CA FTB 3525 2022 free printable template

Show details

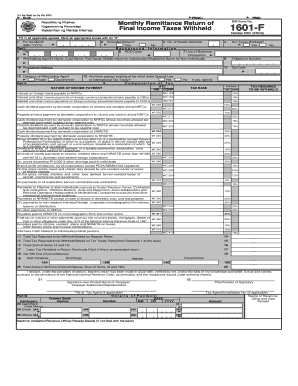

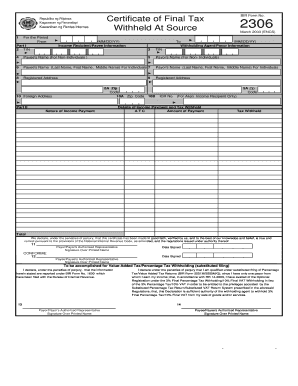

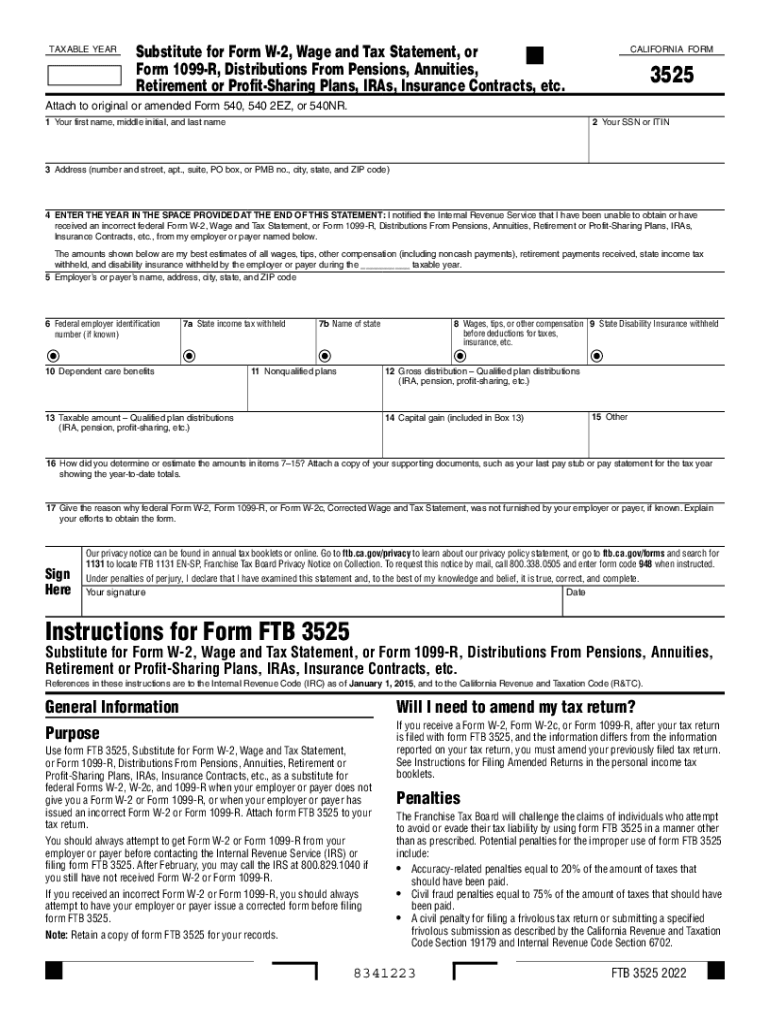

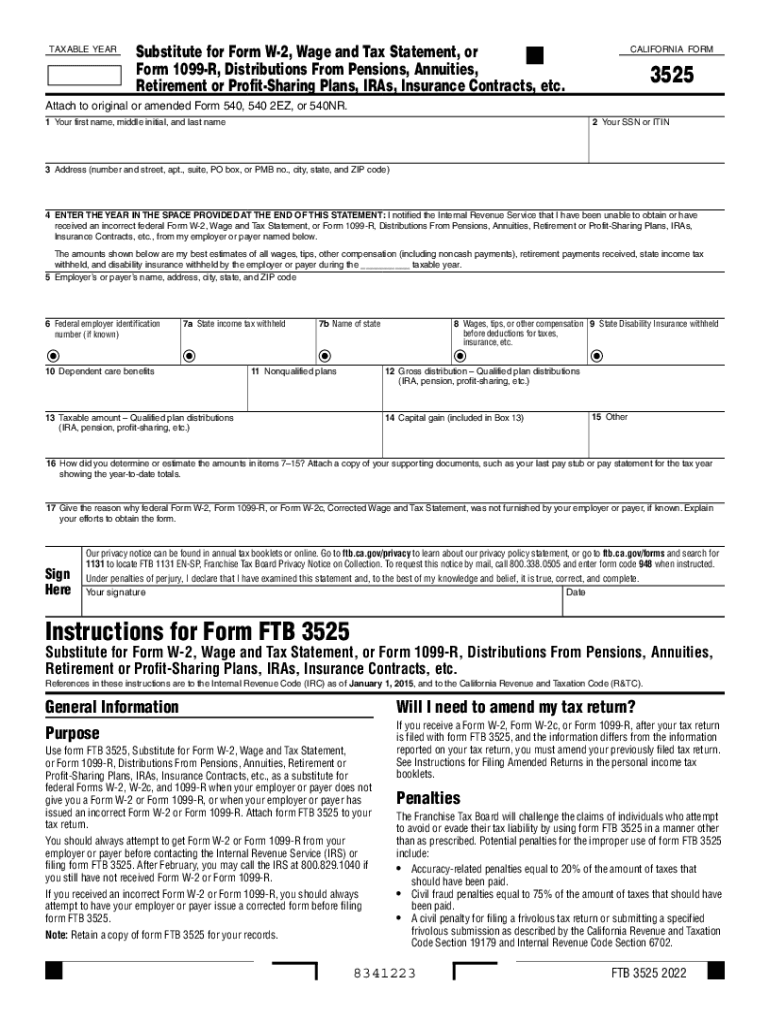

TAXABLEYEARSubstitute for Form W2, Wage and Tax Statement, or

Form 1099R, Distributions From Pensions, Annuities,

Retirement or Profit Sharing Plans, IRAs, Insurance Contracts, etc. CALIFORNIA FORM3525Attach

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 3525

Edit your CA FTB 3525 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 3525 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA FTB 3525 online

To use the professional PDF editor, follow these steps below:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA FTB 3525. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 3525 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 3525

How to fill out CA FTB 3525

01

Download CA FTB 3525 form from the California Franchise Tax Board website.

02

Fill in your personal information such as name, address, and Social Security number.

03

Enter the tax year for which you are requesting the form.

04

Complete Part I concerning the income and withholding information.

05

In Part II, provide details about your state tax refund or credit.

06

If applicable, complete Part III for any other requested information.

07

Review your entries for accuracy.

08

Sign and date the form before submission.

09

Submit the completed form according to the instructions provided, either by mail or electronically if available.

Who needs CA FTB 3525?

01

California residents who want to claim a credit for taxes paid or are seeking a refund of state taxes.

02

Individuals who have experienced a change in their financial situation that affects their tax filings.

Fill

form

: Try Risk Free

People Also Ask about

Can you cross out on tax forms?

Filing online is the fastest way to handle your taxes in 2020 and beyond. A single mistake made while filling out the form by hand can lead to a delayed return or even rejection. You can't just cross out a miswritten letter, number or word.

Can I fold my federal tax return?

Simply put, Yes. The IRS doesn't really care how your taxes come in as long as they are there by the deadline. We typically see them folded in half or in thirds. Each paper return is manually inspected to make sure forms are in order for proper scanning and processing.

Can you use whiteout on tax documents?

When filling out the Form 4506-T, please consider the following: Do not use white out or write over a mistake. If you make a change, line out and initial the change. Beware of address lines!

Can you fold w2 forms?

Because Form W-2 is printed with two forms on a single page, send in the whole Copy A page (the page printed with red ink) to the SSA even if one form is blank or void. Don't cut or fold the page. Don't staple Forms W-2 to each other or to Form W-3.

Can I cross out a mistake on my tax form?

What do I need to know? If you realize there was a mistake on your return, you can amend it using Form 1040-X, Amended U.S. Individual Income Tax Return. For example, a change to your filing status, income, deductions, credits, or tax liability means you need to amend your return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit CA FTB 3525 in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing CA FTB 3525 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I edit CA FTB 3525 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign CA FTB 3525 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How can I fill out CA FTB 3525 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your CA FTB 3525. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is CA FTB 3525?

CA FTB 3525 is a California form used by taxpayers to report their nonresident income and to claim a refund of overpaid taxes.

Who is required to file CA FTB 3525?

Nonresident individuals or entities that have income from California sources and wish to claim a refund of California income tax withheld or overpaid must file CA FTB 3525.

How to fill out CA FTB 3525?

To fill out CA FTB 3525, taxpayers should gather their income information, complete personal identification sections, report California source income, calculate the amount of tax owed, and sign the form before submitting it.

What is the purpose of CA FTB 3525?

The purpose of CA FTB 3525 is to allow nonresidents to report income earned in California and to claim refunds for any excess taxes paid to the state.

What information must be reported on CA FTB 3525?

The information that must be reported on CA FTB 3525 includes personal identification details, income earned from California sources, any tax withheld, and calculations for any refunds being claimed.

Fill out your CA FTB 3525 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 3525 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.