MD Comptroller MW508 2021 free printable template

Show details

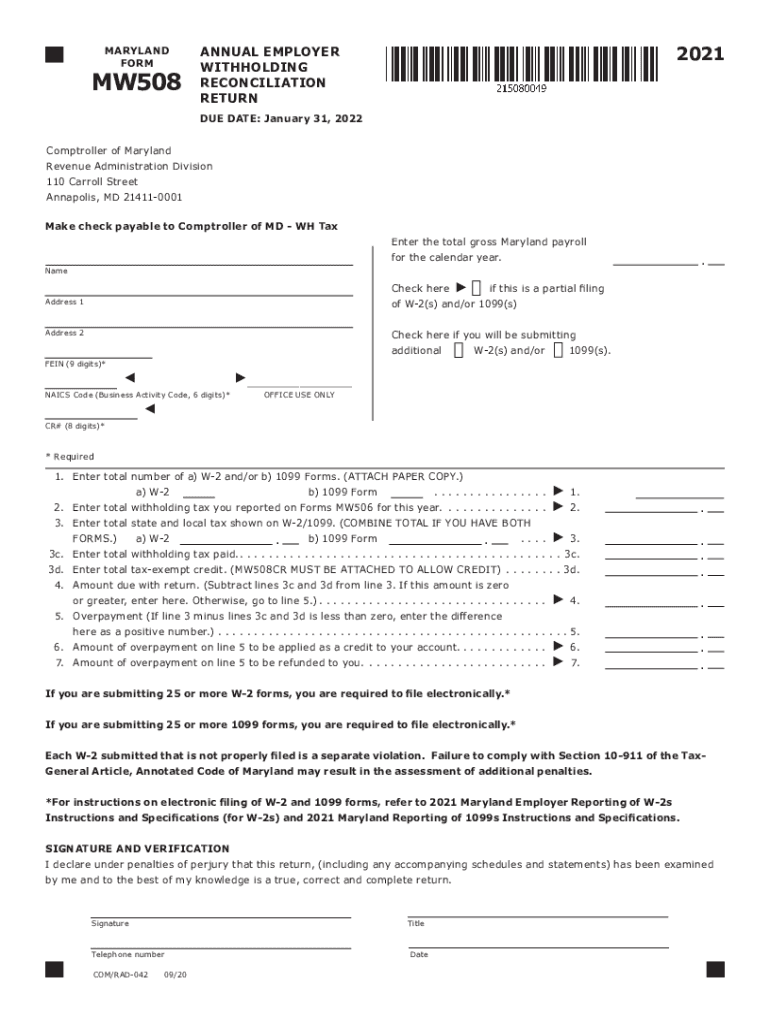

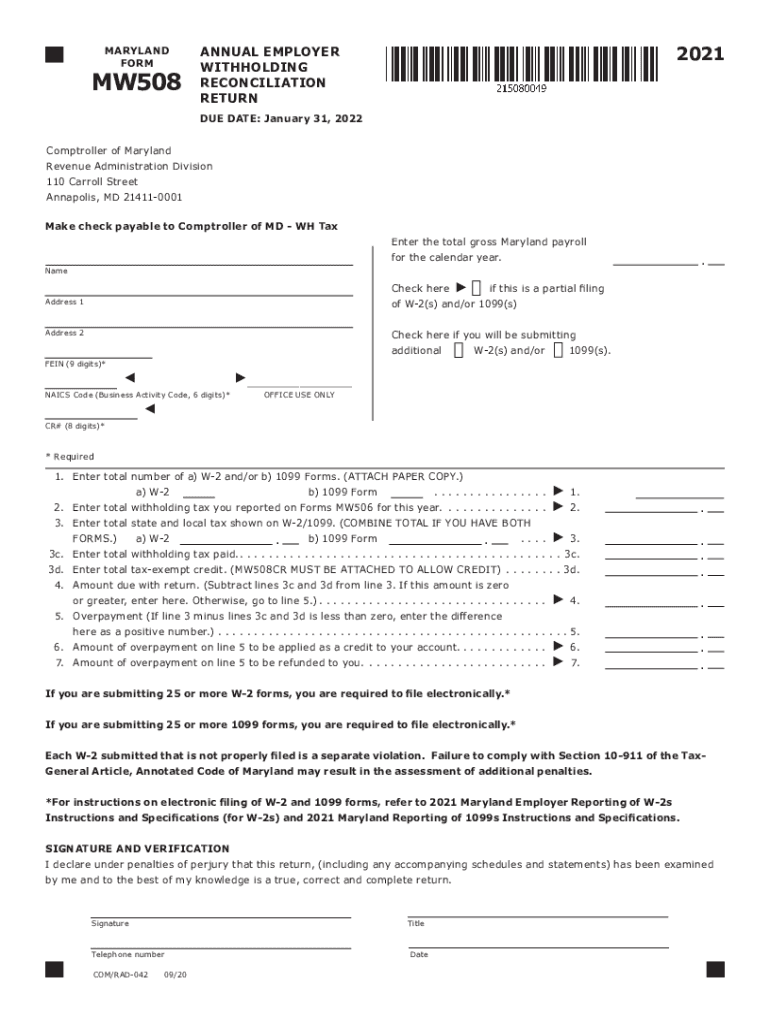

MARYLAND FORMMW5082019ANNUAL EMPLOYER WITHHOLDING RECONCILIATION RETURN DUE DATE: January 31, 2020Comptroller of Maryland Revenue Administration Division 110 Carroll Street Annapolis, MD 214110001

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD Comptroller MW508

Edit your MD Comptroller MW508 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD Comptroller MW508 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MD Comptroller MW508 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MD Comptroller MW508. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Comptroller MW508 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD Comptroller MW508

How to fill out MD Comptroller MW508

01

Obtain the MD Comptroller MW508 form from the official website or relevant office.

02

Fill in your personal information such as name, address, and Social Security number.

03

Indicate your filing status (single, married, etc.) as required.

04

Report your total income, including wages, tips, and any additional income sources.

05

Calculate deductions and credits that apply to your situation.

06

Total your income and deductions to determine your taxable income.

07

Complete any additional sections as necessary based on your specific circumstances.

08

Review all information for accuracy and completeness.

09

Sign and date the form before submission.

10

Submit the form electronically or mail it to the appropriate office.

Who needs MD Comptroller MW508?

01

Individuals who reside in Maryland and need to report their income for state tax purposes.

02

Employees and self-employed individuals who earned income during the tax year.

03

Taxpayers who are required to file a state income tax return in Maryland.

Fill

form

: Try Risk Free

People Also Ask about

What is a MW508?

MD MW508 - Annual Employer Withholding Reconciliation Return. MI Form 5080 - Sales, Use and Withholding Taxes Monthly/Quarterly Return (and Form 5095) MI Form 5081 - Sales, Use and Withholding Taxes Annual Return.

Can you file Maryland taxes for free?

No matter what company you select, you can always return to file your Maryland tax return for free online, using our iFile or bFile services.

How do I file a MW506 form?

You are required to fill out a MW506 form on an accelerated, monthly, quarterly, seasonal or annual basis, depending upon the amount of tax withheld. You must file your MW506 form by the due dates, even if no tax was withheld. If no tax is due, file by telephone by calling 410-260-7225.

How do I change my Maryland withholding?

Call our telefile line at 410-260-7225 or contact Taxpayer Service at 410-260-7980 or 1-800-638-2937 from elsewhere. Please be ready to provide: the account number. type of tax (employer withholding, sales and use)

How do I file a MW506?

You are required to fill out a MW506 form on an accelerated, monthly, quarterly, seasonal or annual basis, depending upon the amount of tax withheld. You must file your MW506 form by the due dates, even if no tax was withheld. If no tax is due, file by telephone by calling 410-260-7225.

What is Maryland withholding exemption certificate?

The law requires that you complete an Employee's Withholding Allowance Certificate so that your employer, the state of Maryland, can withhold federal and state income tax from your pay. Your current certificate remains in effect until you change it.

What is form MW506?

The 7.75 percent tax must be paid to the Comptroller of Maryland with Form MW506 (Employer's Return of Income Tax Withheld). If the payor of the distribution is not currently registered with the Comptroller and has not established a withholding account, the payor can register online.

How do I fill out a MW507 tax form?

1:05 3:24 YouthWorks 2021: MW507 - YouTube YouTube Start of suggested clip End of suggested clip So make sure you understand the document before starting it enter your full name social securityMoreSo make sure you understand the document before starting it enter your full name social security number and street. Address write in baltimore. City for county of residence.

Who is exempt from Maryland withholding tax?

You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. For more information and forms, visit the university Tax Office website.

Is Maryland a mandatory withholding state?

You are not required by law to withhold Maryland income taxes from the wages paid to a domestic employee in a private residence. However, you may do so as a courtesy to the employee. If you wish, you can register your withholding account online and use bFile to file your withholding returns electronically for free.

What is MD MW506?

MARYLAND EMPLOYER WITHHOLDING. FINAL RETURN FORM. IMPORTANT NOTE: Send this form accompanied with the final employer withholding tax return (MW506 or MW506M) if you have discontinued or sold your business or mail separately if you file electronically.

How much should I withhold for Maryland taxes?

For 2022, we will use eleven brackets: 2.25%, 2.40%, 2.65%, 2.81%, 2.96%, 3.00%, 3.03%, 3.05%, 3.06%, 3.10%, and 3.20%. Refer to the county listing below and use the table that agrees with, or is closest to, without going below the actual local tax rate.

How do I get a Maryland withholding number?

Find Your Maryland Tax ID Numbers and Rates Look up your Central Registration Number online by logging into the Comptroller of Maryland's website. Locate your eight digit (XX) Central Registration Number on any previously filed Annual Reconciliation Return (Form MW-508). Call the Comptroller's office: 800-MD-TAXES.

How do I know if I am exempt from Maryland withholding?

If you have an employee who expects to have less than $12,950 in income during 2022, you are not required to withhold Maryland state and local income tax.

Where do I file my MD withholding tax?

The 7.75 percent tax must be paid to the Comptroller of Maryland with Form MW506 (Employer's Return of Income Tax Withheld). If the payor of the distribution is not currently registered with the Comptroller and has not established a withholding account, the payor can register online.

Who needs to fill out a MW507?

Maryland Form MW507 is the state's Withholding Exemption Certificate and must be completed by all residents or employees in Maryland so your employer can withhold the correct amount from your wages. Form MW507 is the equivalent of the W-4 that all American workers complete for federal withholding.

Does Maryland have a state tax withholding form?

The State of Maryland has a form that includes both the federal and state withholdings on the same form. Your current certificate remains in effect until you change it. The absence of a completed form results in being taxed at the highest rate and undeliverable paychecks.

How do I file a MW508?

Copy this file to a CD or 3 1/2 inch diskette and send it to Comptroller of Maryland, Revenue Administration Division, Attn: Electronic Processing-Room 214, 110 Carroll Street, Annapolis, MD 21411-0001. Include a contact name and phone number.

What is a MW508 form?

If you are submitting less than 25 W-2s and/or 1099s you may file electronically or by paper.* If you are filing the MW508 by paper, complete Form MW508, Employer's Annual Withholding Reconciliation Return. Send. this form, accompanied by the STATE copy of Form W-2/Form.

What is MD 508?

Maryland Route 508 (MD 508) is a state highway in the U.S. state of Maryland. Known as Adelina Road, the state highway runs 1.20 miles (1.93 km) from MD 506 in Bowens north to MD 231 near Barstow. MD 508 was constructed in the early 1930s from MD 231 to Adelina.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MD Comptroller MW508?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the MD Comptroller MW508 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make edits in MD Comptroller MW508 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your MD Comptroller MW508, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my MD Comptroller MW508 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your MD Comptroller MW508 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is MD Comptroller MW508?

MD Comptroller MW508 is a tax form used in Maryland for reporting employee wages and withholding tax information to the state.

Who is required to file MD Comptroller MW508?

Employers in Maryland who have employees and are required to withhold state income taxes must file MD Comptroller MW508.

How to fill out MD Comptroller MW508?

To fill out MD Comptroller MW508, employers need to provide details such as the total wages paid, the amount of state income tax withheld, and employee information, following the guidelines provided by the Maryland Comptroller's office.

What is the purpose of MD Comptroller MW508?

The purpose of MD Comptroller MW508 is to report the state income tax withheld from employees' paychecks and to ensure compliance with Maryland tax laws.

What information must be reported on MD Comptroller MW508?

The information that must be reported on MD Comptroller MW508 includes the employer's information, total wages paid, amount of state income tax withheld, and details of each employee for whom taxes were withheld.

Fill out your MD Comptroller MW508 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD Comptroller mw508 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.