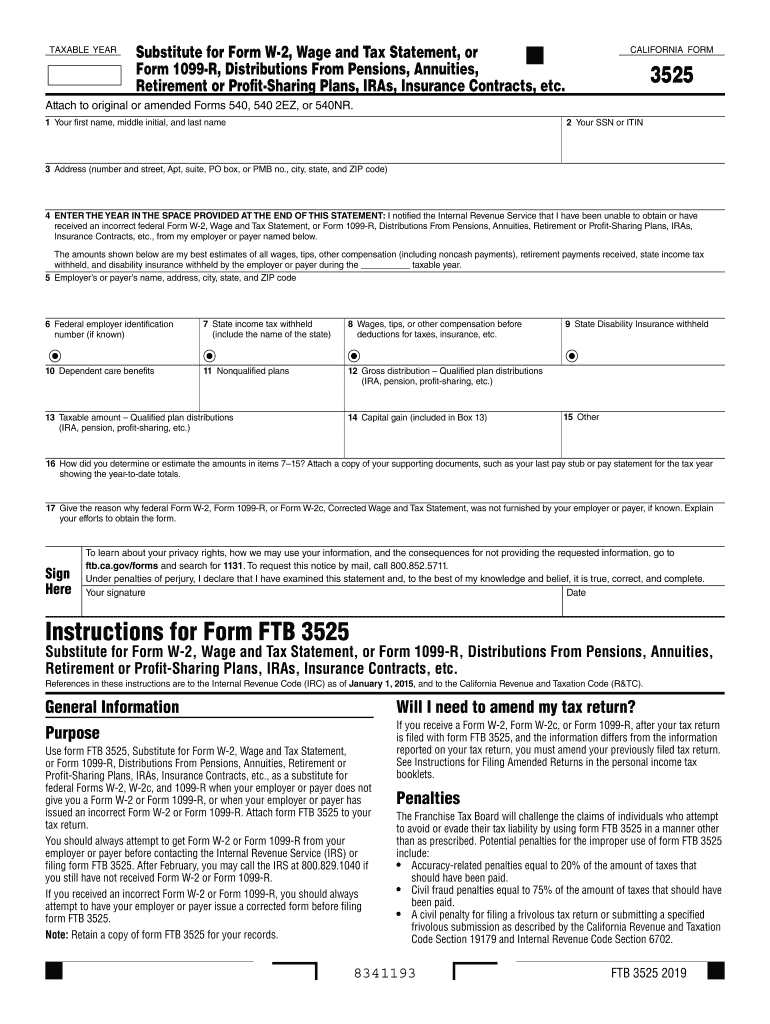

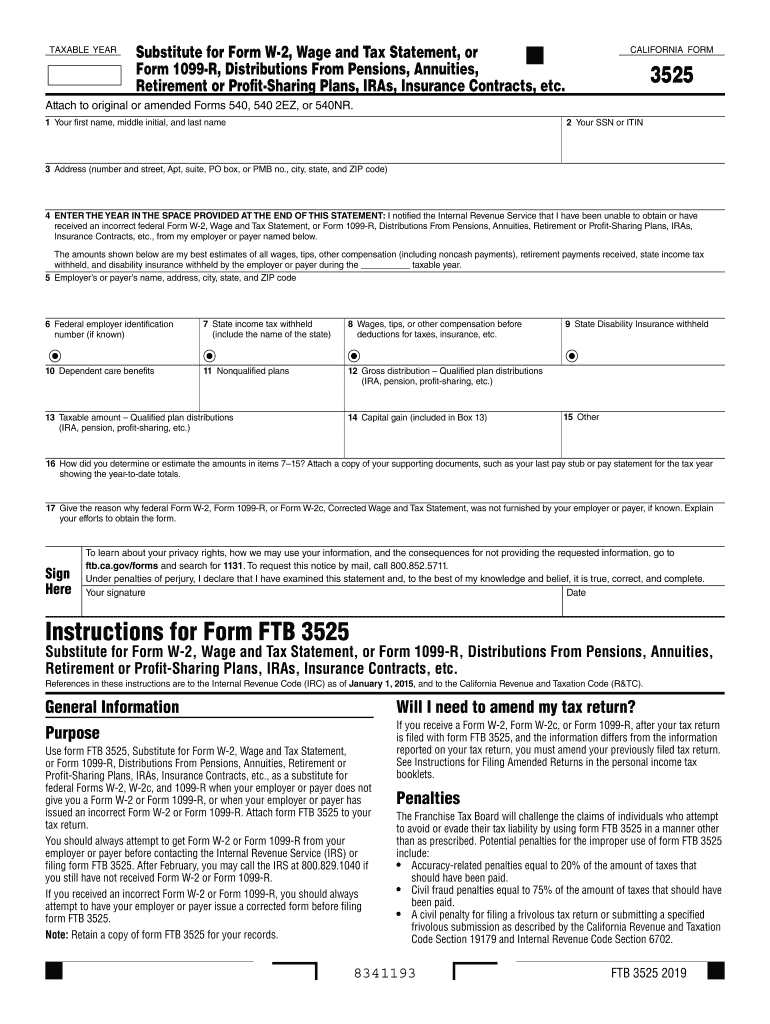

CA FTB 3525 2019 free printable template

Show details

Date Your signature Instructions for Form FTB 3525 References in these instructions are to the Internal Revenue Code IRC as of January 1 2015 and to the California Revenue and Taxation Code R TC. After February you may call the IRS at 800. 829. 1040 if you still have not received Form W-2 or Form 1099-R. attempt to have your employer or payer issue a corrected form before filing Note Retain a copy of form FTB 3525 for your records. Penalties The Franchise Tax Board will challenge the claims...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 3525

Edit your CA FTB 3525 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 3525 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA FTB 3525 online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA FTB 3525. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 3525 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 3525

How to fill out CA FTB 3525

01

Begin by downloading the CA FTB 3525 form from the California Franchise Tax Board website.

02

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the tax year for which you are filing.

04

Complete the part of the form that pertains to your income, deductions, and credits, providing all necessary details and calculations.

05

Follow the instructions for reporting any specific adjustments or entries required for the form.

06

Review the completed form for accuracy to ensure all information is correct and complete.

07

Sign and date the form before submitting it to the appropriate address as specified in the instructions.

Who needs CA FTB 3525?

01

The CA FTB 3525 form is required for individuals or entities who received a Franchise Tax Board tax notice and need to respond to it, such as those who are seeking a penalty abatement or a resolution of disputed tax liabilities.

Fill

form

: Try Risk Free

People Also Ask about

Can you cross out on tax forms?

Filing online is the fastest way to handle your taxes in 2020 and beyond. A single mistake made while filling out the form by hand can lead to a delayed return or even rejection. You can't just cross out a miswritten letter, number or word.

Can I fold my federal tax return?

Simply put, Yes. The IRS doesn't really care how your taxes come in as long as they are there by the deadline. We typically see them folded in half or in thirds. Each paper return is manually inspected to make sure forms are in order for proper scanning and processing.

Can you use whiteout on tax documents?

When filling out the Form 4506-T, please consider the following: Do not use white out or write over a mistake. If you make a change, line out and initial the change. Beware of address lines!

Can you fold w2 forms?

Because Form W-2 is printed with two forms on a single page, send in the whole Copy A page (the page printed with red ink) to the SSA even if one form is blank or void. Don't cut or fold the page. Don't staple Forms W-2 to each other or to Form W-3.

Can I cross out a mistake on my tax form?

What do I need to know? If you realize there was a mistake on your return, you can amend it using Form 1040-X, Amended U.S. Individual Income Tax Return. For example, a change to your filing status, income, deductions, credits, or tax liability means you need to amend your return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CA FTB 3525?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the CA FTB 3525 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for signing my CA FTB 3525 in Gmail?

Create your eSignature using pdfFiller and then eSign your CA FTB 3525 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit CA FTB 3525 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute CA FTB 3525 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is CA FTB 3525?

CA FTB 3525 is a form used by the California Franchise Tax Board for the reporting of California source income for nonresidents and part-year residents.

Who is required to file CA FTB 3525?

Individuals who are nonresidents or part-year residents of California and have income sourced from California are required to file CA FTB 3525.

How to fill out CA FTB 3525?

To fill out CA FTB 3525, you need to provide your personal information, report California source income, and calculate the tax owed based on the income reported.

What is the purpose of CA FTB 3525?

The purpose of CA FTB 3525 is to ensure that nonresidents and part-year residents accurately report and pay taxes on income earned in California.

What information must be reported on CA FTB 3525?

CA FTB 3525 requires reporting of personal identification details, California source income, and any related deductions or credits.

Fill out your CA FTB 3525 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 3525 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.