Get the free Cost Accounting in Higher Education. Simplified Macro-and ...

Show details

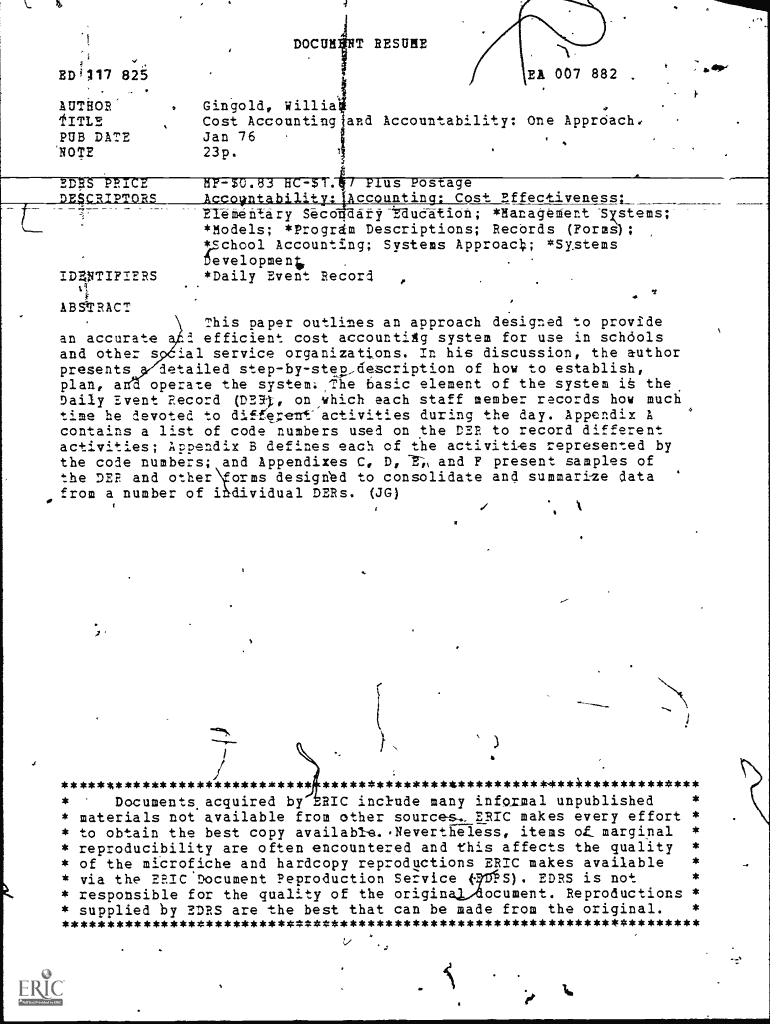

4.DOC UMT RESUMED 007 882ED\' 117 825.s. 41101\'.AUTHOR,

TITLE

PUB DATEGingold, William\'

Cost Accounting a.d Accountability: One Approach,

Jan 76\'NOTE23p.CRIPTORS17 Plus Postage

Accountability:Accounting:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cost accounting in higher

Edit your cost accounting in higher form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cost accounting in higher form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cost accounting in higher online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit cost accounting in higher. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cost accounting in higher

How to fill out cost accounting in higher

01

To fill out cost accounting in higher, follow these steps:

02

Understand the purpose of cost accounting in higher education. It is used to track and analyze the costs associated with various activities and departments in a higher education institution.

03

Familiarize yourself with the cost accounting system used by your institution. Different universities may have different systems and processes in place.

04

Identify the key cost drivers in higher education. These may include personnel costs, facilities costs, instructional costs, research costs, etc.

05

Collect relevant data and information related to each cost driver. This may involve gathering payroll records, utility bills, procurement data, etc.

06

Allocate costs to appropriate cost centers or departments. This involves distributing the costs based on the activities or services provided by each department.

07

Analyze and interpret the cost data. This step involves comparing actual costs to budgeted costs, identifying cost-saving opportunities, and making data-driven decisions.

08

Prepare cost accounting reports and communicate the findings. These reports may include budget variances, cost trends, and recommendations for improvement.

09

Review and update the cost accounting system regularly. This ensures that the information is accurate and reflects the current cost structure of the institution.

10

Remember to consult with your institution's finance or accounting department for specific guidelines and procedures.

Who needs cost accounting in higher?

01

Cost accounting in higher education is needed by:

02

- University administrators and management: They use cost accounting to make informed decisions about resource allocation, budgeting, and strategic planning.

03

- Financial analysts and auditors: They rely on cost accounting data to assess the financial health and performance of the institution.

04

- Government agencies and funding bodies: They may require cost accounting reports to ensure accountability and transparency in the use of public funds.

05

- Researchers and analysts: They utilize cost accounting information to study the cost-effectiveness of academic programs and initiatives.

06

- Students and parents: Cost accounting data can help students and parents understand the breakdown of tuition fees and other expenses.

07

- Accrediting bodies: They may evaluate the financial sustainability and efficiency of higher education institutions based on cost accounting reports.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cost accounting in higher from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including cost accounting in higher, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send cost accounting in higher for eSignature?

When you're ready to share your cost accounting in higher, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit cost accounting in higher on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign cost accounting in higher right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is cost accounting in higher?

Cost accounting in higher education refers to the process of analyzing and recording expenses related to educational activities within an institution.

Who is required to file cost accounting in higher?

Institutions of higher education that receive federal funding through grants or contracts are required to file cost accounting reports.

How to fill out cost accounting in higher?

Cost accounting in higher education can be filled out using the guidelines provided by the U.S. Department of Education and other regulatory bodies.

What is the purpose of cost accounting in higher?

The purpose of cost accounting in higher education is to ensure that institutions are using federal funds efficiently and effectively for educational purposes.

What information must be reported on cost accounting in higher?

Cost accounting reports in higher education typically include details on expenses related to instruction, research, and other educational activities.

Fill out your cost accounting in higher online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cost Accounting In Higher is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.