OR OR-CPPR 2022 free printable template

Show details

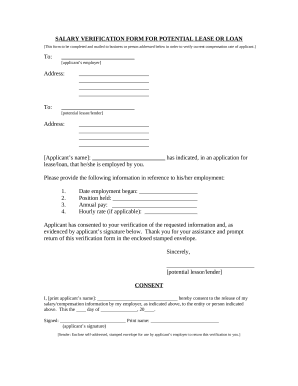

20222022Confidential Personal Property Returner ORC PPR (ORS 308.290)Assessment of Business: Furniture, Fixtures, Equipment, Floating Property, and Leased or Rented Property ATTENTION: If you did

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR OR-CPPR

Edit your OR OR-CPPR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR OR-CPPR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OR OR-CPPR online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OR OR-CPPR. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR OR-CPPR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OR OR-CPPR

How to fill out OR OR-CPPR

01

Gather all necessary personal and financial information required for the OR OR-CPPR.

02

Visit the designated website or location where the OR OR-CPPR can be accessed.

03

Download or obtain a physical copy of the OR OR-CPPR form.

04

Fill out the form carefully, ensuring that all required fields are completed accurately.

05

Double-check the information provided for any errors or omissions.

06

Sign and date the form as required.

07

Submit the completed form through the designated submission process, whether online or in person.

Who needs OR OR-CPPR?

01

Individuals or entities that have experienced a specific type of financial event or change.

02

Those seeking assistance, benefits, or reporting requirements related to financial submissions.

03

Organizations or businesses required to complete the OR OR-CPPR for regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 40 Alabama?

Alabama Form 40 is used by full-year and part-year residents to file their state income tax return. The purpose of Form 40 is to calculate how much income tax you owe the state. Nonresident filers will complete Alabama Form 40NR. Taxpayers with simple returns have the option to use Form 40A (Short Form).

What are the Oregon state income tax brackets?

Income Tax Brackets Single FilersOregon Taxable IncomeRate$0 - $3,6504.75%$3,650 - $9,2006.75%$9,200 - $125,0008.75%1 more row • 23-Dec-2021

What is the standard deduction for Oregon income tax?

The state of Oregon offers a standard deduction for its taxpayers. For the 2021 tax year, Oregon's standard deduction allows taxpayers to reduce their taxable income by $2,350 for single filers, $4,700 for those married filing jointly, $3,780 for heads of household, and $4,700 for qualifying widowers.

What is a 10 40 tax form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

How do I get my 10/40 form?

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

Who qualifies as an Oregon resident for income tax purposes?

If a permanent place of abode is maintained in Oregon, and the person is in this state for more than 200 days during the tax year, then the person is taxed as a resident of Oregon.

Does everyone have to fill out a 10/40 form?

While people with more complicated tax situations may need more forms and schedules, everyone filing taxes will need to fill out Form 1040 in order to file their taxes.

What is the Oregon standard deduction for 2022?

The 2022 standard deduction for each filing status is: $2,420 for single or married filing separately. $3,895 for head of household. $4,840 for married filing jointly or qualifying widow(er).

What is standard deduction for 2022?

For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard deduction will be $20,800 for tax year 2023, up $1,400 from the amount for tax year 2022.

What is an or-40 form?

2021 Form OR-40, Oregon Individual Income Tax Return for Full-year Residents, 150-101-040.

What is the Oregon state income tax rate for 2022?

Oregon Tax Brackets 2022 - 2023 Tax rate of 4.75% on the first $3,750 of taxable income. Tax rate of 6.75% on taxable income between $3,751 and $9,450. Tax rate of 8.75% on taxable income between $9,451 and $125,000. Tax rate of 9.9% on taxable income over $125,000.

Who must file Form 1040?

Almost everyone in the United States needs to file IRS Form 1040. But for business owners, independent contractors, and the self-employed, there are some specific details you should know about. Read on for the information you need for a stress-free tax filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete OR OR-CPPR online?

pdfFiller makes it easy to finish and sign OR OR-CPPR online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit OR OR-CPPR in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your OR OR-CPPR, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit OR OR-CPPR on an iOS device?

Create, edit, and share OR OR-CPPR from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is OR OR-CPPR?

OR OR-CPPR stands for Oregon Annual Tax Reporting for Other Resources - Commercial Professional Practice Reporting. It is a form used by businesses in Oregon to report certain financial information to the state.

Who is required to file OR OR-CPPR?

Entities that operate in Oregon and are engaged in a commercial professional practice must file the OR OR-CPPR. This includes certain professionals such as doctors, lawyers, and other service-based businesses.

How to fill out OR OR-CPPR?

Filling out the OR OR-CPPR involves providing financial details such as gross income, deductions, and specific resource information as required by the form. It typically includes instructions to help guide filers through the information needed.

What is the purpose of OR OR-CPPR?

The purpose of OR OR-CPPR is to ensure compliance with Oregon tax laws by requiring businesses to report accurate financial data relevant to their professional practices.

What information must be reported on OR OR-CPPR?

Information required includes gross receipts, expenses, specific business deductions, and any other financial data pertinent to the commercial professional practice being reported.

Fill out your OR OR-CPPR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR OR-CPPR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.