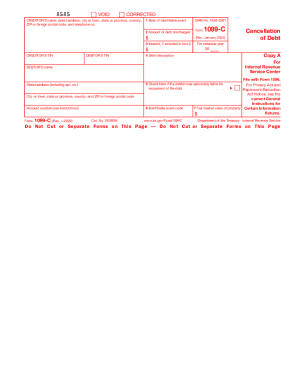

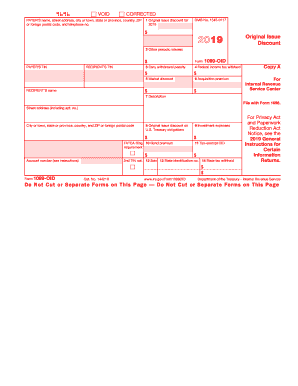

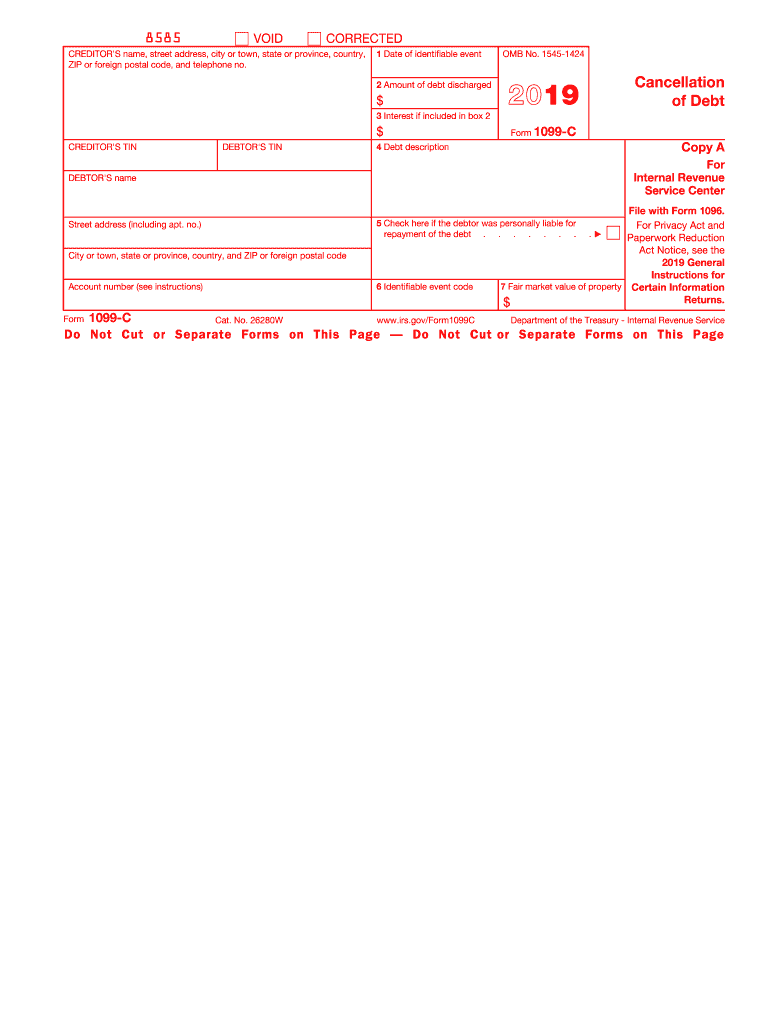

IRS 1099-C 2019 free printable template

Instructions and Help about IRS 1099-C

How to edit IRS 1099-C

How to fill out IRS 1099-C

About IRS 1099-C 2019 previous version

What is IRS 1099-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-C

What should I do if I need to correct an error on my IRS 1099-C?

If you find an error on your IRS 1099-C after it has been filed, you need to file a corrected form. Use the same form but indicate that it is a correction by checking the appropriate box. Ensure you provide accurate information to avoid any potential issues with the IRS.

How can I verify if my IRS 1099-C was successfully received and processed?

To verify the status of your IRS 1099-C, you can call the IRS or use their online tools. Keep in mind that e-filed forms may take longer to process; checking common rejection codes can help identify filing issues, allowing you to rectify them promptly.

What should I know about e-signature acceptance for IRS 1099-C submissions?

When submitting an IRS 1099-C electronically, e-signatures are generally accepted if your software supports it. However, ensure that you maintain compliance with IRS guidelines regarding digital signatures to safeguard your data and avoid complications.

What are common mistakes to avoid when filing IRS 1099-C?

Common mistakes when filing IRS 1099-C include reporting incorrect amounts or not including all required information. Double-check all entries for accuracy and ensure that all payer and payee details are correctly filled out to prevent processing delays.

What should I do if I receive a notice from the IRS regarding my 1099-C?

If you receive an IRS notice about your 1099-C, carefully read the letter to understand the issue. Prepare any necessary documentation and respond promptly to resolve the matter, as timely communication can often mitigate penalties or further complications.

See what our users say