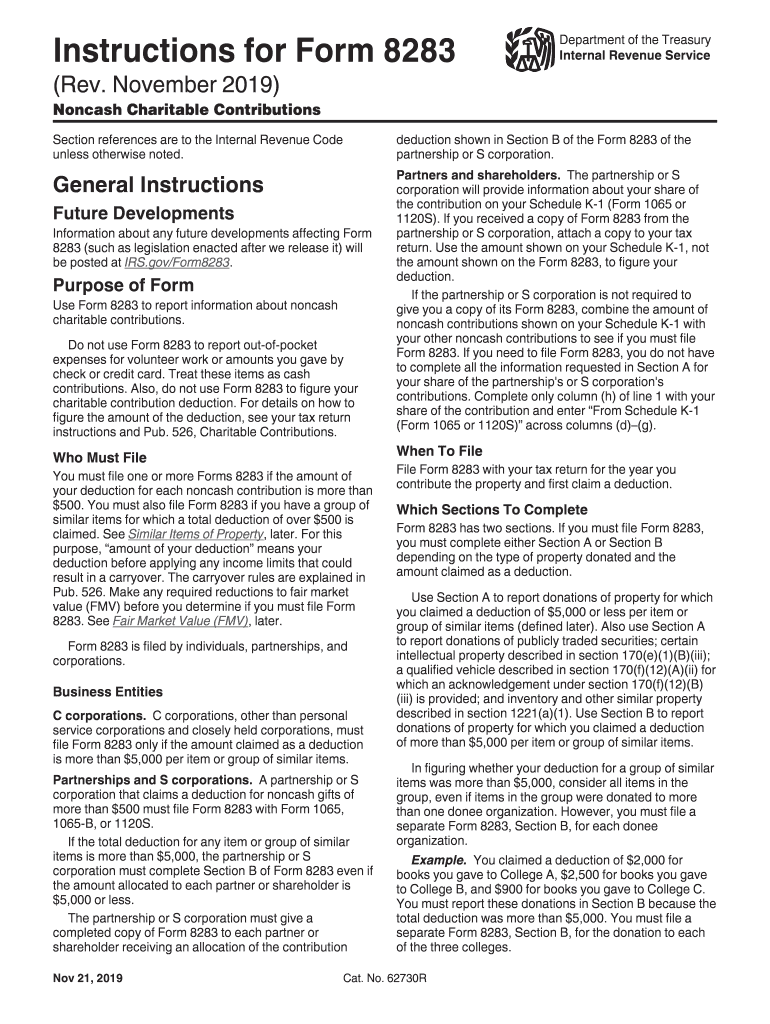

IRS Instruction 8283 2019 free printable template

Get, Create, Make and Sign IRS Instruction 8283

How to edit IRS Instruction 8283 online

Uncompromising security for your PDF editing and eSignature needs

IRS Instruction 8283 Form Versions

How to fill out IRS Instruction 8283

How to fill out IRS Instruction 8283

Who needs IRS Instruction 8283?

Instructions and Help about IRS Instruction 8283

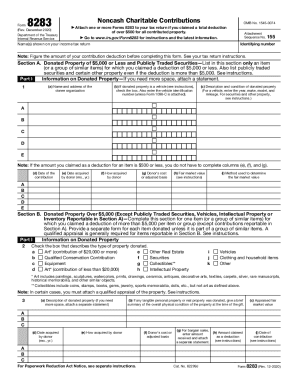

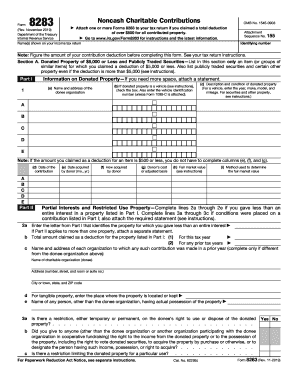

Laws dot-com legal forms guide Form 8283 is United States Internal Revenue Service tax form used to report non-cash charitable contributions of over $500 made by an individual or corporate taxpayer only use this form for the donation of property not the donation of time or funds that are cash based Form 8283 can be obtained through the IRS s website or by obtaining the documents through a local tax office this form is to be submitted along with your regular income tax return but only if you are claiming on that return more than a ×500 deduction for all property given to a charity use section an if the property is valued under $5,000 for items over $5,000 use Section B of this form state your name and tax identification number at the top of the form your social security number or corporate tax identifier in Part 1 identify the name and address of each organization in which you donated property next to each named organization you must describe the property donated if you are including a donated car you must provide a detailed description of the car including VI n number and mileage in the next box you must describe the donation in detail provide the dates of transfer method of donation donors cost basis fair market value of the property and how fair market value was determined complete this for each item donated part 2 is to be used if you did not donate a complete interest in the property this is typically for partial donations of land or title to property that is encumbered or jointly held if applicable complete part 2 providing the name of the property donated what percentage of ownership was granted the location of the property total amount claimed as a deduction in the prior year and any restrictions attached to the donation section B Part one of the Form 8283 is to be used to claim a deduction on the donation of property valued at over $5000 section B is to be filled out just the same as section a however you must indicate the nature of the property that was donated by checking the appropriate box on line 4 you must certify the section B donation by signing and dating the form likewise a qualified appraiser must also certify your Section B claims by signing dating and providing their information on part three finally the charitable organization must acknowledge receipt of the donated property by certifying the Form 8283 at the very bottom of the form once completed submit the form with your tax returns and retain a copy for your personal records to watch more videos please make sure to visit laws comm

People Also Ask about

Can you electronically file Form 8283?

Who provides form 8283?

Can you electronically file form 8283?

Can you file a return without including a Form 8283?

What is the IRS Form 8283 for 2018?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS Instruction 8283 directly from Gmail?

How can I get IRS Instruction 8283?

Can I create an electronic signature for the IRS Instruction 8283 in Chrome?

What is IRS Instruction 8283?

Who is required to file IRS Instruction 8283?

How to fill out IRS Instruction 8283?

What is the purpose of IRS Instruction 8283?

What information must be reported on IRS Instruction 8283?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.