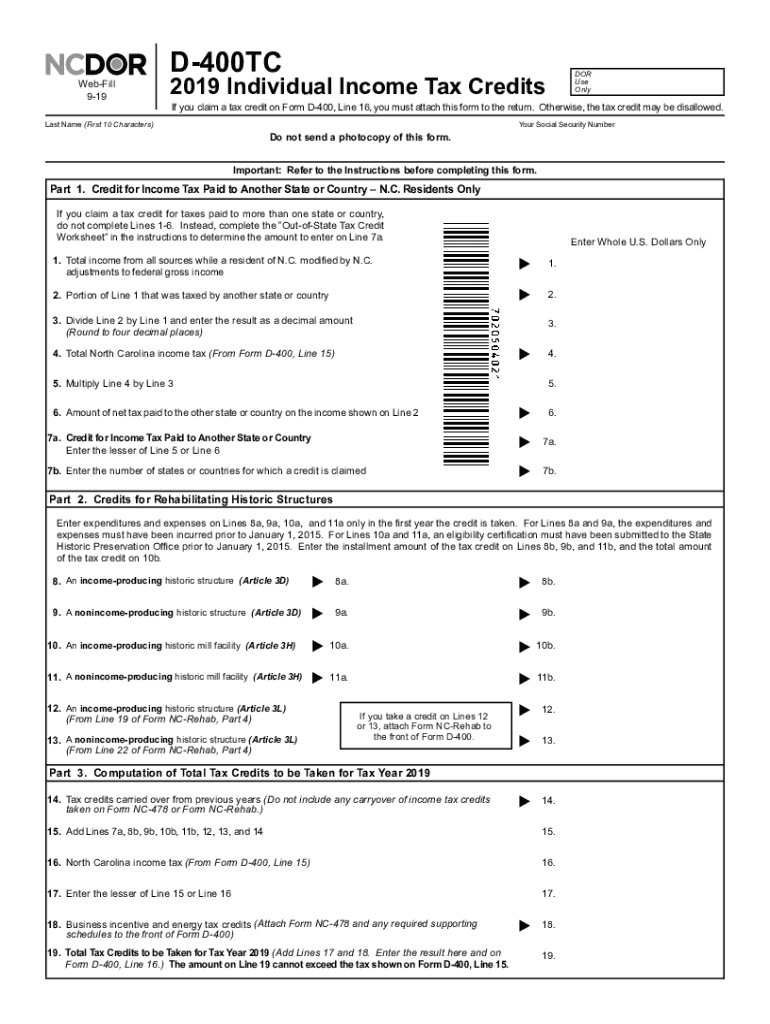

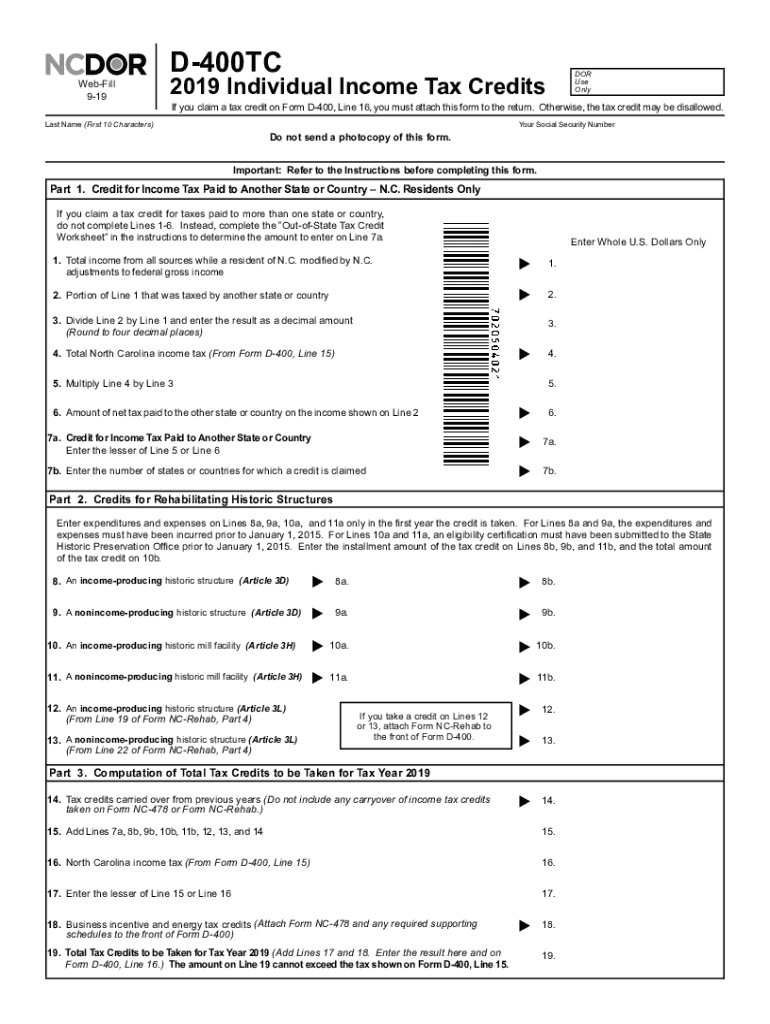

NC DoR D-400TC 2019 free printable template

Get, Create, Make and Sign NC DoR D-400TC

Editing NC DoR D-400TC online

Uncompromising security for your PDF editing and eSignature needs

NC DoR D-400TC Form Versions

How to fill out NC DoR D-400TC

How to fill out NC DoR D-400TC

Who needs NC DoR D-400TC?

Instructions and Help about NC DoR D-400TC

In this tutorial you will learn where to find state tax forms we will be using the tax administration's website to narrow down the specific forms needed for a particular state this process is great because you can easily locate state tax forms for any state in the US first go to the tax administration website then click state this website features an image map so simply click on the state you want to inquire about from here click the current year tax forms this will take you to the form section where you can locate the right forms it will redirect you to that state's website lastly locate form you will now see all the forms available for this state choose the one you need to fill out and send them in you have now successfully found state tax forms leave your comments below or contact us by email this was a high tech TV tutorial thanks for watching

People Also Ask about

Can you print tax forms front and back?

Where can I get NC State tax forms?

Are NC tax forms available?

Is NC DOR accepting tax returns?

Where can I get Illinois tax forms?

Are NC tax forms ready?

Where can I get federal tax forms and booklets?

Is NC state accepting tax returns?

Where can I get hard copies of tax forms?

When can I file North Carolina state taxes 2022?

Where can I get CRA tax forms?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get NC DoR D-400TC?

How do I edit NC DoR D-400TC online?

How do I edit NC DoR D-400TC in Chrome?

What is NC DoR D-400TC?

Who is required to file NC DoR D-400TC?

How to fill out NC DoR D-400TC?

What is the purpose of NC DoR D-400TC?

What information must be reported on NC DoR D-400TC?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.