jointly, $3,780 for heads of household, and $4,700 for qualifying widowers.

What is a 10 40 tax form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

How do I get my 10/40 form?

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

Who qualifies as an Oregon resident for income tax purposes?

If a permanent place of abode is maintained in Oregon, and the person is in this state for more than 200 days during the tax year, then the person is taxed as a resident of Oregon.

Does everyone have to fill out a 10/40 form?

While people with more complicated tax situations may need more forms and schedules, everyone filing taxes will need to fill out Form 1040 in order to file their taxes.

What is the Oregon standard deduction for 2022?

The 2022 standard deduction for each filing status is: $2,420 for single or married filing separately. $3,895 for head of household. $4,840 for married filing jointly or qualifying widow(er).

What is standard deduction for 2022?

For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard deduction will be $20,800 for tax year 2023, up $1,400 from the amount for tax year 2022.

What is an or-40 form?

2021 Form OR-40, Oregon Individual Income Tax Return for Full-year Residents, 150-101-040.

What is the Oregon state income tax rate for 2022?

Oregon Tax Brackets 2022 - 2023 Tax rate of 4.75% on the first $3,750 of taxable income. Tax rate of 6.75% on taxable income between $3,751 and $9,450. Tax rate of 8.75% on taxable income between $9,451 and $125,000. Tax rate of 9.9% on taxable income over $125,000.

Who must file Form 1040?

Almost everyone in the United States needs to file IRS Form 1040. But for business owners, independent contractors, and the self-employed, there are some specific details you should know about. Read on for the information you need for a stress-free tax filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit OR OR-CPPR in Chrome?

Install the pdfFiller Google Chrome Extension to edit OR OR-CPPR and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for signing my OR OR-CPPR in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your OR OR-CPPR and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit OR OR-CPPR on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share OR OR-CPPR from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is OR OR-CPPR?

OR OR-CPPR refers to the 'Occupancy Report' or 'Occupancy Report - Conditional Property Performance Report', which is a form used for reporting occupancy and performance metrics for certain properties.

Who is required to file OR OR-CPPR?

Entities owning or managing qualifying properties, particularly those that are involved in government programs or funding, are required to file the OR OR-CPPR.

How to fill out OR OR-CPPR?

To fill out the OR OR-CPPR, entities should collect required data on occupancy rates, property management details, and any additional performance metrics outlined in the instruction guide. The form must be completed accurately and submitted to the appropriate governing body.

What is the purpose of OR OR-CPPR?

The purpose of the OR OR-CPPR is to collect data on property occupancy and performance, which helps in assessing compliance with regulations and the effectiveness of housing programs.

What information must be reported on OR OR-CPPR?

The OR OR-CPPR must report information such as occupancy rates, tenant demographics, property condition, management practices, and any relevant financial data related to the property.

Fill out your OR OR-CPPR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR OR-CPPR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.